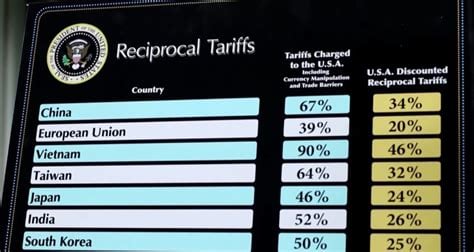

tariff

Tariff impact is just about the only news item anywhere. While pundits opine, nobody knows what’s coming next. The on-again-off-again tariffs have made markets unstable.

The news reports suggest the travel market is not only in turmoil, but travel to the US is declining. Here’s some data on international travel from the United States that might help provide some actual evidence of what consumers are doing. The data source is the I-92 from DHS and is through March 2025.

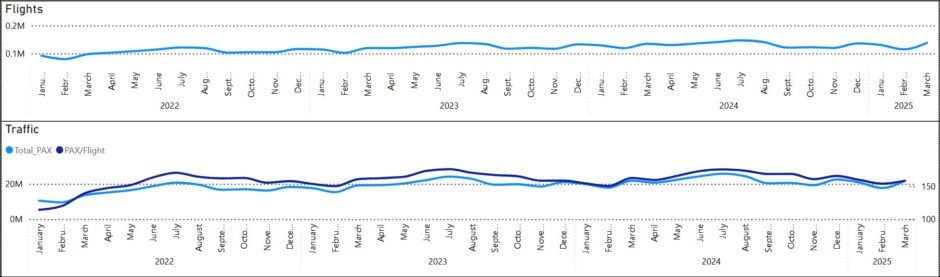

Overall Market

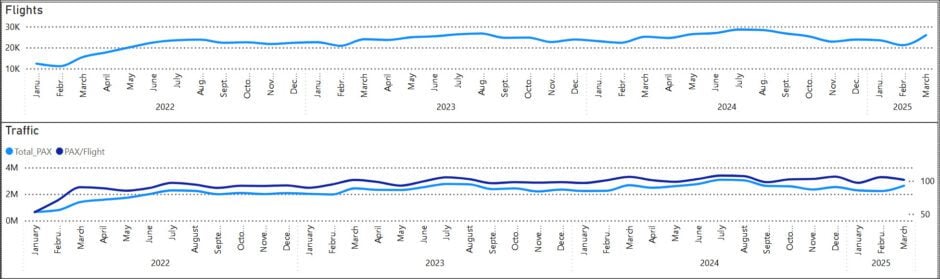

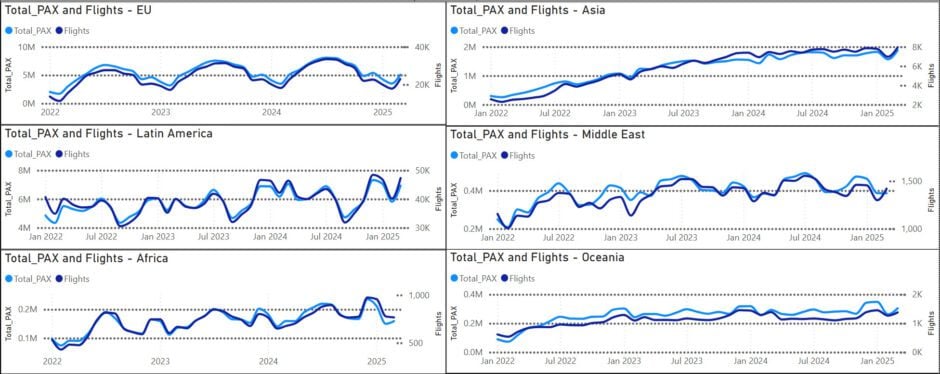

The charts provide a perspective on how travel patterns are well established. The past is never prologue, but habits don’t change easily.

The charts show traffic patterns from the pandemic, which impacted international travel more than any other. Yet the charts show steady and consistent patterns. Yes, this is looking back rather than forward. The charts suggest that the patterns are so consistent that one might expect them to continue. What kind of shock is required to break these patterns? Is the tariff chatter sufficient?

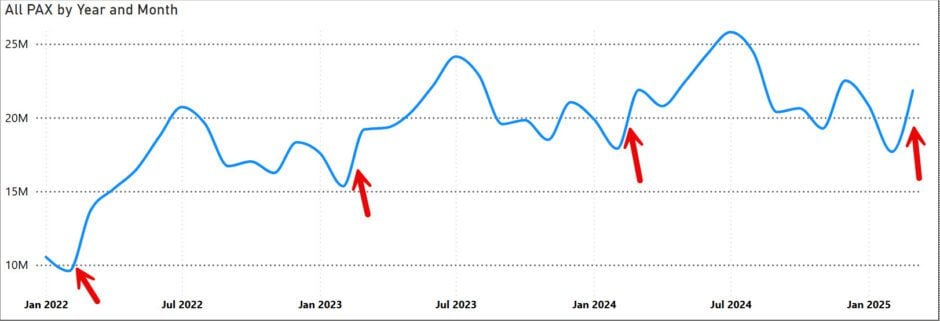

Here’s another chart that shows consistent first quarter market behavior.

