339734476 987267212153084 1705420415898987597 n

All Nippon Airways (ANA) returned to profitability in 2022, reporting its first black numbers since the pandemic started in 2020. The ¥89.4 billion net profit for the financial year 2022 follows a strong recovery of the Japanese airline, which is set to continue as FY23 will be a year of further growth based on the airline’s post-pandemic cost structure. All Nippon Airways back in the black.

ANA generated ¥1.707 billion in revenues compared to ¥1.020 billion in FY21, with ¥1.539 billion coming from the air transportation business. Note that ANA’s financial year ends on March 31. While higher, operating expenses of ¥1.587 billion versus ¥1.193 billion last year didn’t exceed revenues thanks to strict cost control. This resulted in a higher-than-expected operating income of ¥120 billion versus ¥-173.1 billion in the previous year and a net profit of ¥89.4 billion versus a ¥-143.6 billion loss in FY21. EBITDA was ¥264.3 billion, and free cash flow was ¥373.1 billion.

At the start of FY22, Japan was still confronted with the state of emergency and resulting travel restrictions. After this was lifted, air travel recovered quickly. International revenues were 6.2 times higher to ¥433.4 billion compared to ¥70.1 billion in FY21. The number of passengers increased to 4.2 million versus just 825.000 the year before. The focus was initially on routes the North America (which generated ¥39.6 billion in passenger revenues), but in the final January quarter, ANA added capacity from Tokyo Haneda to India and Australia. The international load factor was 73.6 percent, up from 27 percent.

Domestic travel only resumed in earnest in the second half of the year after the relaxation and then the lifting of restrictions. ANA’s domestic passenger number doubled to 34.5 million, revenues increased to ¥529.5 billion from ¥279.8 billion, and the load factor was up to 64.5 percent from 47.8 percent. The Boeing 777 fleet was redeployed on the domestic network again.

International cargo revenues were down to ¥308 billion from ¥328.7 billion and tonnes carried to 805K from 976K, with domestic cargo revenues down to ¥24.1 billion from ¥24.9 billion and tonnes carried actually slightly up to 253K from 251K. The overall lower number reflects a decline in parts from the automotive industry, says ANA, resulting in lower freighter capacity to eleven freighters.

Low-cost subsidiary Peach produced ¥90.2 billion in revenues, up from ¥37.8 billion in FY21. The carrier benefitted from a strong recovery in the leisure and visit friends and relatives markets and re-opened its international network again. Peach carried 7.8 million passengers at a 73.5 percent load factor compared to 4.3 million and 61.6 percent in the previous year.

Outlook

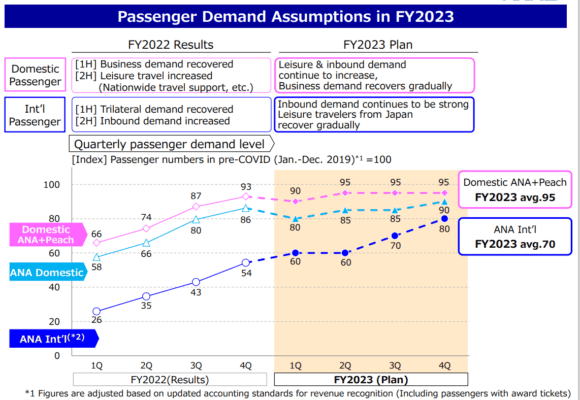

For FY23, ANA is optimistic that domestic leisure and inbound demand will continue to recover strongly. Business travel is behind but will catch up. Capacity for ANA domestic and Peach should grow from 90 percent this Q1 to 95 percent in Q4 (January-March 2024).

International inbound travel should be strong, but ANA expects more Japanese to pack their suitcase and explore the world. This translates into a capacity forecast of 60 percent in Q1 to 80 percent in Q4 versus 2019. The airline wants to capture the increasing leisure demand between Japan and China. Peach should fully recover its international network, while the domestic focus is on reorganizing the network and cost structure. In February 2024, AirJapan is set to launch operations within the Southeast Asian markets.

ANA guides consolidated revenues to grow to ¥1.970 billion, with international revenues expected to be up by ¥183.5 billion, domestic by ¥100.4 billion but cargo down by ¥90 billion. Operating expenses will be around ¥60 billion higher caused by price increases and higher costs for staffing. This should bring the FY23 operating income to ¥140 billion and the net profit attributable to shareholders to ¥80 billion.

ANA ended FY22 with net 276 aircraft, the same number as in FY21, but there were additions and retirements over the year that includes two new Boeing 787s and the retirements of two 767-300ERs and 777-300ERs. Peach took delivery of six new Airbus A321neo’s and -LRs but retired two A320s.

As operations recover to pre-pandemic levels, ANA is aware that it will need to offset carbon emissions from early 2024. After a drop during the pandemic years, emissions are expected to increase to 2019 levels again of 7.94 million tonnes. This requires its targets to be updated to the CORSIA transition scenario and accelerate the purchase of more sustainable aviation fuel (SAF) that is produced through direct capture technology. ANA presented its medium-term strategy in February.

Views: 9