GAMA

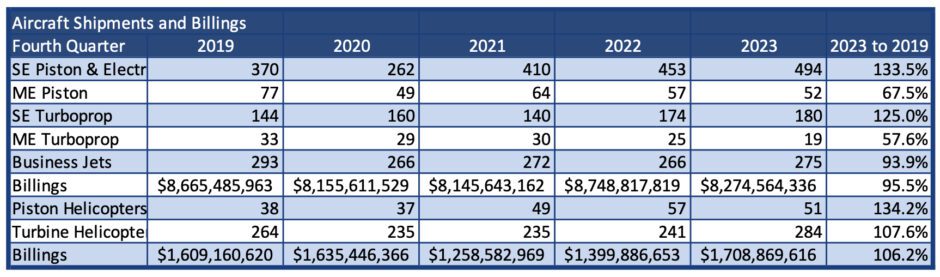

The GAMA 2023 Shipments and Billings report was released earlier today, summarizing the results for the general aviation industry for the 4th quarter and full year 2023. Business aviation continued its slow improvement during the fourth quarter, with single engine piston and turboprop aircraft above 2019 pre-pandemic levels. Business jets remained soft, reaching 93.9% of 2019 deliveries, and billings were also soft, at 95.5% of 2019 levels due to supply chain constraints in the business jet market. On an inflation-adjusted basis, the industry still has a long way to go to achieve pre-pandemic revenues.