AirInsight

Here’s the score as Thursday closes in Dubai. The show turns out to have been much more impactful than we anticipated.

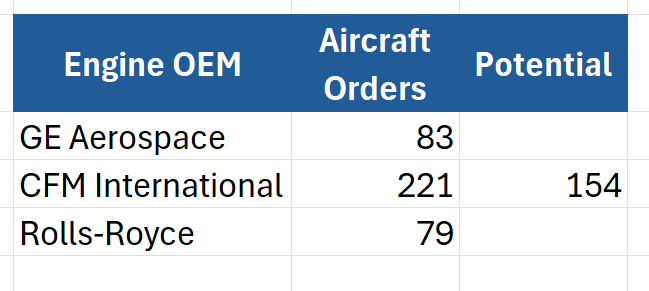

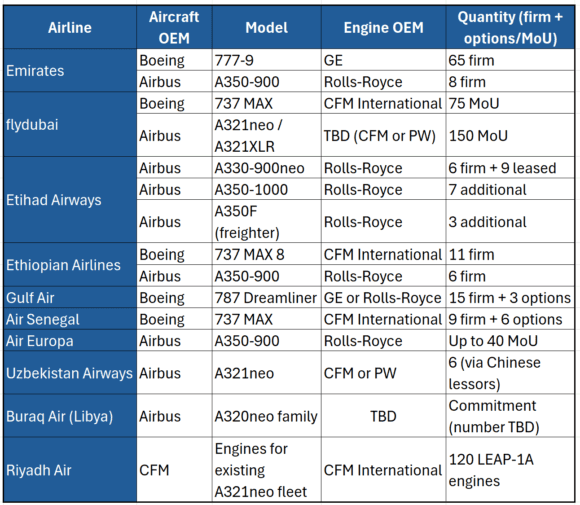

- The big winner isn’t Airbus or Boeing. It’s GE. and then CFM. Rolls-Royce comes third and nothing for P&W. In the table below there are two deals for A320neo and we believe these are going to CFM.

- The flydubai A321 order should not have been a surprise as any growth requires more capabilities and there’s nothing else except the A321. Wisely they also placed a big MAX order. We explained out thinking on this here. Had the MAX 10 been available the A321 deal would have been priced far better to win.

- The ME3 (Emirates, Etihad & Qatar) ambitions are back but more measured than in the pre-Covid era. There’s no Akbar for OEMs and competitors to taunt and likewise no Akbar to annoy OEMs. On balance the industry was more fun with gadflies, but there you are. The ME3 appear more disciplined than ever. Which is not good for ambitious carriers like Turkish.

- The 777-10 could be a gauntlet being thrown, with hopes that Airbus responds like it did last time with the A380. Airbus lost a lot on that program but recovered much from learning how to be smarter on the A350. A key first question is which OEM can grow their top models most cost effectively? Second key question, is Rolls-Royce up to competing with any GE9X growth? Third question is can Airbus persuade GE to wean itself from Boeing?

As always the industry remains fascinating as we watch tectonic shifts that play out over two decades, one show at a time. One shift that stands out is Air Europa switching to Airbus, for example. Another is the A330-900 steadily attracting business – but at a very slow rate, reflecting how good the A330ceo has been. Of course the Emirates 777-9 commitment is, well, intriguing given that program’s aggravation for their network planning. What was the conversation tone during those negotiations?

As we stated yesterday, the biggest winner in our view is GE Aerospace. Look at the following table for evidence. GE won big deals on those 777-9s, and owns half of the CFM wins, too. Of the two TBD deals listed, we believe CFM wins those. Rolls-Royce made wins because it defaulted from Airbus sales just GE did from Boeing. Which makes those CFM deals the clincher.

The OEM with the toughest show is Pratt & Whitney with no deals. P&W had a show presence and participated in MRO/services discussions, emphasizing GTF Advantage durability improvements and FAST™ inspection turnaround times. The ongoing GTF durability issues (powder metal, inspections) continue to make customers cautious, contributing to CFM winning most disclosed narrowbody engine deals.

The GTF Advantage program will have to overdeliver fast for the engine maker to get back in the game. For several years the GTF was engine of choice on the A321. But the AOG experience has burned many in an industry that cannot afford unreliable engines. Pratt & Whitney’s GTF delivered better fuel burn numbers than the CFM LEAP. But that win was lost in AOG numbers.

Views: 538