2024 03 20 10 44 06

The momentum behind ESG seems to wane—this is the way of fads. However, considerable capital remains invested in creating electrically powered aircraft, which will make their initial impact on regional service.

The US is the world’s largest regional air travel market; what insight can we draw from the available data?

Regional service typically covers up to 500 miles. US airlines frequently push their regionals to fly further, especially during the pandemic. This chart provides a good context for the US market.

The green splodge shows the range variation for US regionals over the period. At the end of 2023, the average was 491 miles, and the high point was 551 miles in 2020. Therefore, we can see the expected stage length from any regional aircraft for US commercial service. If you were to argue that electrically-powered aircraft are better compared to turboprops, then the average stage drops to about 330 miles.

How about the number of flights? This metric should also guide the extent of the market. The following chart is for US regionals, and the trend does not look promising.

The turboprop chart is even more depressing.

So far, the range is between 300 and 500 miles, and the number of flights is declining.

The following chart combines regional and turboprop traffic to get the whole mix. The number of flights has declined precipitously. Post-COVID, the pilot shortage moved regional airlines away from 50-seater aircraft. The number of flights declined even as regional airlines moved to larger aircraft.

The market scenario is, to be charitable, challenging.

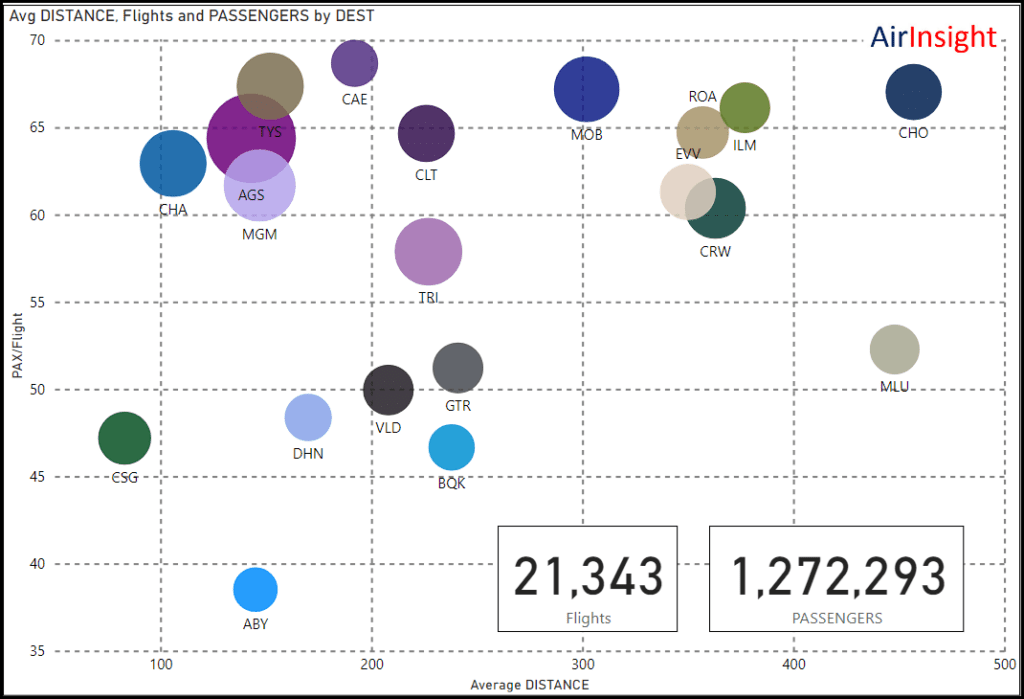

How about an an example market?

- Using Atlanta, the world’s busiest airport, as the origin point

- Using 2023 traffic, limited to regional aircraft

- Focus on up to 500-mile range.

- The ball size depicts traffic volume.

In 2023, the market potential for routes with a maximum 500-mile range from Atlanta using regional aircraft generated over 21,000 flights with about 1.3 million passengers. This looks potentially attractive.

Then, consider that electrically powered aircraft offer around 30 seats. Larger models are planned, but the EIS is unclear. A predictable response from the OEMs would be that they could open new markets that don’t appear in the traffic data. Perhaps. Hybrid-electric solutions are also helpful.

Meanwhile, regional jet operators continue ordering more E175s, even if they have LOIs or other deals for the forthcoming electrically-powered and hybrid-electric regional aircraft.

Views: 0