A Viva Aerobus aircraft parked in Monterrey International Airport 3 scaled

It is remarkable to see how the tariff chatter has impacted travel, with its effects now subsiding. It was the flavor du jour early in the year, and now it seems to have settled into background noise. It turns out that the impact might not be as bad as many expected, and unfortunately, some had hoped. The pandemic’s impact was so damaging that one should never wish anything bad for the travel industry again. Don’t mess with Karma.

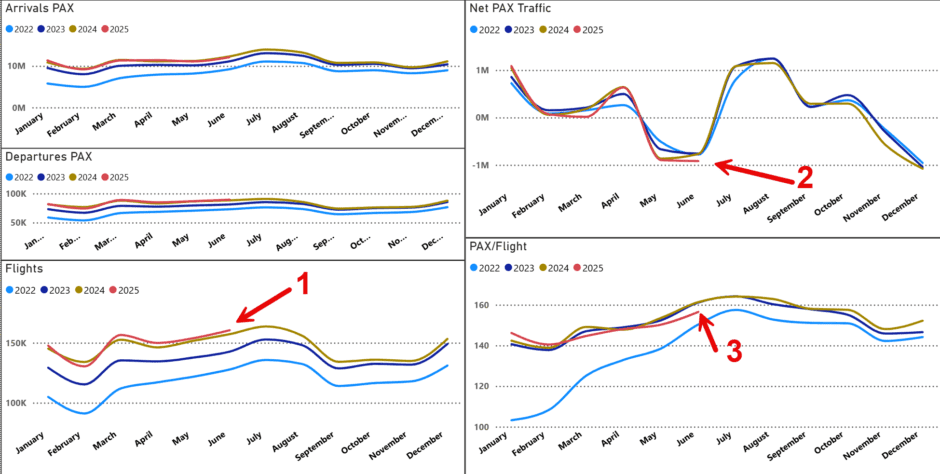

As always, let’s go to the charts. The first is a busy chart, but please follow along below.

- The two upper left charts show that the number of arrivals and departures of passengers looks to be close to the 2024 volumes.

- Item 1 shows that the airlines have added flights, which is a bullish sign in the negative tariff chatter.

- Item 2 shows that the net traffic is lower in 2025 than in previous years. Net traffic is arrivals minus departures. So a negative means more departures than arrivals. Notice that each year shows a net outflow of traffic from May as Americans travel abroad in greater volumes than visitors arrive. What could be a negative signal is not, but rather a consistent annual event.

- Item 3 shows that 2025 has fewer passengers per light than previous years. This trend should be viewed in conjunction with the higher number of flights. If passenger volumes are approximately stable and there are more flights, the passenger/flight ratio will drop.

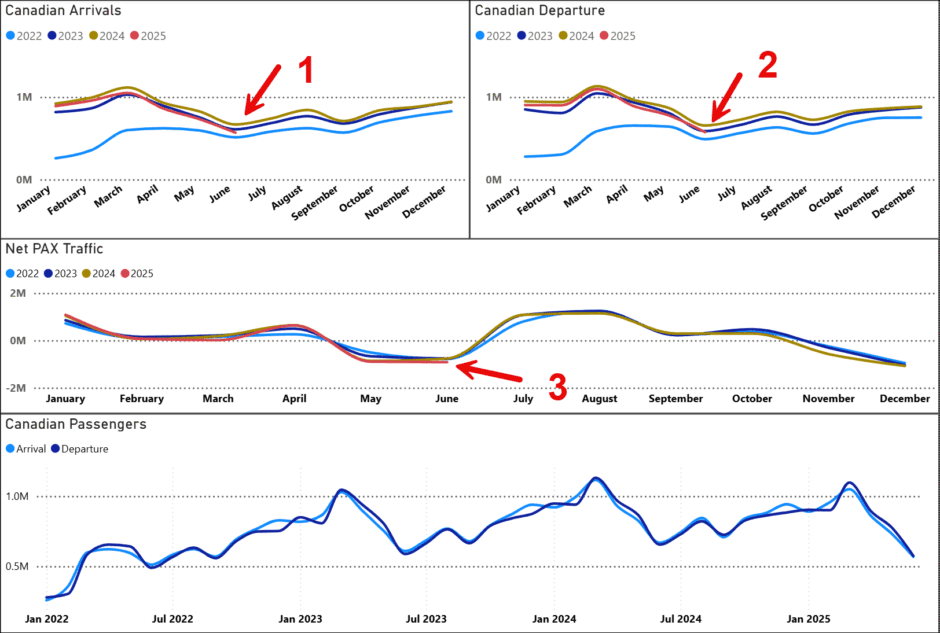

Canada

This market is a special case because of geographical proximity and, particularly, because of the political heat. Here’s what the charts show.

- Item 1 shows lower arrivals for 2025.

- Item 2 shows equally lower departures.

- Item 3 shows negative traffic flow, consistent with previous years. However, the net volume is lower this year by 19.2% compared to the average of the earlier years. Political impacts are playing out.

