16 agosto 2013 dreamliner aeromexico 174

The US-Mexico market is having one of the best recoveries of the current pandemic. Fueled by VFR and leisure segments, beach destinations like Cancun and Los Cabos, it has seen an uprise of bookings from the US. And airlines such as Delta, American, and others are taking notice.

Mexico continues to dwarf every other country pair of the US, according to Airlines For America. So far, the Mexico-US market has received 1.282 million total nonstop air passengers, while the second place, the Dominican Republic, has received 285 thousand. Canada and the UK, the former hotspots for US travelers, are exceptionally behind.

The mix of a lack of restrictions against travelers in Mexico and the proximity to many US cities led to an increase in the number of winter bookings. According to ForwardKeys, the bookings on routes from the US to Cancun and Los Cabos have already surpassed the 2019 trends, while the booking on routes to Puerto Vallarta is only 3% down from last years’.

How has the US-Mexico market evolved?

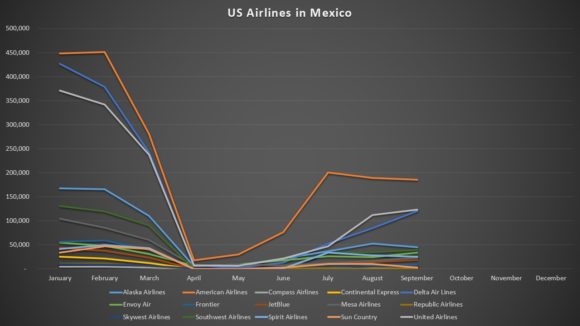

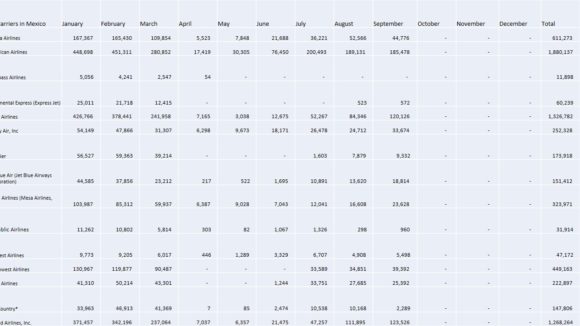

As we can see in graph 1, 15 US carriers serve Mexico (albeit some work on behalf of larger carriers like Skywest Airlines). They all saw a drop in the number of passengers transported in April but had their first signs of recovery in May.

Between May and July, American Airlines was having a V-shaped recovery before stalling in the number of passengers transported. Meanwhile, Delta and United took longer to recover but are now seeing an increase in the number of passengers transported into Mexico, according to Government stats.

Now, with the winter season approaching the US, the second waves of COVID-19 infections in Europe, and the lack of certainty as to international travel restrictions, we will see a surge of passengers transported between Mexico and the US for the fourth quarter of 2020.

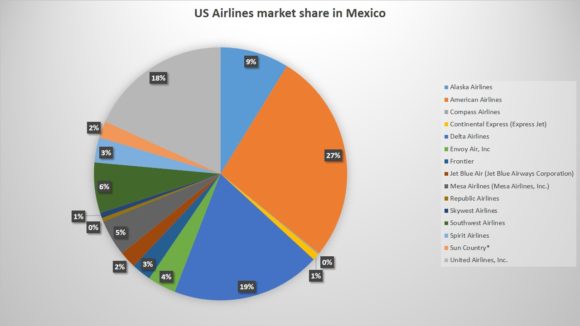

But that’s not all. We’ll also see the US carriers seizing the market and gaining even more share. According to the Mexican Government, in September, US airlines had 64% of the international market share between both countries.

Moreover, according to OAG, the market share will increase in the following months. OAG states that Mexican airlines reduced by 10K its number of seats on a year-to-year basis, while US carriers increased it by 40K. This means that, for the week of 14 December, US carriers will have a 74% market share.

Mexican airlines are having a hard time

US carriers are putting their capacities on the Mexican market, and the Mexican airlines are having a hard time to adjust. Volaris and Viva Aerobus are low-cost carriers that mainly fly to Texas and Californian cities, where there are the largest Mexican communities. Meanwhile, Grupo Aeromexico focuses on its Chapter 11 reorganization and uses its alliance with Delta to its maximum. Finally, Interjet, which used to be the second-largest player in the Mexican international market, has stopped flying abroad altogether.

According to Mexican authorities, in September, the three leading Mexican airlines had a 28% market share of the US-Mexico market.

But not everything is lost for Mexican airlines. The best way for them to compete is through codeshare agreements. For instance, Grupo Aeromexico announced today that, along with its partnership with Delta, they will recover 95% of their ASKs for December in transborder routes. Volaris has a codeshare agreement with Frontier Airlines.

Views: 2