RF20160224 XBC 102

AirAsia X intends to exponentially but at the same time prudently further grow capacity as it continues its recovery from the pandemic in Asia. With one exception: China. The carrier plans to grow capacity to China three-fold by the end of the year as traffic gains momentum, AirAsia X said on August 28 in its Q2 earnings release.

The carrier experienced strong growth in Q2, with seat capacity up 26 times year on year to 818.422 seats and the number of passengers carried up by seventy percent to 621.984. Capacity in available seat capacity (ASK) was up 25 times to 3.5 million kilometers but is still at only 42 percent of 2019 levels.

As part of the recovery, AirAsia X launched services to Bangkok, Beijing, and the Australian Gold Coast. Sydney to Auckland, Melbourne, and Osaka saw significant demand. China also saw pent-up demand, but the recovery has been gradual since travel restrictions were lifted in January.

“As passenger traffic for China continues its gradual recovery, the Company remains optimistic about the massive potential the country has to offer for the future and already has in motion plans to ramp up operations to routes in China as demand gradually increases post the strict restriction movements for this core destination,” AirAsia X says.

CEO Benjamin Ismail says: “We continue to focus on our consolidated growth strategy to build yield and enhance the recovery of our network capacity gradually in line with demand in our core markets as our first priority. Our revised business plan continues to highlight improvements across all key metrics. In the last twelve months, we have been prudent by reinstating services from initially two destinations and three times weekly flights. Comparatively, we now have 18 destinations with 96 weekly flights, and this exponential growth is expected to grow further as more aircraft are brought to service and connectivity with FlyThru will be further amplified.”

Return to profitability

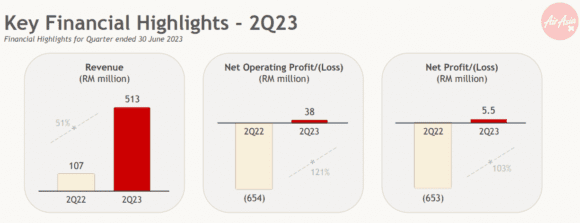

AirAsia X reported a RM 5.5 million net profit for Q2 compared to RM -652.5 million in the same period of 2022. Revenues grew to RM 512.9 million, up from RM 107.2 million last year. Ancillary revenues reached RM 236 per passenger. EBITDA was RM 100.5 million, up from RM -691.5 million, and the net operating profit was RM 38.2 million versus RM -653.8 million. Costs per ASK (CASK) ended at 11.75 sen, revenues per ASK (RASK) at 14.61 sen. Liquidity stood at RM 269 million.

Subsidiary AirAsia X Thailand reported total revenues for Q2 of RM 351.9 million, up five times year on year. The net operating profit was RM 33.5 million, but unrealized foreign exchange losses pushed the airline into a net loss of RM 73.6 million. Passengers carried grew 28 times to 311.337, and capacity (ASK) by 44 times to 1.805 million.

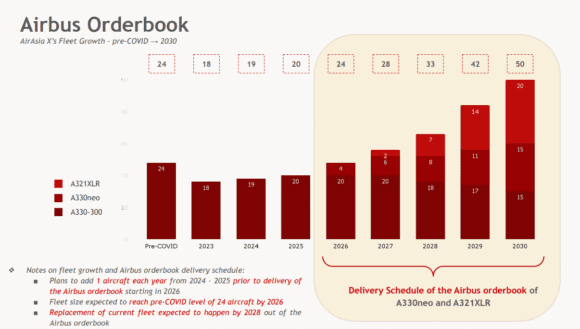

The airline had activated eleven Airbus A330-300s to operate the network compared to five last year as two leased aircraft were inducted in August. Another one will be added in September, while two more will follow in November and one in December. This should bring the fleet to seventeen activated aircraft by the end of the year and to eighteen aircraft available.

“We will continue to work with our business partners to ensure that all aircraft can be returned to service timely to meet our network relaunch timeline. At this juncture, we remain on track to have at least sixteen aircraft operational by the final quarter of the year and are assured that we will maximize the upside from the market once the year-end peak travel season kicks in.”

In the medium term, AirAsia X plans to grow the fleet back to 2019 levels of 24 aircraft by 2026, when deliveries start of the first A330-900s and A321XLRs that will continue through 2030. By then, the fleet should count fifty aircraft, including twenty XLRs, fifteen A330-900s, and fifteen A330-300s.

Views: 5