airbuslogo

Here’s the updated model.

Notes:

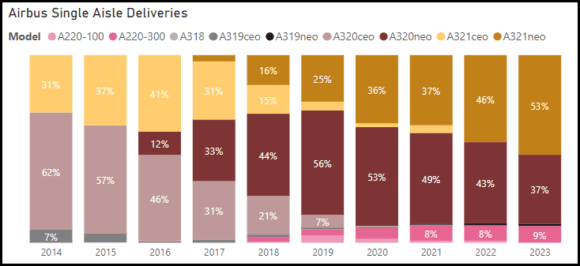

- YTD A321 deliveries outpace A320 by ~1.5. This is, in our view, a crucial item to be watching.

- A321neos are 52% of YTD orders and 47% of YTD deliveries. The chart shows how single-aisle deliveries are focused on three models. How does Airbus respond to the MAX 10? Do they need to? The A321neo family is now the “go-to” model for so many airlines.

- A321neos are 52% of YTD orders and 47% of YTD deliveries. The chart shows how single-aisle deliveries are focused on three models. How does Airbus respond to the MAX 10? Do they need to? The A321neo family is now the “go-to” model for so many airlines.

- Orders are ahead this year over last year already. But, given the supply chain crisis, orders can be expected to change.

- Like we see with Spirit dumping A3219neos for A321neos.

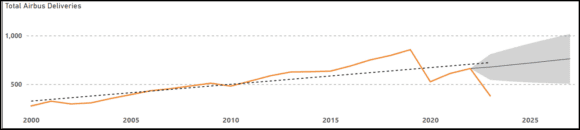

- The delivery rate was 54 for the month, lower than in June but the same as in May. YTD monthly average is 47. This projects to 574 for the year – way below the forecast of 720.

- Given supply chain stress, the pressure to open more FAL capacity is mounting. Where in India, we are wondering? This chart clues us into the need for more capacity.

- Delta and IndiGo are the top two delivery customers.

Views: 1