IMG 6672 scaled

This series of stories covers our takeaways from the Paris Air Show from a strategic perspective on the topics of Technological Change, Aftermarket and Retrofit Growth, Urban/Advanced Air Mobility, SAF and Carbon Reduction, and Airbus vs Boeing.

Airbus versus Boeing

The battle for order supremacy at the Paris Air Show continued in 2023. Airbus signed the largest single aircraft order in history for 500 A320neo family narrowbodies from IndiGo. Combined with other orders, it cemented its leadership position in the narrowbody market.

Boeing gathered a few orders at the show, and both Airbus and Boeing benefited from Air India finalizing its order for 250 aircraft from Airbus and 220 aircraft (plus 70 options) from Boeing.

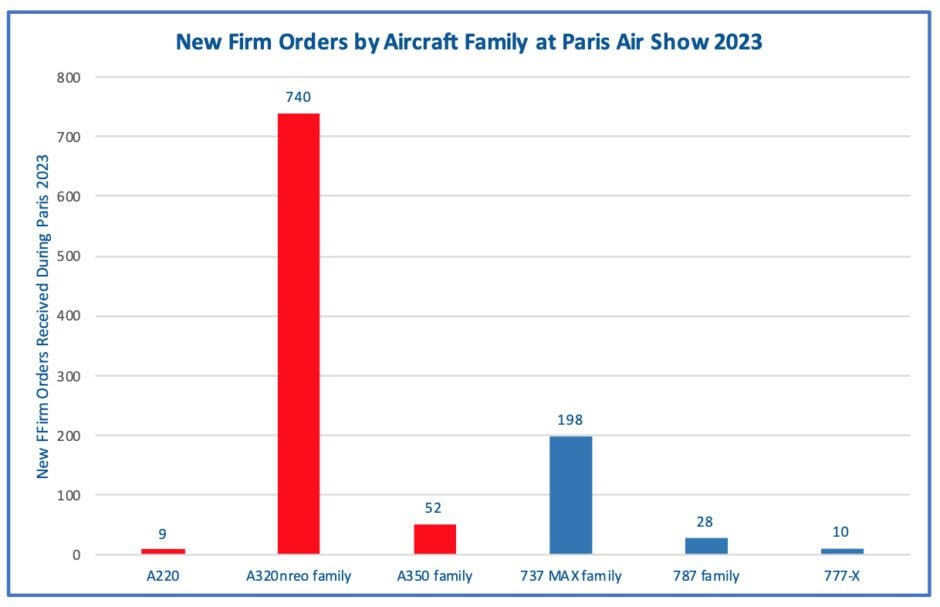

Let’s take a look at Airbus and Boeing orders by aircraft family at the 2023 Paris Air Show:

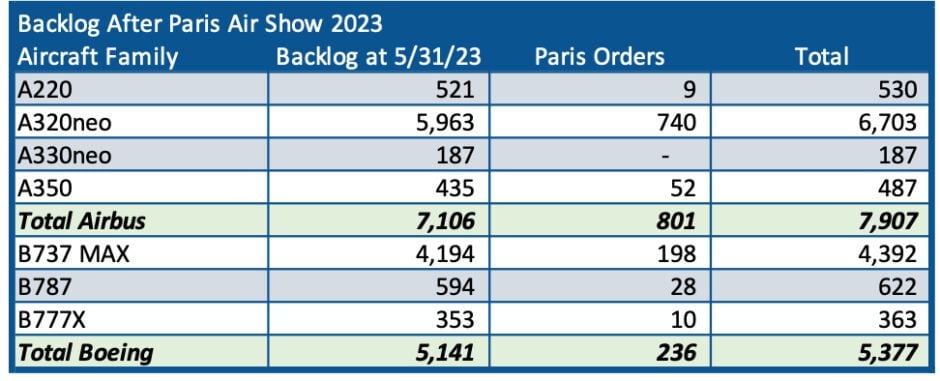

Airbus gained 801 new orders, shown in red, compared to 236 from Boeing, shown in blue. The massive differential in show orders will impact the overall backlog significantly. Airbus already had a massive lead in narrow-body backlog, but lagged Boeing in widebody backlog as of May 31.

The additional orders at the show have extended the Airbus lead in narrowbodies and slightly closed the gap in widebodies. Note that Avolon announced an MoU for 20 A330-900s that needs confirmation, so it is not included in this overview.

Our numbers for Boeing do not include the ASC 606 adjustment which removes orders that are viewed as having the potential not to materialize. Currently, the ASC 606 adjustments for financial reporting reduce Boeing’s gross backlog by 560 737 MAX, 55 787, and 102 777X. Airbus has no similar requirement for its financial reporting.

The Bottom Line

The increase in narrowbody orders in Paris has extended Airbus’s lead in this segment by a wide margin, with a 62.2 percent to 37.8 percent market share. With the ASC 606 adjustments, that market share would rise to 66.6 percent in Airbus’s favor. Boeing’s lead in widebody backlog is 59.6 percent to 40.4 percent, adjusted to 55.1 percent with ASC 606 included.

But an aircraft sale isn’t simply a one-time transaction. These days, it is a potential aftermarket revenue stream for the service life of the aircraft. Every order counts for the aftermarket, and this could provide Airbus with a strategic advantage over the next two decades.

The larger future Airbus fleet will provide additional opportunities for Airbus to capture MRO services, particularly for narrowbody aircraft that have higher cycles, and thereby heavier maintenance requirements than widebody aircraft. Every airplane is also an opportunity for emerging digital services.

With the success of the A321neo, which is now outselling the A320neo, it appears that Boeing’s decision not to replace the 757 will have long-lasting effects that Boeing didn’t anticipate. One wrong decision can have a generational impact on the life of a company, and Boeing is still paying for that decision, both in lost aircraft sales and lost service revenues.

Views: 49