iberia 1197559984c00

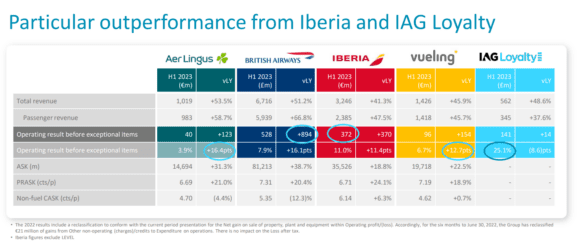

Strong results at Iberia and British Airways have helped to boost International Airlines Group’s (IAG) operating profit of €1.3 billion euros in HY1. Traffic on routes to North and South America was particularly strong and should have fully recovered to pre-pandemic levels by the end of this year. Indications are good, as Q3 bookings already have generated eighty percent of passenger revenues for the quarter, IAG said on July 28. Record-result Iberia benefits IAG HY1 profits.

IAG reported a €1.037 billion profit before tax compared to a €-843 million loss in HY1 last year. The net profit is €921 million versus €-654 million. “This has been a good start to the year, delivering a record first-half profit. We are looking forward to delivering another strong quarter in the summer and finishing the year positively,” said CEO Luis Gallego

Total revenues increased by 45.3 percent to €13.583 billion from €9.351 billion. Passenger revenues were €11.784 billion, up from €7.604 billion. Cargo generated €603 million in revenues, down from €843 million in the same period last year. Yields are still 21 percent higher, but as CFO Nicholas Cadbury said, there is a significant imbalance between demand and supply. Other revenues from loyalty programs, MRO, and BA Holidays contributed €1.196 billion to the result compared to €904 million in 2022.

Passenger revenues per available kilometers (RASK) were up 18.4 percent year on year. British Airways, Iberia, Vueling, Aer Lingus, and LEVEL carried a combined 54.3 million passengers at an 84.1 percent seat factor. Capacity/available seat kilometers (ASK) was up 30.9 percent to 154 million. Corporate travel is recovering more slowly than expected but differs by airline. Iberia is seeing a stronger recovery than BA and Aer Lingus.

Expenses were up 26.2 percent to €12.323 billion from €9.768 billion. The biggest single cost factor was fuel, up 38.3 percent to €3.550 billion and reflecting more flying activities and higher hedged fuel prices. Employee costs were up 20.4 percent to €2.610 billion. IAG produced an operating profit of €1.260 billion versus €-446 million last year. The operating margin was 9.3 percent.

For Q2, IAG posted a €1.158 billion profit before tax (2022: €73 million) and a net profit of €1.008 billion (€133 million). Consolidated revenues grew to €7.694 billion (€5.916 billion), with passenger revenues up 36.2 percent to €6.743 billion. Expenses totaled €6.443 billion, up 14.7 percent year on year. The operating profit was €1.251 billion (€301 million) at a margin of sixteen percent.

IAG has started to reduce gross debt and repaid €500 million in unsecured debt, bringing gross debt to €19.6 billion. Thanks to the strong EBITDA, net debt is down to €7.6 billion from €11 billion. The group bolstered its cash position by €2.4 billion to €12 billion and has now €15.6 billion in liquidity.

Record-high operating profit Iberia

As mentioned, Iberia performed particularly strongly in both North and Latin America. The Spanish airline produced a €372 million operating result before exceptional items at an operating margin of eleven percent. Total revenues in HY1 were up 41.3 percent to €3.246 billion. In Q2, the carrier reported a record-high €307 million operating profit, an operating margin of 17.8 percent, and €1.780 billion in revenues. With an on-time performance of 90.4 percent, Iberia is the third most punctual airline in Europe.

British Airways reported a €528 million HY1 operating profit before exceptional items, up €894 million year on year, at a 7.9 percent margin. Total revenues grew 51.2 percent to €6.716 billion. In Q2, the operating profit was €514 million, up from €60 million last year. Revenues increased to €3.674 billion. The airline is performing strongly on the North Atlantic routes and has a 37 percent market share at Heathrow. BA is rebuilding its network to Asia, having resumed services to China, Japan, and other countries.

Despite having beefed up its workforce by 4.000 new BA employees, a strike at London Heathrow, ATC issues at London Gatwick, ground handling problems, and bad weather at the main hub contributed to a low 57.2 percent on-time performance. CEO Luis Gallego said that BA will have to improve punctuality, although not all is in it hands. Rest assured that the problems are top of the list when IAG and BA management meet with the new CEO of Heathrow.

Aer Lingus and Vueling are more exposed to seasonality but also improved their operating results. After a Q1 loss, Aer Lingus posted a €40 million operating profit, up 123 percent, with revenues up 53.5 percent to €1.019 billion. The operating margin was 3.9 percent. In Q2, the carrier produced a €121 million operating profit with €643 million in revenues. Both long-haul routes to the US and short-haul routes have been doing well in Q2. The on-time performance was 63.2 percent and, like that of BA, will need to improve. One action is that Aer Lingus will add more check-in facilities at its Dublin hub.

Vueling reported a €96 million operating profit in HY1 at a 6.7 percent margin. Revenues were up 45.9 percent to €1.426 billion. In Q2, the result was €160 million, up from €40 million last year. Revenues were €902 million, with ancillary revenues up by 21 percent.

Vueling is operating at 2019 levels and reached a 91 percent load factor in Q2 and has a very strong position at its Barcelona hub. The on-time performance of 79.3 percent reflects schedule disruptions mainly caused by ATC strikes in France, which force the airline to fly longer routes. Like Iberia, it had benefitted from better aircraft utilization.

Booking trends look good for Q4

Booking trends of Q3 are strong and also looking good for Q4, with already thirty percent booked. IAG continues to guide full-year capacity at on average 97 percent for all carriers combined. In Q3, Aer Lingus is at 103 percent, Vueling at 102 percent, Iberia at 99 percent, BA at 94 percent, and LEVEL at 143 percent of 2019. Full-year, Vueling should operate at 109 percent, Aer Lingus at 105, Iberia at 103, British Airways at 91, and LEVEL at 136 percent. The lower figure for BA is caused by the low capacity levels to Asia in the earlier quarters.

IAG is not giving full guidance for the rest of 2023 as it has less visibility for Q4. It only says: “We continue to expect non-fuel unit costs for the year to be in the range of 6% to 10% better compared to full year 2022. We expect to generate sustainable free cash flow this year and for our net debt at December 31, 2023, to reduce compared to December 31, 2022, in line with our profit outperformance.” Fuel is hedged 67 percent for this year and just over forty percent for 2024.

Building back the long-haul fleet

Finally, IAG announced on Thursday that it had exercised options on six Boeing 787-10s for British Airways and placed six new options. It also exercised an option on one Airbus A350-900 for Iberia. The aircraft will be delivered in 2025 and 2026 and will help to rebuild the long-haul capacity of the two airlines that was reduced since the pandemic. British Airways phased out its Boeing 747-400s and currently operates 122 widebodies compared to 135 in 2019, while at 36 widebodies, Iberia is still down five aircraft on 2019.

The narrowbody fleets are almost back at pre-pandemic levels. At 157 aircraft, BA is still short ten aircraft on 2019 but will take delivery of a few more during the year. Iberia has two more narrowbodies than in 2019, Vueling one, while Aer Lingus is on par. During HY1, IAG took delivery of eleven aircraft. For HY2, it counts on another nineteen deliveries, including one leased A330 to LEVEL. Earlier this month, IAG exercised options on ten Airbus A320neo’s.

Views: 63