A320 PW GTF 100 SAF flight scaled

Airbus’s third quarter results are best summarized as beating Boeing. The two key members of the commercial aviation duopoly continue to account for almost all (>90%) commercial aircraft in service. Post announcing their results, Boeing’s share price declined and Airbus firmed. Airbus 3Q22 results signal confidence.

Both firms face headwinds: supply chain stress, labor shortages, and of course, yet another war. Guillaume Faury, Airbus Chief Executive Officer said: “The supply chain remains fragile resulting from the cumulative impact of COVID, the war in Ukraine, energy supply issues and constrained labor markets. Our strong focus on cash flow and the favorable dollar/euro environment have enabled us to raise our free cash flow guidance for 2022. The commercial aircraft delivery and earnings targets are maintained. Our teams are focused on our key priorities and in particular, delivering the commercial aircraft ramp-up over the coming months and years.”

Airbus has sent the kind of signal the market wants: they reiterated deliveries outlook at 700 this year. Given the demand for new aircraft as airlines seek greener credentials, Airbus is well placed. The market is looking for a single-aisle MoM and, really, the A321 is the best option. The Boeing MAX 9 is not competitive with the A321neo family and the MAX 10 has yet to be certified. Boeing has threatened to cancel the program. United’s Scott Kirby has stated that if United can’t get the MAX 10 they will buy the A321. United has orders for the A321XLR already. United is planning a big order.

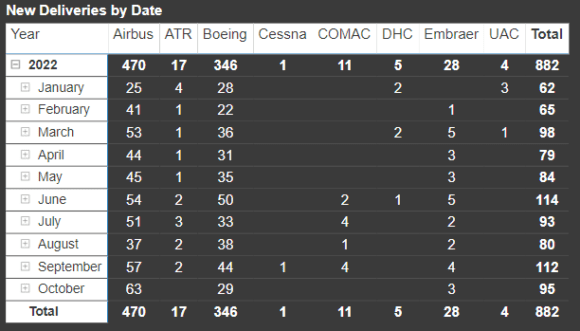

Another crucial signal is that Airbus is projecting its monthly delivery rate at 65 for 2024 and raising it to 75 for 2025. If you are a lessor or airline and updating a fleet, where would look first? You would, always, seek stability and currently, the place for that is Airbus. Here are our estimates for new deliveries for 2022 through October 30.

Airbus has some advantages in terms of products, but a key advantage has been Boeing’s stumbles. How else does one say it?

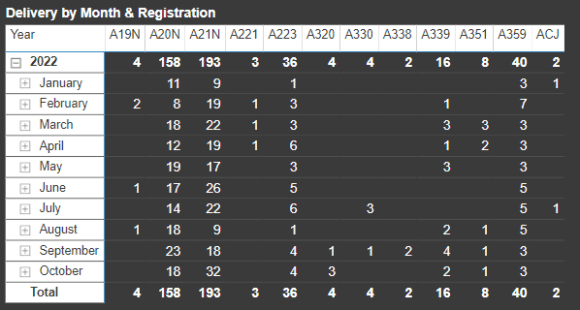

Here is our breakdown of Airbus 2022 YTD deliveries.

Note that Airbus has been able to deliver its single-aisle family, and that family includes the A220. Boeing’s competitive MAX 7 awaits certification and is also threatened with cancelation. Boeing faced long delays in 787 deliveries, while Airbus’ competitive A350 and A330 were being delivered. Airbus aims to deliver 700 aircraft this year and that target looks doable. It needs to deliver ~3 aircraft per day through the year-end. Typically, it has a production rush to make deliveries in December and 2022 will be no different, Faury said. Financial markets feel confident this goal is within reach.

Airbus reflects its confidence in talking up its production rate for 2024 and 2025. The European airframer is exploring a build rate increase on widebody and reiterated they are on track for 65 per month on the A320 family in early 2024. This confidence is likely to keep attracting orders. For example, we expect to hear about a big widebody order from Delta before year-end. Orders from airlines like Delta (and United) act as a guide and confidence builder for smaller airlines that lack fleet planning expertise internally.

Consequently, Airbus has raised its forward cash flow guidance. The strong dollar has also played a role since much of Airbus production costs are in Euros. All things considered, Airbus doing pretty well.

Views: 2