AirFrance A330 5 scaled

Two years earlier than what it said only some months ago, Air France-KLM wants to free itself from all French and Dutch state aid and state-backed loans as early as coming April. With that, the airline group wants to get rid of any restrictions that currently prevent it from potential mergers and acquisitions under the terms set out in the 2020/2021 aid. Air France-KLM frees itself from state aid in April.

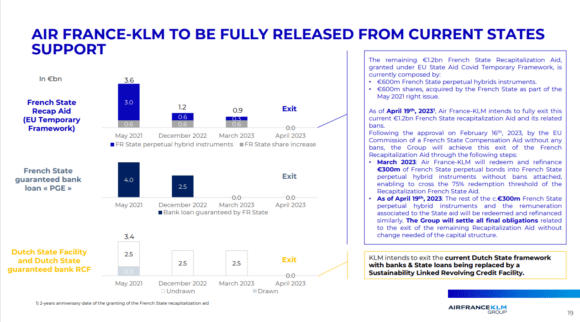

In the months immediately following the Covid-crisis in 2020, Air France received €4.0 billion in Pret Garanti par l’Etat (PGE) bank loans that were guaranteed at 90 percent by the French state and €3.0 billion in French state loans. The latter was converted into perpetual quasi-equity in April 2021. KLM received €1.0 billion as a direct state loan from the Dutch government, of which €942 million was drawn. The airline also received a €2.4 billion revolving credit facility from banks that was 90 percent state-guaranteed.

The group strengthened its buffers with a €1.0 billion capital increase in the middle of 2021 and redeemed €500 million of the PGE loans in December 2021, leaving €3.5 billion to be redeemed. Of this, €800 million was scheduled to be redeemed in 2023, and two amounts of €1.3 billion each in 2024 and 2025. But redemption has been accelerated from mid-2022, resulting in €2.5 billion in PGE loans by the end of December. This will now be fully redeemed by March this year.

A €2.256 billion rights issue in July 2022 was used to partially redeem the €3.0 billion French perpetual bonds plus €0.6 billion of the French state’s subscription to the April 2021 capital increase. In November, the group placed undated deeply subordinated unsecured bonds convertible into new shares and/or exchangeable for existing shares for €300 million. Last December, €1.2 billion in state recapitalization aid granted under the EU State Aid Covid Temporary Aid framework remained, of which only half has been drawn. Another €300 million will be redeemed in March into French state perpetual hybrid instruments, followed by the remaining €300 million in April. By then, Air France will have been released from all French state aid.

KLM redeemed €942 million of the Dutch state loan in July 2022, leaving €2.5 billion of the undrawn revolving credit facility available. Without the need for capital investment, KLM intends to exit these loans in April by using the €1.0 billion in proceeds of the sustainability-linked bonds that were issued in January plus €1.5 billion of cash. In April, Air France and Air France-KLM combined and KLM intends to implement two new Sustainability-linked Revolving Credit Facilities.

Without the constraints of state-imposed conditions and restrictions, Air France-KLM is free to follow its own strategy and “negotiate with confidence and more legitimacy with any opportunities that present themselves,” CEO Ben Smith said during today’s earnings call. He confirmed that he is still interested in TAP Portugal if a door would open up for the Portuguese airline that itself is heavily dependent on state aid.

Net profit for 2022

Air France-KLM ended 2022 with a net profit of €728 million compared to a €-3.292 billion loss in 2021. Total revenues increased 84 percent to €26.393 billion from €14.315 billion. EBITDA was €3.615 billion from €745 million. The fuel bill soared by 164 percent to €7.241 billion. The operating profit was €1.194 billion from €-1.626 billion. The group carried 83.3 million passengers. Air France-KLM reduced net debt by €1.9 billion to €6.3 billion. The operating free cash flow was at €1.9 billion, a significant improvement over €-631 million a year earlier.

In Q4, consolidated net profit was €496 million compared to €-126 million in 2021. Revenues were a record-high €7.128 billion, up from 4.838 billion in 2021 and some €500 million more than in 2019. The operating result was €134 million versus €199 million. Long-haul yields were strong and outpaced short and medium-haul.

The two network airlines faired differently. Full-year, KLM’s operating result of €706 million was higher than the €483 million of Air France, but revenues were higher in Paris at €16.285 billion versus €10.679 billion in Amsterdam. KLM’s operating margin was 6.6 percent versus 3.0 percent for Air France.

But in Q4, there are significant differences. Where Air France reported a €144 million operating result with €4.541 billion in revenues and an operating margin of 3.2 percent, KLM produced a €-0.2 billion operating loss with revenues of €2.758 billion and a negative operating margin of -0.1 percent. KLM’s growth was constrained by the capacity restrictions at its Amsterdam Schiphol hub and grew capacity by only nine percent. It cost KLM €170 million in lost revenues. Air France didn’t have these restrictions in Paris and increased capacity by 31 percent.

Transavia reports a loss

Low-cost subsidiaries Transavia and Transavia France produced a €-100 million operating full-year loss compared to €-150 million in 2021. Revenues totaled €2.218 billion, up from €1.011 billion. The airline operated at 114 percent capacity of 2019. Unit costs per available seat kilometer were 28 percent higher to €6.32 due to higher fuel prices and disruption costs.

How much of that is attributable to the restrictions in Amsterdam isn’t clear. CEO Marcel de Nooijer of Dutch Transavia said in October he expected his airline to be profitable in 2022. It isn’t specified either how much the French subsidiary has been loss-making. In Q3, the airline also incurred a loss as it is in the process of growing in size and network. In Q4, the operating loss was €-113 million compared to €-37 million with operating revenues of €513 million versus €326 million.

Full-year scheduled cargo revenues of Air France-KLM and Martinair ended at €3.049 billion compared to €3.167 billion in 2021 as 931 tons versus 1.053 tons was carried by its full freighters and as belly cargo. HY1 was strong and was followed by a softer second half. Traffic was 14.5 percent lower than in 2021 but yields remained higher. The airline’s maintenance business produced a €163 million operating result compared to €88 million in 2021, thanks to higher activities.

Outlook

In its outlook for 2023, the network carriers plan to grow capacity from 82 percent in December to 90-95 percent by the end of the year. Long-haul will lead the way, while short and medium-haul are at a slightly lower level of 85 to 90 percent. Transavia will grow capacity from 114 percent last year to around 135 percent. On a group level, capacity in ASKs will only fully recover in 2024. Net Capex should be around €3.0 billion, with the operating margin at seven to eight percent.

Investments include the new full flat-bed Business Class on the Air France Boeing 777s and Airbus A350s by the end of this year, which will also get Premium Economy with recliner seats. KLM’s Business Class product and Premium Economy on the 777s and 787s will have been upgraded by Q1 2024. With fleet renewal plans in progress, no new decisions were announced today. This means that the replacement of the Air France medium-haul Airbus A321-fleet and KLM’s A330s and 777-200s is to be expected later.

Views: 14