A320neo Air New Zealand MSN8833 First flight scaled

Air New Zealand has swung back into profitability after one of its most unique years, reporting a $412 million net profit for the financial year 2023 that ended in June. The carrier describes the year as “particularly unique” dominated by significant customer demand, restrained capacity, and lower fuel prices in HY2. For FY24, ANZ is predicting results more reflective of future financial performance.

Air New Zealand started FY23 in June 2022 still coming out of the pandemic as New Zealand had just reopened its borders for international traffic again. The airline had a large part of its long-haul fleet still in storage and had been reliant on strong domestic demand. In February, ANZ reported that the recovery was well underway. It ended the financial year this June at 94 percent domestic capacity compared to 2019 and bookings at 100 percent. Overall capacity in revenue passenger kilometers (RPK) was up by eighty percent year on year to 36 million.

The airline carried a combined 15.8 million passengers, up from 7.7 million, which is two million short of 2019 levels. The load factor improved to 84.7 percent from 67.1 percent. The domestic network produced the highest results with 10.9 million passengers, up from 6.8 million. The international network saw 1.5 million passengers versus 175K in the previous year, 37 percent behind pre-pandemic levels. International bookings are back to 86 percent. On the Tasman and Pacific Islands network, ANZ carried 3.4 million passengers versus 752K.

Revenues and expenses up

Total revenues ended at $6.330 billion, up from $2.734 billion in FY22. Passenger revenues were $5.349 billion versus $1.476 billion, cargo revenues dropped to $628 million from $1.016 billion. Revenues from contract services were slightly higher to $133 million from $117 million. Overall revenues per available seat kilometer (RASK) excluding fuel improved to 15.5 cents, up from 13.9 cents.

Operating expenses reached $5.044 billion versus $2.738 billion, not surprisingly the effect of more flying activity and higher fuel needs, staffing costs, and inflation. Direct labor costs were up by 15 percent as the airline rebuilt its workforce to 11.474 people. Variable costs were up by 21 percent, with the total cost base up by 16 percent. Costs per ASK were up by 40.3 percent to 14.03 cents. The fuel bill increased to $1.5 billion from $560 million. Fuel is hedged 54 percent for FY24.

The operating profit reached $1.286 billion, up from $-4 million last year. The profit before tax and significant items improved to $585 million from $-725 million. The net profit was $412 million compared to $-591 million. Free cash flow was a healthy $937 million.

Air New Zealand will pay out $200 million in special dividends to shareholders. The airline has $2.6 billion in liquidity. Gross debt stood at $3.3 billion, and net debt at $0.4 billion. The net debt to EBITDA ratio of 0.3 times is outside the target of 1.5 to 2.5 times, so this is something the management says it will work on using a number of tools.

“After several volatile years it’s great to be back in the black and standing on our own two feet,” said CEO Greg Foran. “We know increased costs and high demand have made flying more expensive. In the past year, we put more aircraft and seats in the air, so there are more choices for customers which helps alleviate the cost of flying. At the same time, our own costs continue to rise and the reality is that airfares are unlikely to return to pre-pandemic levels.”

Capacity outlook

While demand remains strong, Air New Zealand is aware that it won’t see another recovery as in FY23. Domestic leisure and visiting friends and relatives (VFR) traffic continue to underpin demand, while domestic corporate is above pre-pandemic levels again. International bookings to North America are also strong. Tasman and the Pacific Island is already at pre-Covid levels. ANZ says that demand to Asia and in particular India is exceeding expectations, while China is starting to recover.

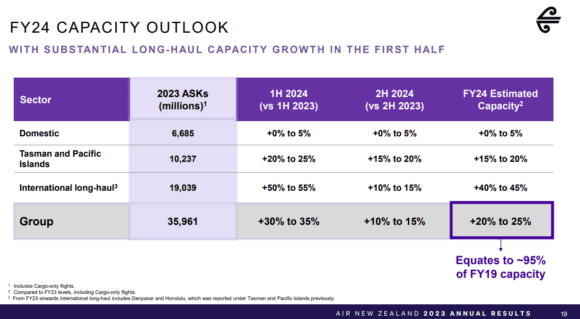

The focus for FY24 will be on maintaining a resilient domestic operation with increased productivity and higher aircraft utilization. Domestic capacity is expected to grow by on average zero to five percent. The international network will be further optimized, in part thanks to deepening the alliances with partner airlines.

Air New Zealand is projecting a 20 to 25 percent capacity growth on the Tasman/Pacific network in HY1 before reducing it to 15-20 percent for HY2. International long-haul will see a steep 50-55 capacity increase in HY1, reducing to 10-15 percent in HY2 and 40-45 percent on average for the full year. Overall capacity should be up 20-25 percent for FY24, which is 95 percent of 2019 levels.

“Looking ahead to the first half of the 2024 financial year, customer demand remains strong across our markets. We are mindful of the uncertain economic environment however and acknowledge a number of factors that may impact future customer demand and profitability. These factors include increased international competition, volatile fuel prices, a weaker New Zealand dollar, ongoing wage inflation and increased airport charges. Given the uncertainty and volatility of some of these macroeconomic factors, the airline will not be providing guidance at this time.”

New aircraft orders

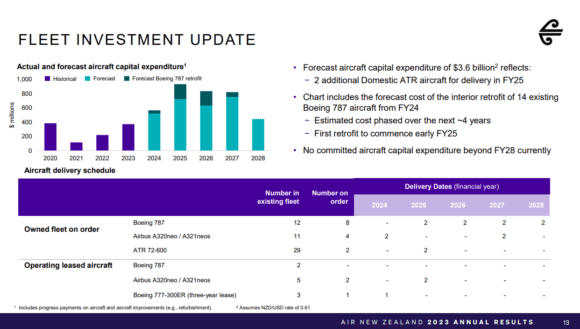

To prepare itself for further growth, Air New Zealand announced a couple of aircraft orders. The first one is for two ATR 72-600s that will be delivered in FY25 between late 2024 and the beginning of 2025, in addition to the 29 already in the fleet. There are also two options.

The second order is for two Airbus A321neo’s for the international short-haul Tasman/Pacific network due in FY27. ANZ already has sixteen owned and leased A320neo/A321neo’s in the fleet. It has four more aircraft on direct order with Airbus for delivery in FY24 (domestic network) and the latest two in FY27, plus another two to be sourced from lessors for delivery in FY25.

The long-haul fleet of fourteen Boeing 787s and seven 777-300ERs will grow with eight 787-10s that are due for delivery from FY25 through FY28. The triple sevens will have been phased out by then, although an eight (leased) aircraft will join the airline in due course. The existing Dreamliners will get a cabin makeover from early FY25. The airline has no aircraft deliveries beyond 2028 when the fleet will include 22 Dreamliners, 31 A320neo/A321neo aircraft, 31 ATRs, and 23 De Havilland Canada Dash 8-300s. Total capital expenditures are guided at $3.6 billion.

Views: 19