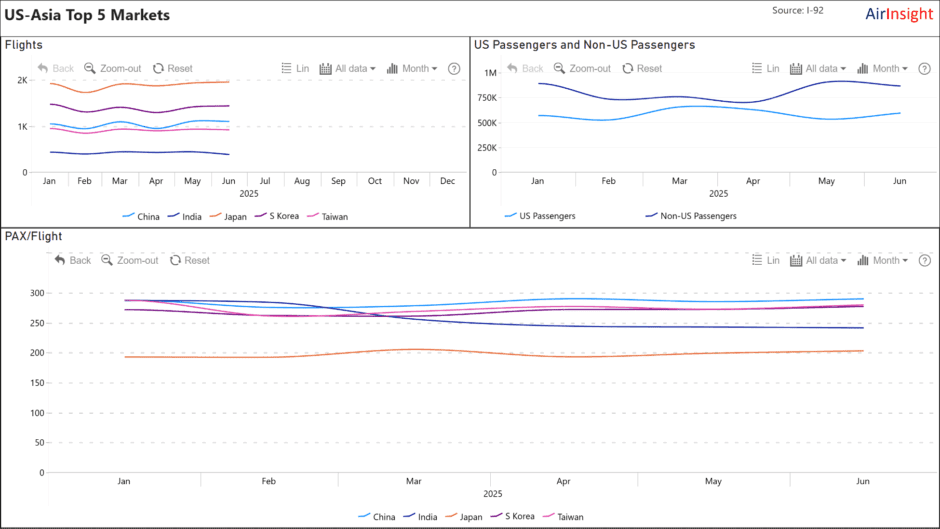

Asia

Here is the chart for Asia’s top five markets’ traffic for 1H25. The trends look relatively stable. The heated China-US political chatter seems to have had little impact on traffic.

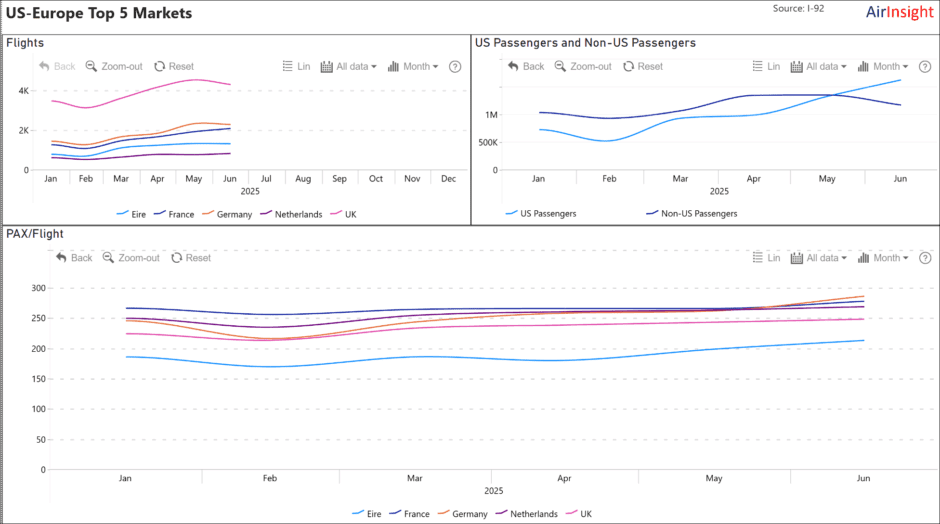

Europe

Here is the chart for Europe’s top five markets’ traffic for 1H25. The trends also look relatively stable. Any heated political chatter seems to have had little impact on traffic. European travel to the US declined from a trend that might have sent it higher this year, though. As the next few months of data come in, this trend might re-emerge. Note also that as summer started, U.S. travelers flocked to Europe as usual.

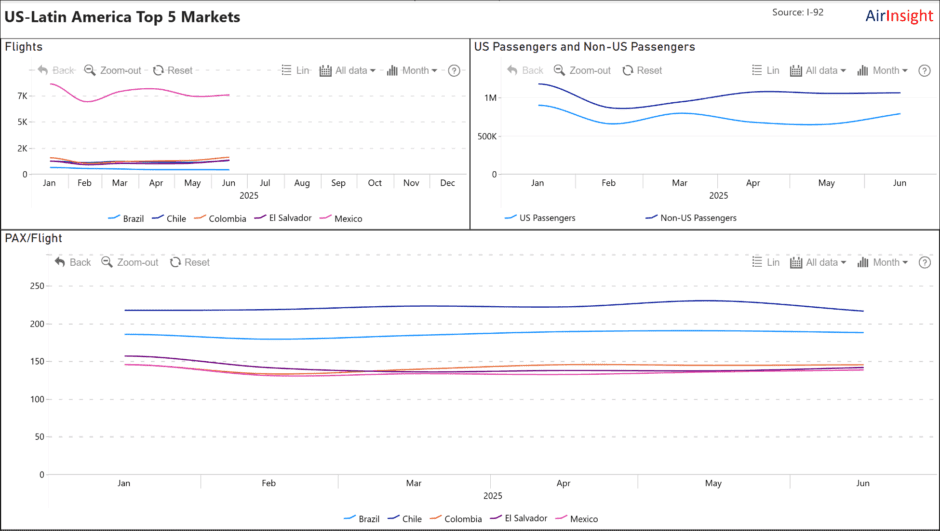

Latin America

Mexico is by far the most critical market. Like Canada, its proximity multiplies the impact of political rhetoric. Once again, we see a relatively stable market.

Conclusions

- There has been an impact on traffic volumes due to the tariff chatter, which created uncertainty. This has almost certainly led to shorter travel planning periods.

- However, on balance so far, it appears the impacts are smaller than we might have expected. This is especially the case for Canada and Mexico, two neighbors that faced heated political rhetoric.

- As we reported in our previous note on this subject, we need to work through the summer to gain a clearer picture. In October, when we receive the September numbers, we will likely be able to see how tariff chatter impacted the peak summer season.

Views: 118

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}