291592549 781369773298258 1742044223612760569 n

Here is the updated model for Airbus November Orders & Deliveries.

Notes:

- Airbus notified the market it wouldn’t reach its delivery target for the year. This is the biggest news item this month.

- Delivering another 135 in December is a bridge too far.

- Airbus has had a great year, though, and recovered from the impact of the pandemic faster than its rival.

- YTD 2022, Airbus has a 54% market share in deliveries. As readers know, that is both good and bad news from a Game Theory standpoint.

- Airbus has the most “in-demand” aircraft in the A321neo and can combine deals with the A220 to upset Boeing and Embraer as circumstances allow.

- Accelerating out of the pandemic led to backlogs that stretch for years – a good thing in the short term but a problem requiring rate increases over the longer term.

- Fortunately, supply chain firms are clamoring to get into Airbus’ production plans.

- As the saying goes, “the big dog eats” – Airbus now has negotiation power over the supply chain. This is a crucial advantage over the A220 supply chain.

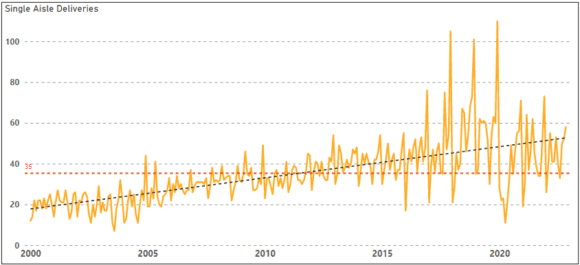

To provide a perspective on Airbus delivery rates, look at this table. The red numbers are peak delivery rates and have frequently been in December. Airbus likes the late push. Can they get to 135 this month? Probably not, because the supply chain can’t handle it.

Let’s look at this in another way. The typical month’s average delivery rate is in the mid-30s for the year, with December averaging 54. The chart below shows the average at 35 for single aisles, while the trend has steadily increased. 2022 has been a great year for Airbus, even if it does not get to ~700 deliveries.

We would not be surprised to see 625 for the year, which would be 89% of target. That should qualify as a passing grade.

Views: 2