clear sky

Last week at the Farnborough Airshow, Airbus’ A321XLR made its debut. It was very quiet and looked like any other A321. The long-range tanks behind the wing are only noted by aviation geeks.

With 550 on order, Airbus is confident they will pick up more orders, so there is confidence this aircraft has a great future. This correspondent admits to being part of that group.

However, there is another important view. Boeing’s VP of Marketing, Darren Hulst, observed that the long-range single-aisle is a small segment. It would not be smart to dismiss his statement. After all, Boeing won the debate between the 787 and A380.

What does the data show? Looking at the US DoT T-100, we see the following.

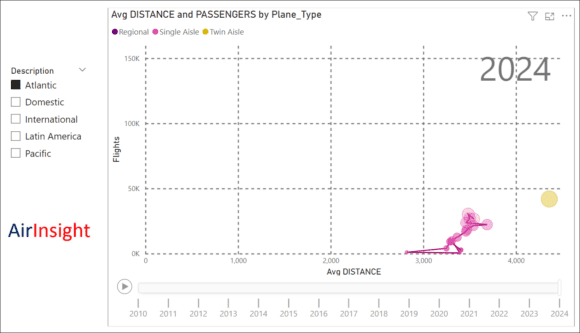

We focus on the Atlantic region, the key disruptive region the A321XLR could disrupt.

The chart shows that the market is small, and the number of single-aisle flights peaked in 2012, and flights peaked at 3,700 miles in 2014.

Looking at the other regions, patterns fall even more with distance. Boeing’s Darren Hulst seems right on.

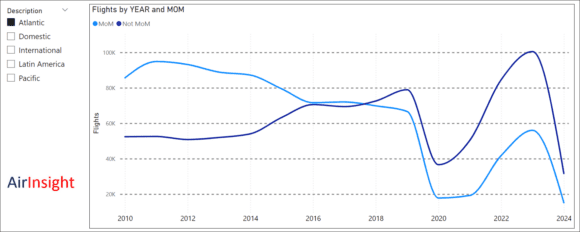

Another view on the market is to look at flights using MoM versus non-MoM models.

The trend is clear – single-aisles have steadily declined, even if the 2024 data is only through April. Larger aircraft show a more robust recovery from the pandemic.

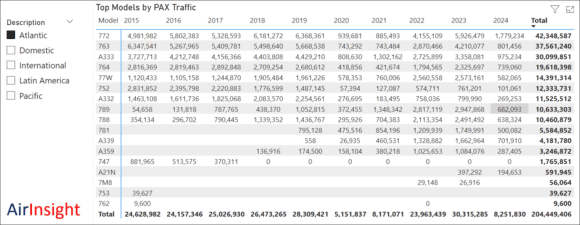

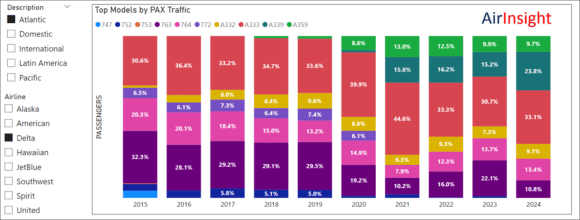

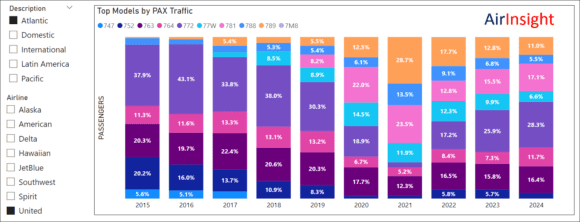

Drilling down some more to see passenger traffic in this market, we have the following.

- The MoM segment is very important in this market

- The 767-300 remains a major traffic carrier

- The 757-200 is ranked #6, and in 2023 and 2024 YTD, it is outpaced by the A321neo

- Twin aisles are the primary models in this market.

- The 777-200 and 767-400 (at United) will likely be replaced by the 787-10 over time.

- The A330 is another key model in this market. Delta’s older 767-400s, 767s and A330s likely to be replaced by the A330-900

A final series of charts to further peel back the layers.

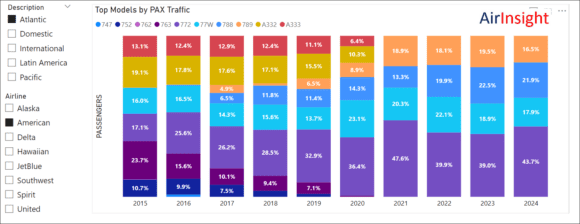

American Airlines

American streamlined its fleet, with more than half its traffic on 777s.

Delta Air Lines

Delta also made fleet changes, such as dropping the 777. Note the switch from 767 to A330neo and A350.

United Airlines

Among the big three, United is the only 757 operator in this market. We expect their A321LR and XLRs to enter the market. United’s 777-200 and 787-10s are busy in this market. Interestingly, United also has a sizable 767 fleet active in this market.

Summary

- A single-aisle long-range model like the A321XLR might be disruptive, but only in a few cases.

- Here, we imagine EU-based operators entering the market serving secondary cities. i.e., Brussels-Hartford.

- For US operators, the origin would be a fortress hub to a secondary EU destination. i.e., Washington DC – Lyon.

- The Atlantic market, seen by many as the ideal disruptive opportunity for the A321XLR, is probably not as big as many (including us) had thought.

While this seems to back the Boeing view, one cannot dismiss 550 orders for the XLR. As Airbus told us at the show, they have no idea what operators will do once they have these aircraft. History shows operators experiment and try novel ideas – like the 757-200 across the Atlantic.

The analysis suggests that Boeing has a point, but operators might prove that point pyrrhic.

If you want to experiment with our model, please use this link. Suggestions to tweak it are welcomed.

Views: 49

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →