2022 12 13 14 25 55

Airlines operate in a highly competitive environment. Every advantage is exploited to drive down costs and get ahead of the competition. Since ~75% of operating costs are driven by pilot and fuel costs, fleet choices become strategic decisions. These choices have to be lived with for 20 years or more. United’s mega order impacts industry planning both within the US and abroad.

To give readers perspective, we developed a model of the US airline fleet for 11 big airlines. By big, we mean aircraft, not airline fleet size. SkyWest would be on the list if we focused on the overall fleet size, as it has a huge fleet.

Please click the double-headed arrow at the bottom right of the model to optimize viewing.

On page 1, you can select an airline to see a fleet summary; models, the number of aircraft, and age. Page 2 provides a view of the US airline fleet for these airlines. The model gives you a good idea of how old a fleet is and where operating costs are the highest.

As mentioned above, the two primary cost drivers are pilots and fuel burn. Pilots are unionized and, especially now, in a powerful negotiating position. Running an airline anywhere means not irritating pilots for now. A better ROI is to be found in cutting fuel burn. The best way to do that is to deploy the latest engines and aircraft.

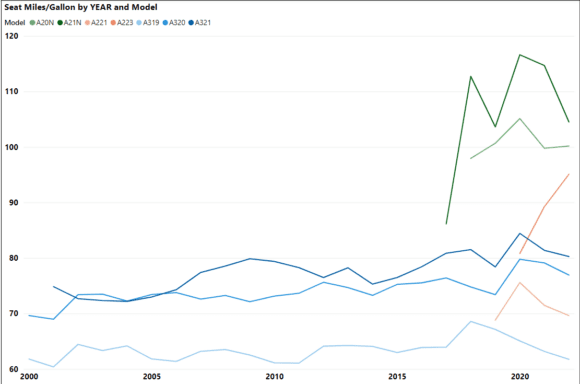

The following table lists fuel burn for single-aisle models in the US. The greener the number, the better. No surprise, the newest aircraft have the best fuel burn. The incentive to chase the lowest fuel burn is self-evident (fuel burn is ~40% of operating costs) and helps operators move to the “greener” future.

Here’s another way to see how much the latest aircraft generation offers improved fuel burn. Among the Airbus single-aisle models, the neos offer a step change improvement. For Boeing, the picture is the same, but for the MAX grounding making the chart look weird – which is why we are not showing it.

The case in favor of updating an airline fleet is clear. However, the United order impacts lessors and airlines with its sheer size. Airbus has a backlog of well over five years, and now, in all likelihood, Boeing will have the same. Anyone wanting the latest generation equipment will need to see what lessors have in their pool. The pricing of what’s available in that pool just shot up, by the way.

All is not lost, though. This is a moment for firms developing technologies that optimize aircraft operations. If you can’t get your hands on new aircraft, you best find ways to optimize what you have. Otherwise, it will be a long time and expensive before you get new equipment.

Views: 0