Several articles from the recent Singapore show said COMAC was on the move, and the duopoly was under some threat. Reuters spoke of COMAC upstaging Airbus and Boeing, and Bloomberg spoke of COMAC stealing the limelight. After the show, COMAC took its two models on a regional tour of five nations. At the show, COMAC scored some orders, notably from non-Chinese customers.

It is vital to put all this chatter in context. COMAC is not a threat to the duopoly and is unlikely to become a threat soon.

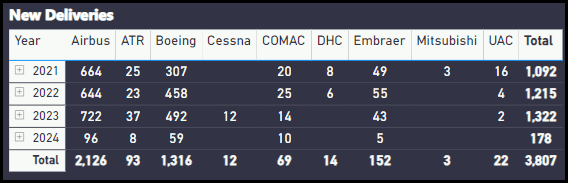

Look at the data for evidence. For COMAC to reach the duopoly production level, it must leap ahead of Embraer. COMAC has two commercial models, and last year, it just managed to beat Cessna with its small commercial footprint.

Based on all of COMAC’s deliveries since 2019 – 64 ARJ-21s and 5 C919s—this is equivalent to 1.6 months of de-rated MAX production over 3.2 years.

Other issues must be pointed out.

- The supply chain that serves COMAC also serves Airbus and Boeing. We shared thoughts on how, de facto, the supply chain has swung towards Airbus from Boeing. For the supply chain to favor COMAC over Boeing (or Embraer) requires a tectonic shift of unimaginable proportions.

- China is the home market that has favored COMAC. However, China’s need for aircraft to serve this vast market is beyond COMAC’s ability, and it is likely to remain that way for many years, probably two decades or more. Airbus, Boeing, and Embraer will not be waiting around during this period.

- COMAC needs to get its aircraft certified outside China. There is talk of an EASA process, but nothing official yet.

- The recent focus on a “Tibet-friendly” C919 is odd. Another aircraft that found favor in the Himalayan market is the A319neo. The few sales this model attracted should have been a signal to COMAC.

- A wiser choice is to stretch the C919 rather than shrink it. The market has moved to ~200-seater single-aisles. The absence of the MAX 10 is an opportunity for COMAC that vastly exceeds the shrunk C919—if COMAC can get such an aircraft ready in the next two years. Since the C919 was launched in 2008, with five deliveries to date, this experience does not support that outcome.

- Then, a global support system for COMAC aircraft is needed. The cost of this effort is probably close to the aircraft’s development cost. As Richard Aboulafia noted, “No one country can build a commercial jet.”

This is not to disrespect COMAC. The OEM has doggedly worked to develop its two models. Both bear distinct similarities to existing aircraft, as Russian aircraft in the past did, too. Rather than mimicking other models, let’s ascribe this to reflecting the existing knowledge base.

COMAC is headed toward a bigger future in commercial aviation because the Chinese state desires and funds it. Airbus, Boeing, and Embraer do not feel threatened enough to complain to the WTO. And if they felt the slightest threat, they would. It is a well-trodden path.

In the epic words of Alfred E. Neumann, “What, me worry?”

Views: 21