WS33009 caution opendoor slowly 80202.1403546520.450.450

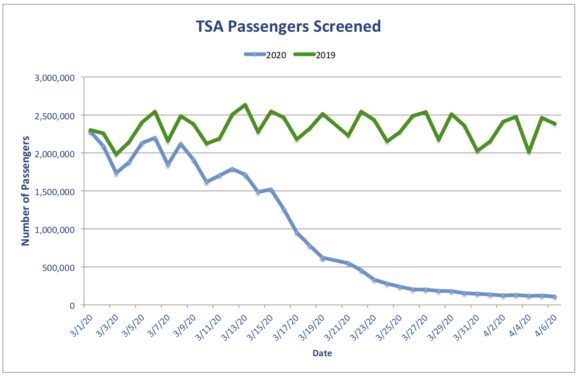

Once the coronavirus crisis ends, air travel will resume, but at lower levels of activity for the first few months as the economy rebounds, employees return to their offices and plants, and airport open at different times throughout the world. Airlines will be loathe to immediately institute a full schedule, as traffic will not warrant either the number of flights nor typical seating capacity for those routes. In past downturns, airlines have returned to service in a conservative manner, utilizing smaller and regional aircraft to restore flights to routes, increasing the size of aircraft as traffic returns. This situation has shut the majority of airline operations down quickly and has had a severe effect on load factors, as evidenced by this chart of TSA passengers screened.

As traffic and passengers return, we expect that airlines will reintroduce flights on a market by market basis, not all at once, and begin many routes with the lowest risk aircraft they can fly in that market. That typically means an initial focus on smaller aircraft, including regional jets and small narrow-bodies for domestic operations, and large narrow-bodies or smaller wide-bodies for international operations in certain markets. That may or may not match the actual fleet in place after the downturn, and airline fleet planners are currently analyzing their future orders, deciding which airplanes to keep on order and which to defer or cancel as they project alternative demand scenarios.

Subscriber content – Sign in [maxbutton id=”1″ ] [maxbutton id=”2″ ]

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →