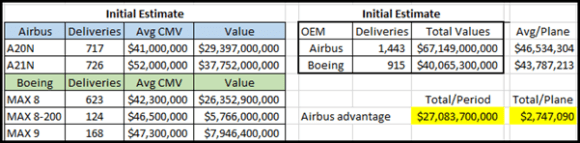

Last week, AirInsight published an estimate of the value of Airbus’s advantage in the single-aisle market. There were two key numbers: AirInsight estimated Airbus has an average of $2.7m per aircraft delivery and that Airbus has, between January 2021 and the end of October 2023, accrued $27Bn in value.

The data used for this estimate combined AirInsight’s delivery tracker and current market values from ch-Aviation. The numbers are eye-popping.

AviationValues, a London-based values and data provider, collaboratively provided a fresh dataset to work with. All AviationValues values and data are updated daily. The values are calculated using a sophisticated algorithm that translates real transaction pricing into values, supplying a more accurate and detailed view of the delivery picture. AirInsight decided to see if there is any appreciable difference.

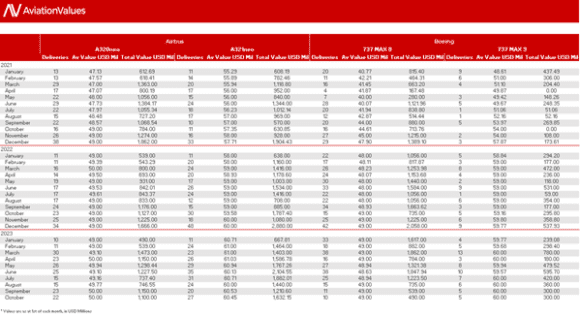

Let’s lay out the data. AviationValues provided the following table of values and volumes.

What does the data tell us in summary?

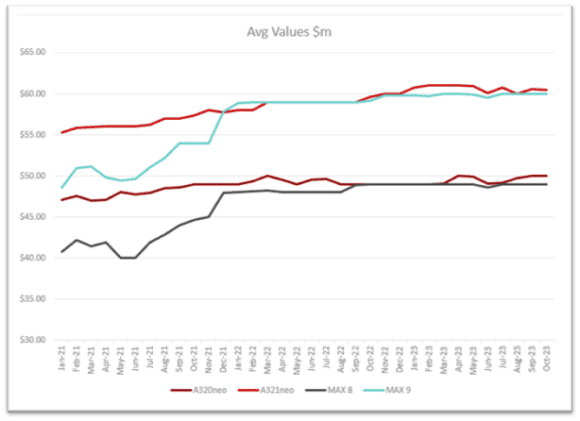

In our initial estimate, as seen below, we estimated Airbus had a $2.7m value advantage per aircraft delivery, based on generic average market value figures, which summed to over $27Bn over the period.

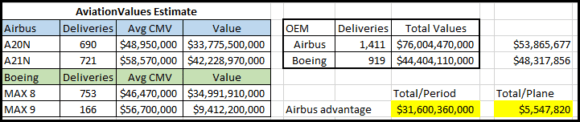

Using the same logic but with AviationValues data and values, here’s what we have now. The Airbus advantage rises to $5.5m per delivery and sums to nearly $32Bn.

Notice the number of deliveries varies between the two sources. Also, the difference in approach to the MAX 8: AviationValues does not assess a value premium to the MAX 8-200 variant on the basis that it accounts for less than 10% of the current MAX 8 fleet and is almost exclusively concentrated with one entity (Ryanair).

In terms of delivery figures, AviationValues numbers are slightly lower for Airbus and slightly higher for Boeing than our initial estimate. However, the values are averaged across and aggregated from delivery value figures by year of delivery. This specificity results in a total accrued value 17% higher than estimates based on generic averages.

The Implications

What are the implications of this data?

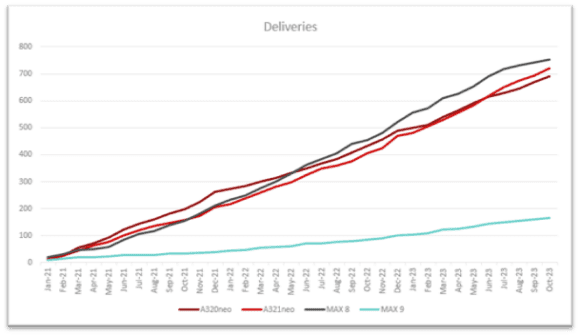

- Airbus has, by either data source, a substantial market and financial advantage. The following chart illustrates the point. Based on AviationValues’ cumulative delivery data, Boeing’s MAX 8 delivery volumes are leading. But both Airbus models are not far behind, and the A321neo has started to overtake its smaller sibling.

- The financial advantage is fundamentally due to Airbus’ dominance of the higher capacity segment: the A321neo clearly outperforms the MAX 9 in terms of deliveries, and its competitor, the MAX 10, has not yet been certificated. AviationValues assesses approximately $10 million in incremental value per aircraft between the MAX 8 and MAX 9 or between the A320neo and A321neo. So, for every A321neo Airbus delivers, the revenue advantage widens.

- The two charts help explain why Boeing is anxious to get the MAX 10 certified. Without the MAX 10, Boeing has no competitive product to capture a share of the A321neo’s market.

- The MAX 10 is the MAX model with the second highest orders after the MAX 8, so there is apparent demand for a competing high-capacity Boeing single-aisle product. But Boeing must bring the MAX 10 to market first before it can crystallise that interest.

- And in the meantime, Airbus is not standing still, with the more capable A321neo LR variant in service and the XLR nearing certification. At present, the A321neo backlog alone is larger than the backlog for Boeing’s entire MAX family, which means Boeing has some significant catching up to do.

- The interest in high-capacity single aisles like the MAX 10 and A321neo highlights a potential issue – what happens to MAX 9 values and demand? Will it be squeezed on either end? That’s going to be one to watch.

Bottom Line

The data suggests that Airbus enjoys a tremendous market advantage in the single-aisle segment. AviationValues’ fleet and values data shows this is mainly due to the success of the A321neo: Airbus has been able to capitalise on a market need in that segment, and Boeing has not.

This advantage is already worth about $30Bn. To put that number in perspective, $30Bn could fund a new aircraft program. At present, the A321neo backlog alone is larger than the backlog for Boeing’s entire MAX family, so barring some unforeseen event that suddenly tips the scales in Boeing’s favour, we would expect this advantage to persist for some time even after the MAX 10 enters service.

- AviationValues contributions written by Gary Crichlow, Head of Commercial Analysts

Views: 28