skilled worker

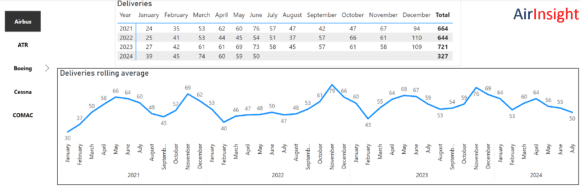

Airbus announced its 2024 delivery guidance update ; our delivery data signaled this was coming.

The rolling average guides to a lower July as well.

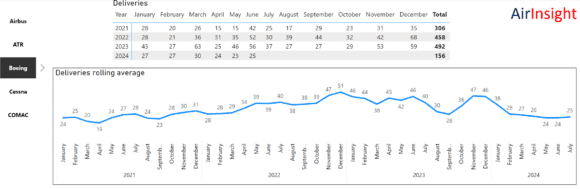

For context, here is the same data for Boeing. Whereas the Airbus trend is softening, Boeing’s might be bottoming out.

Once Boeing works through all the previously undelivered inventory, its deliveries from new production might not be as high as we see for this YTD. However, if Boeing gets its QC back where it needs to be, the FAA might allow a higher rate.

Even if Boeing is granted a higher rate at Renton, the Airbus trend signals bigger problems. We had thought the supply chain had recovered more than it had.

We published a piece last week on the situation with seat suppliers. We decided to dig deeper, but one large seat supplier refused to discuss it. Where there’s smoke, there’s fire. The supply chain is stressed more than it appears. Seat makers face a shortage of certification engineers.

We noted GE’s announcement it is hiring a lot more engineers. This should not be news, but it is. The aerospace silo needs new talent after the great retirement. Aerospace needs engineers by the thousands. Looking at the market, aerospace is not prominent. How can this industry improve its attraction to the best and brightest minds? Where do you suppose a fresh graduate might be looking if he or she were interested in aerospace, Airbus, Boeing, or Space X?

Embraer has an advantage by “growing its own” in San Jose dos Campos. The challenge for Embraer is keeping this talent in-house. Once any engineer has acquired some experience, their LinkedIn profile is updated, and they are marketable. Headhunters snatch up talent. We know of several people who left Brazil for better opportunities. It is a global market, just like for pilots, only better since you don’t need an FAA or EASA license.

The aerospace industry has to attract new talent.

Views: 8