2023 06 15 airBaltic RIX market share

airBaltic can look back on a very good second quarter and first half year, as the airline from the Baltic States presented a significant improvement in its results. The carrier turned around a deep loss and produced its highest-ever HY1 revenues. This could have been higher without the grounding of eleven Airbus A220s due to the Geared Turbofan issues and associated leasing costs. The airline continues to expand its network and restructure its balance sheet.

airBaltic reported a Q2 net profit of €25.960 million compared to a €-46.394 million loss last year. Operating revenues were €186.2 million, of which €134.4 million were from ticket sales and €10.7 million from ancillary revenues. This was thanks to 1.2 million passengers up from 878K last year, at a 77 percent load factor.

Another €33.8 million in revenues was generated in ACMI or wet-leases of thirteen A220s to Eurowings, SAS, and SWISS. Proceeds were up from €22.2 million in Q2 last year and contributed some eighteen percent to all revenues, so are an important income stream for airBaltic.

These wet-lease revenues were offset by €27.8 million as airBaltic itself was forced to lease in the capacity as 27 percent of its own fleet was grounded. This was due to a shortage of Pratt & Whitney spare engines for the A220s as GTF engines were away for considerable periods to MRO shops for repairs. Last year, wet-lease costs were €6.9 million.

“The shortage of spare engines led to an average of eleven aircraft grounded, significantly impacted our performance of Q2. That delayed even greater improvement in total results. To mitigate this capacity loss, we were forced to wet-lease in substitute aircraft,” said CEO Martin Gauss. These are older-generation aircraft that have higher fuel costs than the A220s, while on-time performance also suffered from leasing aircraft from various operators. Replacement aircraft, including Boeing 737-800s and Airbus A320ceo’s, were also bigger than the A220s, which affected load factors.

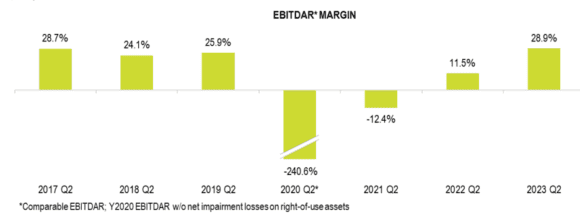

Expenses in Q2 totaled €145.4 million, up from €139.2 million. Fuel costs were down to €36.8 million from €43.6 million, but staffing costs increased to €27.3 million from €20 million. The operating profit was €25.960 million versus €36.394 million. Comparable EBITDAR is €53.8 million, up from €15.2 million, and reached a margin of 28.9 percent.

HY1 profit on the up

The HY1 profit was €14.6 million, a significant improvement from the €-91 million net loss in 2022. Operating revenues reached €291.3 million, up from €191.5 million. Ticket revenues were €214.5 million (2022: €139.3 million) and ancillary revenues €20.4 million (€14.8 million).

Between January and July, airBaltic carried two million passengers (1.3 million) at a 74.5 percent load factor. This is still 13.4 percent below 2019 levels. Seat capacity is also still nine percent below pre-pandemic levels, but was 29 percent over 2019 if ACMI lease capacity is included.

ACMI lease revenues for the period grew to €44.9 million from €26.4 million, but leasing expenses increase to €28.7 million from €8.1 million. Total expenses were €254.2 million, up from €222 million, with fuel costs up to €66.2 million as prices were still higher in Q1. airBaltic has hedged fuel at just six percent this year, which makes it vulnerable to price hikes if they happen in the coming months.

The operating result was €14.604 million compared to €90.110 million, with a comparable EBITDAR of €56.8 million versus €6.532 million. The HY1 operating margin was 19.5 percent, up from 3.4 percent. The operating cash flow was €62.3 million. On June 30, et debt stood at €1.1 billion cash and cash equivalents at €39.8 million, thanks to €20.4 million received in July as a commercial support payment related to the engine shortage in Q2 of 2023.

This month, airBaltic has repaid a €200 million Eurobond. “As of August 1, following the coupon payment on the €200 million Eurobond, the airline had cash balance of €46 million as compared to €65 million cash balance after the coupon payment in 2022.” Another €200 million Eurobond matures next year. “Management has engaged financial advisors to assist the airline in this process and is currently considering the possibility of issuing a $300 million bond and using the proceeds to repay the €200 million bond. (…) If the bond refinancing efforts fail in 2023 due to unfavorable market conditions, the airline is expected to approach the public debt market again in 2024 on the basis of 2023 full-year results.”

Growing the network

In the first half year, airBaltic canceled fifteen routes and launched 22 new routes out of its hubs in Riga, Vilnius, Tallinn, and Tampere (Finland), which was opened in May 2022. The total number of routes grew to 108. The war in Ukraine not only forced the carrier to stop flying to the country but also led to a change from its transfer model to more point-to-points and leisure services.

The closure of Russian airspace initially led to the termination of routes to former Baku, Yerevan, Istanbul, Bucharest, and Belgrade, but they have been reinstated because they are important for generating transfer traffic. “The airline sees potential to develop this segment further and utilize the strategic position of Riga to connect destinations in Northern Europe to destinations in the Balkans, the Middle East, and the Caucasus region,” says airBaltic in its earnings report.

From December, the airline will base two A220s at Gran Canaria for the winter season to connect to nine destinations in the Baltic States and Nordic countries like Norway and Denmark. The airline sees the potential to restore capacity on these routes to pre-pandemic levels and stimulate leisure travel.

Existing A220 order completed next year

By late June, airBaltic had 42 A220-300s and is expecting five more to bring the fleet to 47 by the end of this year and to fifty in 2024. This completes deliveries of the existing Airbus order. The final six aircraft will be financed with a sale and leaseback agreement. Martin Gauss told AirInsight in June that his airline is considering exercising options and purchase rights for thirty to fifty more A220s, but is waiting to place a follow-on order until the GTF issues and supply chain delays have settled down.

airBaltic said earlier this year that it expected to grow full-year revenues to €700 million, but after a softer than expected July-month, it has revised its guidance to between €670 and €700 million. “Based on H1 achieved Comparable EBITDAR of €56.8 million, the management expects the full year EBITDAR to be in the range from €145 million to €160 million. The expectations expressed above would be lowered if there were significant reduction in the demand for air travel during in the second half of 2023.”

Views: 29