RAA

Today, the US Regional Airline Association is having its annual conference.

Regional airlines are the lifeblood of US air travel connectivity — yet they sit at the harshest end of an unforgiving industry. With razor-thin margins and heavy dependence on major carriers, their future is under the spotlight at the RAA’s annual conference today. Control is in the hands of the major airlines that buy regional seats. Even with majors paying for fuel and sometimes aircraft, this is a razor-thin margin operation. If all airlines seek the lowest cost of seat production, US regionals are at the coal face of that effort.

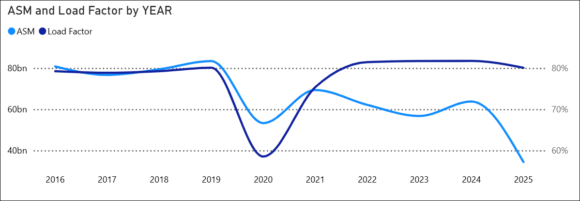

The US regionals have been through several tough years. The pandemic had a significant impact on them, just like it did on all airlines. Except for SkyWest, these airlines don’t necessarily have the deep pockets. Look at this chart to get a sense of how it’s going.

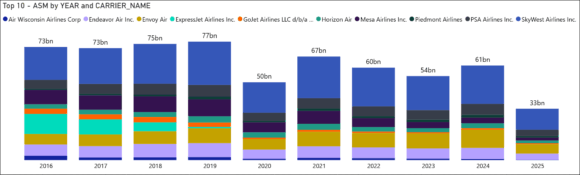

The regional airline industry has seen lots of companies come and go. Consolidation has come to this industry, too. Here’s what the Top Ten airlines look like through 2Q25.

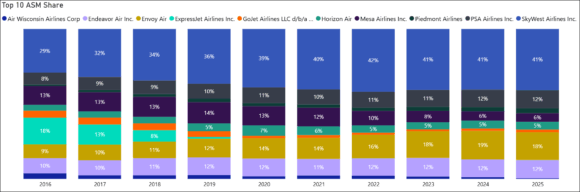

One airline looks relatively robust. Notice that brands have gone as the industry thins out. Here’s another look at the same chart, but reflecting the ASM share.

This is not a picture of an industry in rude health, is it? Which is why we focus on SkyWest almost every time we discuss regional aircraft. Earlier this week, SkyWest made aircraft news. SkyWest has become the indispensable player. For any aircraft OEM seeking entry into the US regional space, SkyWest is the first — and often only — door that matters. The sole OEM in the space is Embraer, soldiering on with its two-decade-old E170/5 models.

The discussion of how we got into this situation could take hours. It takes hours at RAA events and almost every other aviation event. It is in this segment that the new aircraft technologies are likely to enter. Take a listen to new ideas coming from ATR. The need for new aircraft with a step-change economics is clear.

With this backdrop, here’s a summary model that enables you to get a sense of what the industry is doing through 2Q25.

Views: 302

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}