MAX delivery

There’s some chatter (and here) about operators being uncertain about US tariffs and slowing deliveries. There is even some uncertainty about Delta’s decision to take two new A321neos and cannibalize their engines.

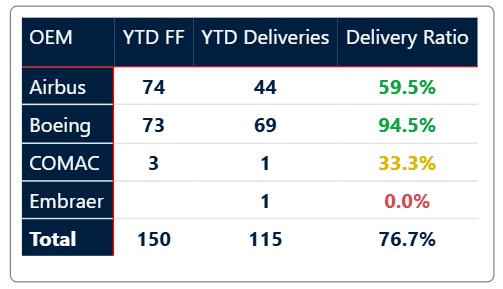

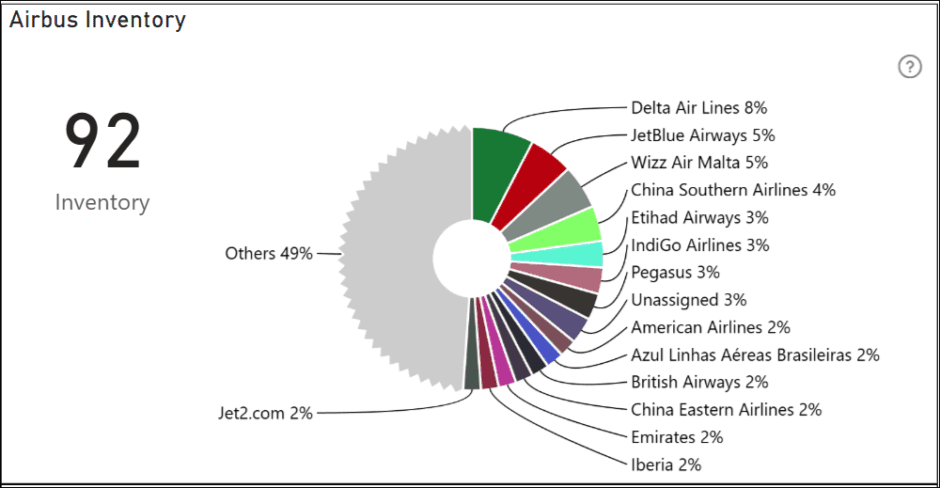

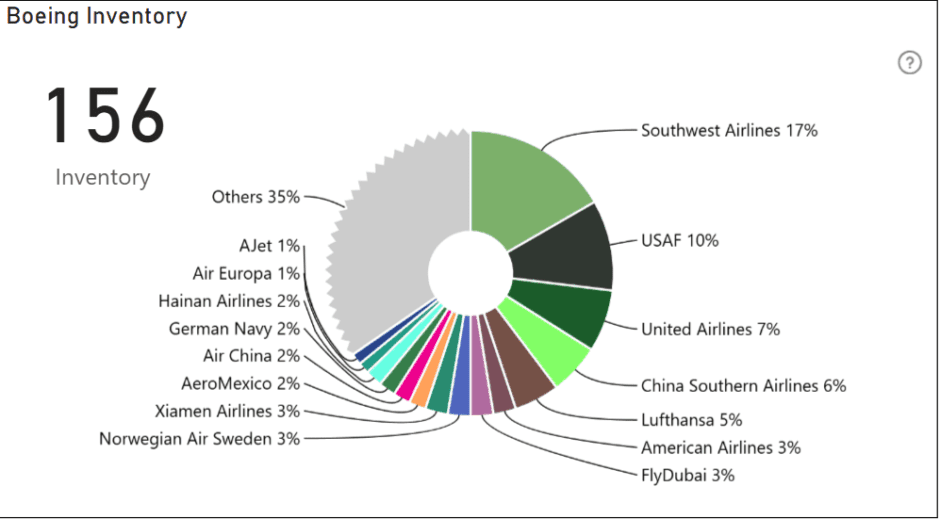

Here are two charts that show the inventory at Airbus and Boeing. This may help clarify some of the confusion—the inventory numbers are based on our daily estimates of production and deliveries. You can see our model here.

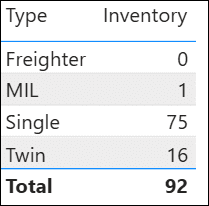

We define inventory as the difference between aircraft that have been produced and have had their first flight, minus aircraft that have been delivered.

- Delta and American are the largest US-based operators with Airbus inventory.

- These operators are waiting for A321neo deliveries. Interestingly, US customers can take delivery from the Airbus Mobile FAL. There should be no tariffs on such deliveries. However, Mobile does not produce fast enough to meet US demand.

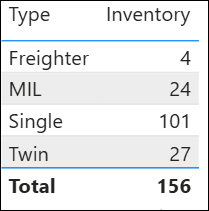

- Engines are pacing deliveries – both P&W (Delta & United) and CFM (American) are running behind schedule. The table breaks down the inventory by aircraft type.

- No surprises among the big customers. It’s MAX and KC-46 that are going slowly.

- Chinese customers feature prominently and are MAX-focused. The China situation is a political issue that predates the tariff chatter. Tariffs are now a convenient addition to further frustrate the industry.

- MAX production is rising again, and creative ways to move inventory are a proven talent at Boeing.

- The MAX inventory is also why Boeing has more inventory than Airbus.

- The table lists the inventory by aircraft type.

Summary

- Tariffs may be creating uncertainty. The on-again, off-again nature of the tariff talk is likely the most significant issue. The noise from DC is not helping an industry that plans years in advance.

- Airlines like Delta found ways to reduce costs by avoiding import duties and tariffs. Kudos to them for being creative and outsmarting DC.

- Airlines face exogenous shocks daily, from weather to conflicts. They are among the most agile companies in existence. To survive, this agility is critical.

- Tariffs are just another market disruption they are working through. Airlines and lessors will have solutions in place within six months or sooner. Politicians come and go, while businesses must endure. The confusion requires new thinking and adjustments to previous ideas and approaches. The industry will outsmart DC now, as it has done every time before.

Views: 195