AFKL 777s nosetonose

Air France-KLM has ended the second quarter and first half-year deep in the red. It recorded a EUR -2.612 billion Q2 net loss or EUR -4.413 billion in HY1, the airline group announced on the evening of July 30, 12 hours earlier than expected.

KLM confirmed on the 31st that another 1.500 jobs are to be made redundant to bring total reductions to 4.000 to 5.000.

The Franco-Dutch airline group had already witnessed a weak Q1, but between April-June it fully felt the effect of the Covid-crisis. Q2 saw a Group loss of current operations EUR -1.553 billion. At Air France, the operating loss was EUR -1.098 billion, at KLM EUR -493 million. The operating margin was down to -189.5 percent for AF and -70.3 for KLM.

Q2 revenues were -83.2 percent lower at EUR 1.182 billion, of which 938 million from the network airlines. This was down -84.4 percent. Passenger numbers were down 95.1 percent to 1.1 million.

Net income of EUR -2.614 billion in Q2 included a EUR 520 million impairment on the Airbus A380 fleet, which has been retired in June. Retiring the A340-fleet cost EUR 72 million. Over-hedging of fuel costs cost EUR 105 million, while a EUR 227 million provision was taken for restructuring costs for voluntary departure at both network airlines.

“The second-quarter results demonstrate the unprecedented impact of the Covid-19 crisis on the activity of the Air France-KLM Group and of all airlines worldwide”, Group CEO Benjamin Smith says in a press statement. “The Group reported an operating loss of 1.5 billion euros for the quarter, with activity virtually at a standstill in April. The cost reduction and liquidity preservation measures rapidly implemented have nevertheless enabled our operational losses to be reduced.”

HY1 worst financial setback ever for KLM

HY1 produced an operating loss for the Group of EUR -2.368 billion, of which EUR -1.594 billion for Air France and EUR -768 million for KLM. Net loss was -4.413 billion on revenues of EUR 6.201 billion, -52.2 percent lower compared to last year. Revenues of the network carriers stand at EUR 5.216 billion.

KLM CEO Pieter Elbers says: “These financial results serve to highlight the huge impact of this unprecedented crisis for the airline industry and KLM in particular. A loss of EUR 800 million for the first six months of the year is the worst financial setback ever experienced in KLM’s history.” The operating loss compares to a EUR 223 million profit in 2019, so the airline has lost almost one billion in a single year.

Cargo operated at -56.3 percent capacity (ATKs) as most of the fleet was grounded and belly cargo was much reduced. Tons flown were 149K in Q2 and 392K in HY1, producing a net result of EUR -1.032 billion in the first six months. Maintenance lost 28.4 percent in revenues in HY1 and ended the period with a EUR -321 million loss.

Transavia and Transavia France were grounded for most of Q2, resulting in a net loss of EUR -111 million of -193 million in HY1. Passenger numbers were down to just 90K in Q2.

By the end of June, the group’s adjusted free cash flow stood at EUR -2.327 billion, or 2.677 billion lower compared to last year. Net debt was up to EUR 7.973 billion or a leverage ratio of 4.8 compared to 1.5 last December. Cash burn improved, from EUR 400 million to 260 million per month.

Thanks to the state aid programs of the French (EUR 7 billion) and Dutch (3.4 billion) governments, Air France-KLM had EUR 14.2 billion in liquidity or credit lines available. Capex has been reduced by 0.3 million to EUR 2.1 billion, which is 1.5 billion down from the original plan for 2020.

CFO Frederic Cagey says that the group will continue to look for additional equity and doesn’t rule out it will have to opt for a rights issue. This confirms last month’s remarks from the Dutch government when Secretary of Finance said that providing additional equity to KLM can’t be excluded.

Air France fine-tunes restructuring

The airline is now embarking on the difficult road of restructuring. In June, Air France announced it would reduce its workforce by 6.560 FTE and another 1.020 FTE at regional airline HOP by 2022. Air France hopes to complete this restructuring as much as possible on a voluntary basis, imposing sixteen to 25 percent net pay reductions and wage freezes for the next two years. The airline is state-financed until September, so the situation after that remains uncertain. Discussions about furloughs and productivity gains through more flexibility will continue.

Air France will restructure its loss-making domestic operations (2019: EUR -200 million) by deleting loss-making routes and transferring more services to its low-cost subsidiary Transavia France which will strengthen the Paris Orly and Lyon hubs and operate to seven airports in southern France. This restructuring will take until 2023.

At Group level, some 1.900 positions will also be cut. The overall target of job reductions is seventeen percent.

Drastic cuts at KLM

KLM has now released its draft proposal, that has been presented to unions earlier this week and will need consultation until October. On top of the 2.000 jobs that are to be lost on a voluntary basis, 500 through natural attrition, and temporary contracts that have been terminated, KLM says it needs 2.000 redundancies to bring the airline at the correct size for its post-Covid network. This means 4.000 to 5.000 positions are to be shelved until the end of 2021. Further cuts are not ruled out if production levels have to be reduced beyond -20 percent that is planned now. The measures affect some 300 pilots and 300 cabin crew as well as ground staff and administrative jobs and will reduce headcount from 33.000 to 28.000.

Consultation with Dutch unions promises to be a hard nut to crack, as it will be mainly cabin crew who feel they have to bear the brunt for the crisis. The Dutch government and parliament have called on the strongest shoulders to accept the pay cuts necessary to reduce KLM’s costs by some fifteen percent. This salary moderation has also been applied to Air France as the profit-sharing scheme has been suspended and general and individual pay increases frozen.

Unions reacted with mixed feelings on the additional redundancies: they acknowledge the serious situation of KLM but say everything should be done to prevent forced job cuts. To one of the biggest unions, FNV, these are unacceptable. CNV is willing to delay a collectively agreed pay rise scheduled for October.

Group sticks to fleet renewal plans

Air France-KLM expects to operate at 45 percent capacity in Q3 and 65 percent in Q4. Load factors on long-haul routes will remain negative as the recovery of this segment is delayed. For 2021, capacity will be reduced by a minimum of twenty percent.

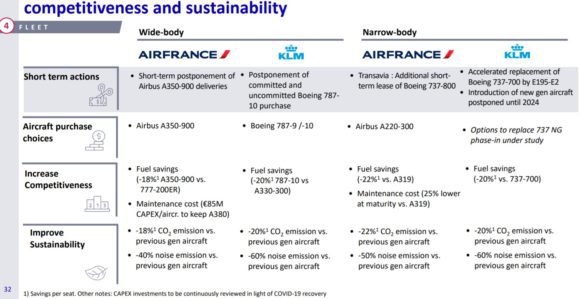

The group confirms its plans to renew the fleet by more modern and efficient aircraft and will keep its delivery schedules for 2021-2025 intact as much as possible in order to meet competitiveness and sustainability targets. Financing options are under consideration. Yet, Air France will defer some short-term deliveries of A350-900s and KLM that of committed and uncommitted Boeing 787-10s. Replacement of KLM’s Boeing 737-700s by Embraer E195-E2 will be accelerated. The introduction on new-generation aircraft to replace the 737NGs and A330s remains under study and is postponed until 2024, although KLM expects to provide a more detailed fleet plan in October.

Views: 3