The second-quarter earnings season is underway. The results are mixed, with some carriers exceeding expectations and others falling short of where Wall Street had hoped they would be. Let’s take a look at the results and what they mean.

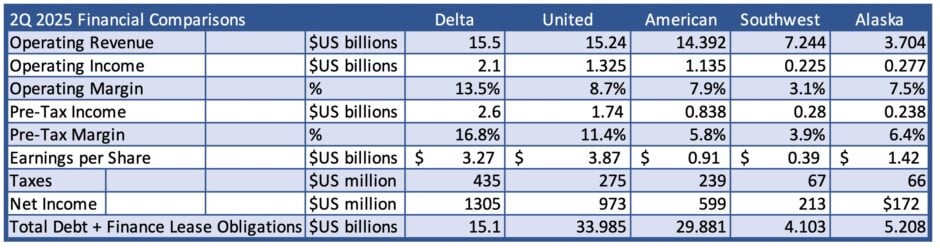

The following table presents earnings for the five largest carriers— Delta, United, American, Southwest, and Alaska — along with some key statistics. The main message from 2025 is that US domestic travel continues to lag 2024, with weakness in the basic economy segment of the industry for low-cost travelers. Economic pressures and uncertainty surrounding tariffs and employment have led to a tightening of household budgets, with discretionary travel one of the first items to be cut. That weakness is being reflected across the board, but has been counterbalanced by substantial international revenues and continued growth in business travel at the big three.

Of the big five, Southwest is in the most vulnerable position, given the nexus of a significant strategy change that many of its customers will not like, as well as a lack of international premium class revenues to counterbalance market weakness. While traffic drops domestically are in the low single digits, such drops are meaningful for carriers known for low-cost travel.

Alaska is also in the midst of change, executing the merger with Hawaiian and upgrading premium class offerings and international routes. When their strategy is complete, Alaska will have products competitive with the big three; however, it has a couple of years left for the full implementation of new cabins and long-haul aircraft.

Let’s dig deeper, airline by airline.

Delta Air Lines

Delta reported a strong Q2 with better-than-expected results, leading the network carriers in multiple metrics. The airline delivered record operating revenues of $15.6 billion with a 13.2% operating margin and a pre-tax profit of $1.2 billion. Earnings per share were $2.10, in line with expectations. Delta increased its dividend by 25% and restored full-year guidance after initial economic uncertainty over Trump’s tariff impacts on international travel.

Delta’s international revenue was up 2%, premium cabin revenue up 5%, cargo revenue up 7%, fuel costs down 11%, loyalty revenue up 8% and card program revenue up 10% year over year, with all of those metrics moving in the right direction.

Delta is not expecting a record year in 2025, but solid profitability, even if slightly lower than in 2024. The company is typically conservative in its forecasting and has a more modest goal of EPS of $5.25-$6.25 for the full year, along with free cash flow of $3 to $4 billion.

Delta’s focus on international travel and premium cabins has led to strong demand for business travel and high brand loyalty, resulting in its financial performance ranking at the top of the industry.

United Air Lines

United reported Q2 earnings that were roughly in line with the Wall Street consensus, which had incorporated the 1.2-point pre-tax margin impact of Newark disruptions and staffing shortages that resulted in passengers booking away from the airport.

United’s operating revenue was $15.24 billion, with an 8.7% operating margin and a $1.7 billion pre-tax profit. Earnings per share were $3.87, in line with expectations.

International RASM was down 1% with domestic RASM down 7%. Premium cabin revenue was up 5.6% year-over-year, with cargo up 4% on record volume. Loyalty revenue was up 9% YoY, and free cash flow was $1.1 billion during the quarter. United also paid down $1.5 billion of MileagePlus bonds, further reducing gross debt. The company also repurchased $235 million in shares during the quarter. The company’s full-year guidance is for EPS between $9 and $11 per share, and it expects slightly more than $2 billion in free cash flow.

United’s focus on international routes and premium cabins is paying off, much like Delta, in both profitability and loyalty, particularly as the US market is showing signs of weakness.

