200323 NW Bahn Parken 020 scaled

While air travel in the Northern hemisphere might be in for an extended summer period of pent-up demand, airlines are likely to respond most cautiously. In Europe, carriers will be prudent of adding capacity to match demand while airlines in the US might react differently, IATA Director General Willie Walsh said on July 7 during the first of two media days.

Last week, American Airlines had to cancel hundreds of flights as it seemed to have been caught out by the surge in demand. The passengers were there to travel, but there wasn’t sufficient cockpit and cabin crew available to fly them from A to B. “Demand has been stronger there than had been anticipated, principally leisure and visiting friends and relatives with business travel still significantly down”, said Walsh. Still, he thinks the situation there is different: “I put the US to one side because we know that the domestic market is very large at some 66 percent. It is a very big market with a single decision, federal decision (to ramp up).”

Getting it wrong might be costly

Europe is different, he says, with international travel accounting for 89 percent of the market and with a lot of decision-makers. The old continent has seen a variety of travel restrictions, with each country (EU-member state or not) abiding by its own rules. That makes it very difficult for airlines to read the market and decide if it is worthwhile to ramp up capacity.

“You will see airline management teams in Europe being very cautious about the reintroduction of capacity. If you get the timing of your increase in the network wrong, your costs will go significantly increase. In many cases, airlines currently aren’t paying for fuel, there aren’t paying for all of their labor costs because there are employee support schemes. All of those costs will come back very quickly.”

And customer behavior has changed dramatically over the pandemic that makes ramping up risky, adds Willie Walsh: “You don’t have the traditional sales in advance. People are only buying tickets when the evidence is up that there is a relaxation in the restrictions. So you see a disconnect between the cash coming in and the cash going out. And this is where airlines are very cautious.” So simply calling back furloughed staff and return an aircraft from storage back into service is easier said than done.

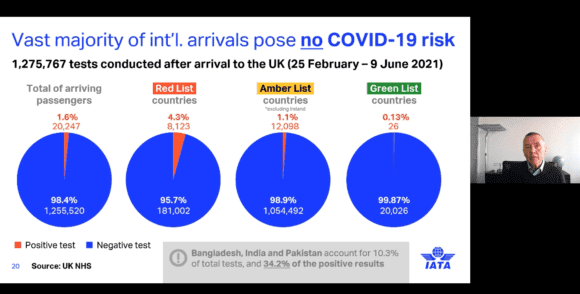

Willie Walsh explains the results of a recent survey on Covid-testing after arrival in the UK.

Carriers will be prudent of adding capacity. And there is a good reason: the Covid-situation. The spreading of the Delta variant is causing huge uncertainty over what will happen to restrictions. “I think it accounts for some 97 percent in the UK, Russia is at 93 percent, the US at 47 percent, Mexico at 74 percent. There are high levels, but the thing that surprised me is the decision by the UK government to put Pakistan on the red list when the data from the UK clearly shows that the level of concern over India was well in excess of that of Pakistan. Are governments genuinely driven by scientific data or is it driven by other decisions? Given that the Delta variant is almost everywhere, you have to challenge if putting additional restrictions in place does make sense.”

Walsh presented data from an IATA survey on testing upon arrival in the UK between February 25 and June 9. Out of 1.2 million PCR tests conducted after arrival, only 1.6 percent or 20.247 were positive. Travelers from red countries accounted for 4.3 percent within their segment, from amber countries 1.1 percent, and from green countries 0.13 percent. The latest positivity rate for UK arrival is 0.5 percent, said Walsh, which compares to a nationwide rate of two percent.

It again made Walsh push governments to finally base restrictions on scientific data, something that IATA and other lobby groups have been calling for during the last months.

The association also presented another survey that many people are willing to fly again, but that the costs for testing are a significant barrier for seventy percent of those surveyed. Walsh noted that in the UK, many of the cheapest tests are supposedly ‘sold out’ and that travelers are ‘ripped off’ to pay extra for an identical test at a higher price. If a test is needed, 86 percent are willing to do it if that is part of the travel process. Of those that have been vaccinated, 81 percent say it will make it more likely to fly again.

Pre-departure airport checks now up to three hours

That is if they ever make it to their airplane on time. IATA is worried about the inconsistency of airport checks and the increased time needed for checks, Nick Careen, Senior Vice President of Operations, Safety, and Security said. Pre-departure airport checks have gone up from 1.5 hours to three hours and could even go to 5.5 hours when traffic returns to 75 percent. If it reaches 100 percent, checks could take as long as eight hours until departure.

Bring on the digital passport, with Careen of course promoting IATA’s Travel Pass. It has to be updated 200 times per day to keep track of all the changes made by governments and airlines. But it offers travelers a simple tool that includes information about your nearest test lab, your latest test results, and can scan QR from certain countries. But not all, said Careen, as the app is still very much work in progress with continuous updates and additions coming up. Also, governments need to enable passengers to share their test and vaccination details in advance of travel. This could save precious time at airport checks.

IATA’s Nick Careen said that Travel Pass is now trialed by 74 airlines on 168 routes.

Qatar Airways is the first to have started a four-week trial to verify vaccine authentication. Another major airline is set to introduce the Travel App for widespread use, Careen said, without identifying which airline that is. Travel Pass is currently trialed by 74 airlines on 168 routes.

Worries over recouping lost revenues by airports and ANSPs

IATA is also very worried about airports and air navigation service providers’ (ANSP) intentions to fully recoup the losses that they have incurred in 2020 and this year. Hermant Mistry, Director Global Airport Infrastructure and Fuel, noted that forty percent of the world’s airports and ANSPs have planned to increase charges, with $9.3 billion to be recovered from 2023. Spain’s airport operator AENA intends to ‘claw back’ $2.4 billion and Heathrow Airport Limited $3.2 billion, but the situation is the same elsewhere. Mumbai accounts for $5.5 billion in potential extra costs to airlines and passengers, Delhi $3.1 billion.

At the same time, airports and ANSPs have taken initiatives for cost reductions of just two percent and have been reluctant to call their governments for aid or loans. “They plan the recovery of losses as if the pandemic hasn’t happened. This is very unfair to airlines and travelers. We need action from the European Commission and states to prevent this, otherwise, it will result in a cash burden of $7.8 billion.”

Mistry pointed out that airport and ANSP shareholders have benefitted from $12 billion in dividends in recent years. So it would be more than justified that they implement urgent cost-cutting measures themselves, as has happened in South Africa. They should finance their short-term requirements by accessing capital markets, as has been done by Frankfurt and Amsterdam Schiphol, Aeroporti di Roma, and NAV Canada. Mistry added that there is also a wide selection of government support packages available to airports and ANSPs across the globe.

Views: 0