GAMA

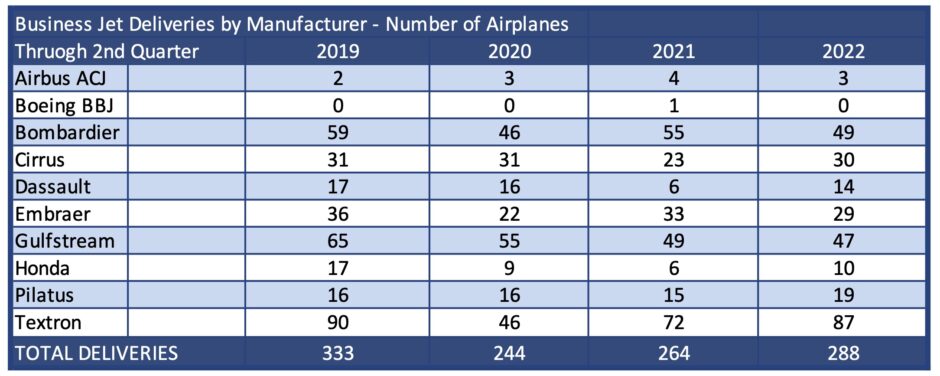

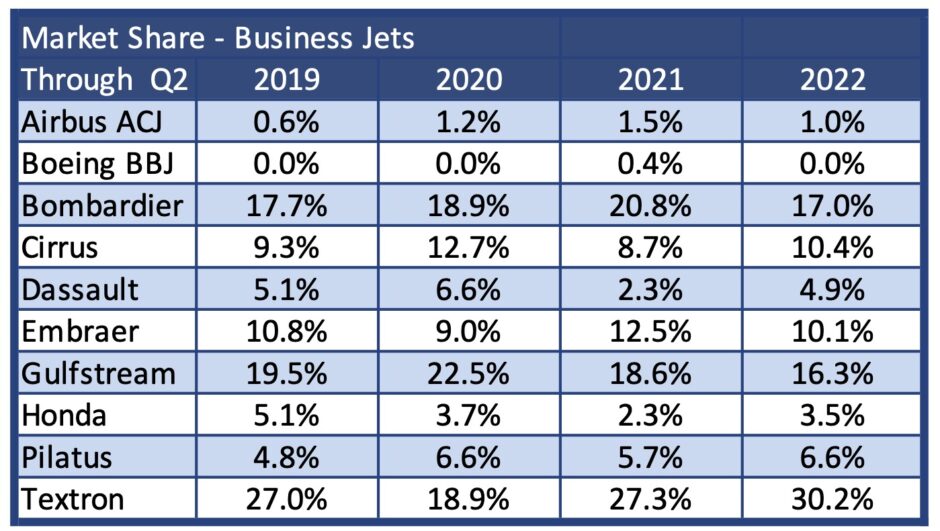

Continued recovery for general and business aviation is illustrated by recent shipment results for business aircraft. GAMA, the General Aviation Manufacturers Association, reported second quarter shipments for the industry today. Single engine aircraft, both piston and turboprop, are exceeding pre-pandemic levels while business jets and multi-engine turboprops are higher year over year but remain behind 2019 levels.