American Airlines

American Airlines reported a positive Q2, with EPS of $0.95 per share, handily beating estimates of $0.79 per share, compared to $1.09 for the quarter last year. While American beat expectations, those expectations were low when compared with Delta and United, the industry leaders. In recent years, American has been eclipsed by its competitors in terms of both preference and financial performance. TRASM fell 2.7% YoY in the quarter, reflecting a softening market.

American had operating revenues of $13.123 billion in Q2, but down 0.6% year-over-year. Its operating margin of 7.9% was positive, but lagged its network carrier competitors. The carrier saw strength in its premium cabins, and Atlantic passenger revenues increased by 5% year over year.

American updated its full-year guidance with an EPS forecast between a $0.10 loss and a positive $0.60 per share, with a midpoint of $0.30 per share. The difficulties in generating revenue in the low-end economy continue to impact the industry, with softness in the back cabin. The outlook for American is much less robust than that for Delta or United, which have each eclipsed it in terms of size, profitability margins, and free cash flow generation.

A potential legal headwind emerged during the quarter, as the US Supreme Court refused to hear the airline’s appeal regarding the Northeast Alliance antitrust case. The refusal upholds a permanent injunction and opens the airline to potential liability in private party antitrust class action lawsuits, which management noted could have a material financial impact.

Southwest Airlines

Southwest Airlines, in the midst of a product strategy changeover, is facing weakening demand, with Q2 passenger revenues down 3% year-over-year. The result is lower-than-expected earnings and revenues, as lingering uncertainties over tariffs and the economy are disproportionately impacting primarily domestic carriers like Southwest.

The company reported an adjusted EPS of $0.43 for Q2, below analyst expectations of $0.51. Operating revenue of $7.24 billion also fell short of the $7.29 billion Street expectations. Southwest also cut its target for full-year 2025 to between $600 million and $800 million in EBIT, which is less than half of its prior forecast of $1.7 billion.

The strong summer season is falling short this year, with lower demand for economy seats. Unlike Delta and United, which can rely on premium seats for additional revenue, Southwest has a single class of service and is finding weakness in demand for its lowest fares.

Southwest, after years of offering a “bags fly free” strategy, is now charging for luggage. Next January, it will change its open seating policy to an assigned seating policy. The impact of these changes on Southwest’s traditional customers will define its future, with the economic uncertainty from the Trump administration compounding the issue. Southwest is in a challenging position, facing a weakening economy and strategic changes that coincide.

Alaska Airlines

Alaska Airlines exceeded earnings guidance, with the integration of Alaska and Hawaiian Airlines gaining traction. The company reported adjusted EPS of $1.78 for the quarter, following a disappointing first-quarter loss of $0.77. Second quarter revenue was $3.7 billion, with a pre-tax margin of 8.0%. The Alaska Accelerate strategy, which includes integrating Hawaiian behind the scenes, although each brand will remain, is expected to gain $1 billion in incremental profitability by 2027.

RASM was down 0.6% during the quarter, but premium cabin revenues were up 5%. Alaska is still amid its premium cabin upgrades, which should help future quarters. Cargo revenue was up 34% YoY, and loyalty revenues grew 5%.

The carrier projects third quarter EPS of $1.00 to $1.40, reflecting an approximate $.10 impact from the July computer system failure that caused a short ground stop to all of the carrier’s operations. Full-year guidance is for Adjusted EPS of $3.25 or more, with capacity up around 2%, RASM flat to low single-digit increases, and CASM up mid-single digits.

The Bottom Line

The big five airlines in the US are reporting mixed Q2 results, with international routes and premium cabins providing a cushion for the three network carriers against weakening demand, which disproportionately impacts the business models of low-cost carriers like Southwest. Alaska, still in transition with stronger premium class offerings following the Hawaiian merger, is transitioning between the two business models.

The weakness in economic travel is typically a precursor to an economic downturn, which would impact the entire industry and likely the global economy. The uncertainties provided by the Trump trade negotiations and changes in direction are likely to harm the industry, and hopefully will not lead to retaliatory taxes that exacerbate trade relationships. Nonetheless, the industry is experiencing a downturn, which is likely to continue through the third and fourth quarters.

Views: 1863