MG 7745 scaled

Air France-KLM has turned the corner on two difficult Covid-years by producing a net profit for Q2. Although HY1 still produced a loss on the back of a weaker Q1, the airline group expects a “significantly positive” Q3 and a positive full-year result. This is despite significant operational challenges and staff shortages, notably at KLM’s main hub Amsterdam Schiphol. Air France-KLM counting on a full-year profit.

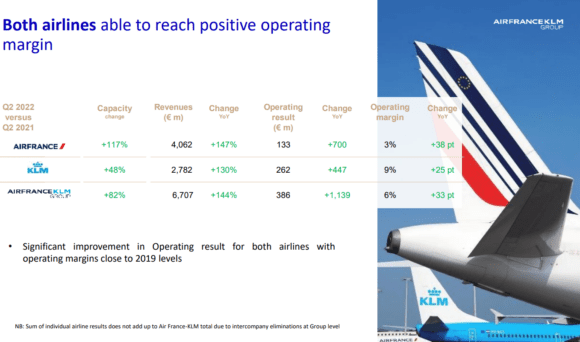

“We are not back at 2019 levels but we are getting closer”, Group CEO Benjamin Smith said in an earnings call. The French-Dutch group reported a €325 million net profit in Q2 compared to €-1.492 billion in the same period last year. The operating profit was €386 million versus €-753 million last year, EBITDA was €931 million versus €-249 million. Total revenues increased to €6.707 billion from €2.750 billion.

Chief Financial Officer Steven Zaat called the year so far “exceptional”, with unit revenues back at 2019 levels despite China and Japan missing in the picture and operational problems. Revenues for HY1 grew to €11.152 billion compared to €4.910 billion last year. But despite a strong Q2, the group still ended the first six months at a net loss of €-226 million versus €-2.975 billion in 2021, although the operating result was positive again at €60 million compared to €-2.801 billion. EBITDA was at €1.152 billion from €-877 million. Fuel costs were up from €982 million to €2.9 billion in HY1, but the airline had a benefit thanks to 72 percent hedging.

Both Air France and KLM were back to positive operating margins in Q2. Air France grew capacity by almost 100 percent. It produced a €133 million net profit in Q2 (2021: €-567 million) but in HY1, the French carrier was still loss-making at €-230 million (€-1.409 billion). The operating margin was 3.3 percent in Q2 but -3.4 percent for HY1.

KLM produced a €262 million Q2 profit (2021: €-185 million) and an HY1 profit of €266 million (€-521 million) on €4.685 billion in revenues (€2.137), resulting in a operating margin in Q2 of 9.4 percent or 5.7 percent in HY1. The Dutch carrier benefitted from €138 million in payroll support (NOW) in Q1 but even without this aid, the result would have been positive. The recent capacity constraints at Schiphol limited growth to forty percent.

Load factors at the network airlines are almost back at 2019 levels, reaching 88 percent in June for the long-haul network and 86 percent on the short to medium-haul network. Yields also saw double-digit growth in most markets, with 16.9 percent yields in Economy and 12.5 percent in Premium cabins. This is fifteen percent up on 2019. Although China and Japan were still closed, yields were the highest in Asia Pacific (39.4 percent) and Latin America (23.6 percent). Corporate travel is steadily growing to 65 percent in June or 70-75 percent in revenues and is strong, especially on transatlantic routes. The network airlines operated at 82 percent of 2019 levels in Q2.

Transavia

Transavia and Transavia France operated at 110 and 140 percent capacity in Q2 respectively and carried a combined 7.8 million passengers in the first six months. Although revenues were up 379 percent to €601 million in Q2 and by 422 percent to €850 million in HY1, the leisure airline produced a €-18 million Q2 loss and a €-110 million loss in the first six months. This is down to the extra costs related to the French business, which grew stronger and took over more French domestic routes.

The group’s maintenance unit is almost at 2019 levels and produced a €101 million operating profit in HY1 on €1.742 billion in revenues. In Q2, revenues were up by 34.1 percent to €911 million, with third-party revenues up 35.3 percent to €345 million.

Cargo reported €1.828 billion in revenues in HY1 and €918 million in Q2. Capacity grew by 27.4 percent as more belly capacity was available. Although tonnes carried were down by 12.7 percent to 472 in HY1, yields remain consistently high.

Positive outlook

Smith remains worried about the situation in Amsterdam, where Schiphol introduced a cap on the number of flights for this summer until the end of August as it is very short on staff, notably in security. This contributed to €70 million in disruption costs to compensate customers who had to be rebooked. KLM’s new CEO, Marjan Rintel, said that the airline has recruited more ground staff and concluded a new collective bargaining agreement, which should help to improve operational stability. KLM has taken legal steps against the Amsterdam slot coordinator to fight the proposed reduction in flights.

As demand continues to recover, Air France-KLM expects to operate at 80-85 percent capacity in Q3 and 85-90 percent in Q4, bringing the average for the year to eighty percent. Transavia will operate at over 100 percent. With yields expected to remain strong, Q3 should produce a further improvement. The full year should be the first profitable one since 2019. Thanks to fuel hedging contracts, the airline counts on a €1.0 billion hedging benefit for this year.

Repaying the state loans

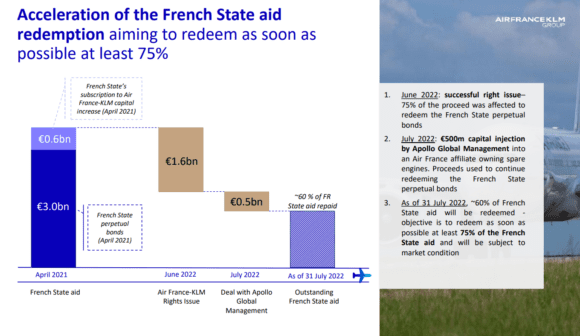

Air France-KLM had €11.9 billion in liquidity available at the end of June and had €6.0 billion in net debt, a reduction of €2.2 billion since December. CFO Steven Zaat was happy with the successful rights issue that generated €2.3 billion in fresh equity in June and brought cargo company CMA CGM Group on board as a new shareholder. It also closed a €500 million investment by Apollo Funds that covers aircraft engines. KLM has repaid all of the €942 million of the state-backed revolving credit facility and direct loan. The carrier still has €2.4 billion in credit facility and state loans at its disposal and is contemplating further equity measures.

The group redeemed €1.6 billion of French perpetual bonds in June and €0.5 billion in July. It has now repaid sixty percent of the state aid and wants to get to 75 percent as soon as possible, but this is subject to market conditions. This will also determine when it will issue €1.2 billion in hybrid bonds, which Zaat said is needed to repay the French state as soon as possible and bolster its equity position as part of the €4.0 billion equity strengthening measures.

Views: 6