The red arrows show a consistent pattern; each January is better than the previous period. These are not signals showing market softening.

Here’s the answer if you’re wondering how traffic looks for 2025.

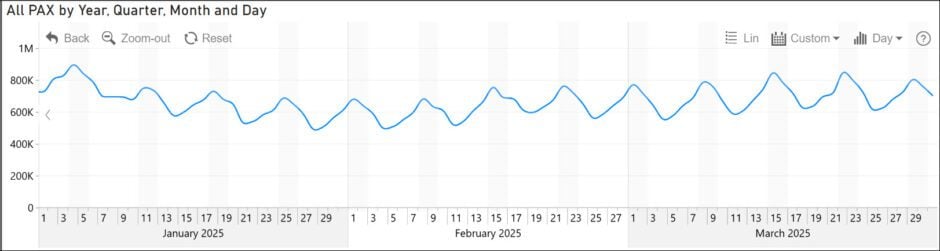

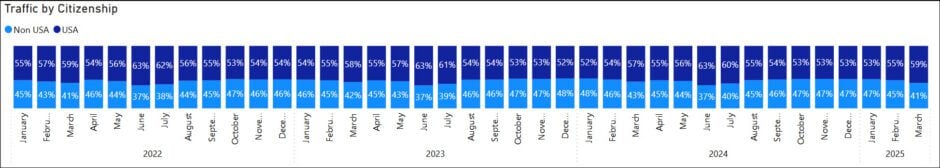

It seems pretty stable. The following chart shows the traffic breakdown by citizenship.

There is a slight seasonal ebb and flow. The US accounts for more than half the traffic. The tariff impact, if there is one, works both ways. If overseas visitors fear that their spending power is curtailed, will they take shorter trips to the US or avoid the US altogether?

For outbound US travelers, a stronger US Dollar means better buying power, which should translate into longer trips and more spending. Since these travelers are the majority, that is a positive for the market.

Let’s look at two key overseas markets for the US.

Canada

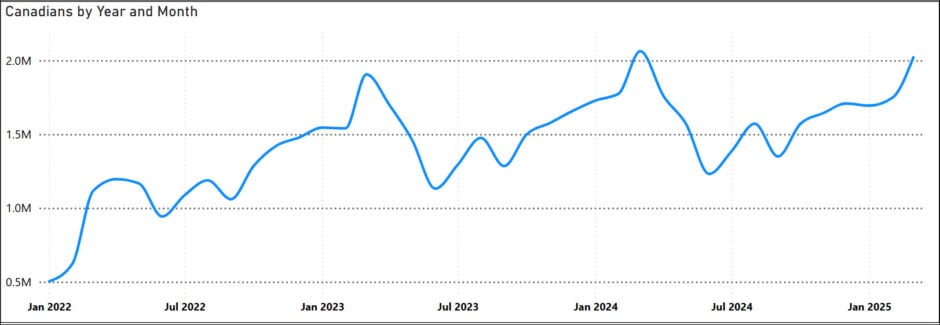

Canadians are in election season, adding more anxiety to the tariff threat. The chart below shows Canadians flying from the US to Canada. Traffic looks robust over the period tracked.

Looking at the Canadian market from an all-traffic perspective, we get this. Notice the consistent patterns in the flows. There was an uptick in flights in March 2025, consistent with overall market growth.

The lower chart shows traffic and passengers per flight. This chart also indicates remarkably consistent patterns.

There have been reports that bookings are down. Our charts reflect what happened through the end of last month. It seems that, by and large, Canadians still want to get away from the cold to warm places they are familiar with, and the southern US remains attractive. Will the strong patterns we see hold going forward? Stay tuned.

Great Britain

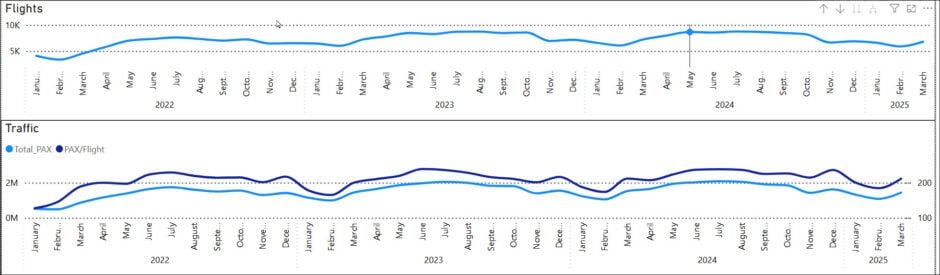

Another market that reports traffic declines is the UK. Are adverse reports to be taken seriously?

There are clear patterns showing seasonality. And like the other charts, this market shows the same behavior.

Other Markets

For those who think we cherry-picked the two markets above, here’s a global view that shows the same patterns.

Summary

The tariff chatter is undoubtedly having short-term impacts, playing on fears. The data suggest that markets are resilient. The tariff issue is fresh, and future data may show it impacting. As of the end 1Q25, there appeared to have been no significant impacts.

Views: 240

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →