Aeromexico 3 scaled

Last week, Grupo Aeromexico reached an agreement with Apollo Global Management to extend the time it has to negotiate a new Collective Bargain Agreement with its Unions. The Mexican airline failed to agree on cost-saving measures with its employees, jeopardizing the Debtor-in-Possession financing under its Chapter 11 bankruptcy.

What’s the status?

The airline had until Thursday 7 to reach an agreement with its four different labor unions. It already was on an extended cure time to avoid the potential event of default since the original deadline was December 31.

It was painfully obvious that neither the airline nor the employees were giving up on their positions during the week. With that in mind, Aeromexico canceled all negotiating talks with its employees and asked for more time with its DIP investor, Apollo Global Management.

The US firm gave Aeromexico until January 27 to reach an agreement with the Unions. Aeromexico swiftly made the announcement at the Mexican Stock Market. But not everything is as good as it sounds.

Is there a deal?

Five days have gone by since the announcement, but the private talks with the Unions have not moved forward. Moreover, the relationship seems to have gone backward. Yesterday, Grupo Aeromexico asked the Mexican labor authorities permission to end the Collective Bargain Agreements with two Unions, pilots, and cabin crew.

These two Unions have been adamantly against the changes proposed by Aeromexico. The Pilots Association (ASPA) and the Cabin Crew Association (ASSA) have publicly opposed the new deal Aeromexico is looking for. The airline stated,

“Based on the force majeure situation in which Aeromexico is, it has requested termination of the collective bargain relationship, as well as the individual agreements with a certain number of pilots and flight attendants in order to reflect the new operating reality of the Company. This decision seeks to guarantee the continuity of our operations to continue offering the best possible service to customers, without affecting their rights.”

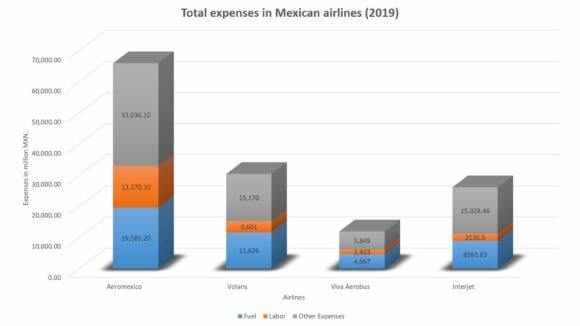

According to different sources, Apollo asked Aeromexico to reduce its workforce by 25%. It also asked the airline to reduce CASK, to compete better against low-cost carriers in the domestic market. In 2019, labor expenses were more than 20% of Aeromexico’s total costs, while Viva Aerobus’s and Volaris’s were approximately 10%.

So far, the airline has laid off 766 flight attendants and 677 ground crew employees. Additionally, around 260 pilots are on temporary leave without salaries. At the same time, Aeromexico tried to give millionaire bonuses to its executive management team, baffling and annoying Unions.

Yesterday, Aeromexico asked the Mexican authorities permission to furlough more employees, although it didn’t clarify how many. While attempting to rule null the Contracts with these two syndicates, Aeromexico reiterated that “it is in the best position to continue conversations with both ASPA and ASSA.”

The labor unions haven’t reacted so far to the latest movement by Aeromexico. Moreover, ASPA claimed that half of the $1billion DIP Financing payment was going to be paid by the pilots if Aeromexico’s proposal had gone through. Instead, the pilots are looking to help with cut reductions of up to $300million.

Meanwhile, the cabin crew union claimed that Aeromexico stopped paying some labor benefits without both parties coming to an agreement. ASSA warned its affiliates against this type of unilateral decisions.

What’s going to happen?

Both the airline and the Unions are against the wall. On one side, they have Apollo, which is already in control of the situation because Aeromexico missed the original deadline. If January 27 comes and goes, Apollo could start pulling the plug on Aeromexico’s DIP Financing, crippling the airline’s liquidity and future.

On the other side, both parties have the government. The Mexican authorities have already stated that they are not saving anyone. There will be no billionaire rescue deal or anything of the sort. If Aeromexico goes under, it will do so, just as Interjet seems to be doing right now.

Finally, there’s one final threat. The two low-cost carriers in Mexico, Volaris and Viva Aerobus, are surging through the crisis. They are taking full advantage of Aeromexico’s and Interjet’s crises. The labor Unions and the airline are aware of this. The need for a new deal is imperative. But the relationship between both parties may be broken.

Views: 1