We have updated our transaction charts through April.

- Airbus saw +24% in transactions YTD than a year ago. Transactions this year were primarily (43%) in A320ceos.

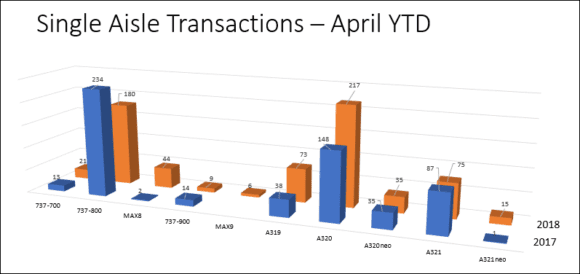

- Boeing saw -17% in transactions YTD than a year ago. Transactions this year were primarily (43%) in 737-800s and MAX8 is already over 10%.

- Bombardier saw -48% in transactions YTD than a year ago. Transactions this year were primarily (25%) in CRJ NGs and CS is close to 9%.

- Embraer saw -50% in transactions YTD than a year ago. Transactions this year were primarily (25%) in E175s.

- We can see the transition at Boeing from the 800NG to the MAX8 is happening. The 900NG remains soft and the MAX9 can help with this.

- Airbus saw a lot of A319 and A320 activity this YTD. The A320neo saw no improvement over last year. There has been some transition from A321ceo to A321neo taking place.

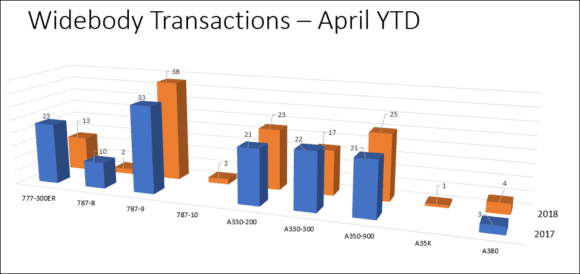

- Boeing continues to see the 787-9 as its top transaction performer. The 787-10 should also see steady progress this year.

- For Airbus, the bright spot is the A350-900 where transactions are up. The A330 program is slightly lower this YTD. The A380 is holding steady.

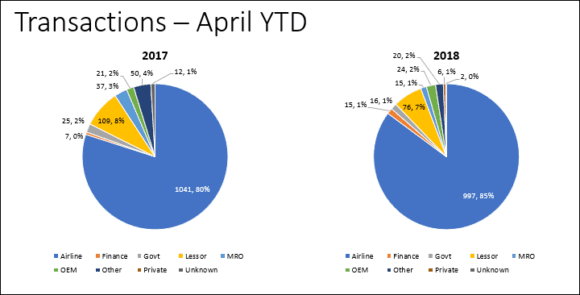

- Overall the market is 10% off this YTD compared to last year. The two biggest segments, airlines and lessors are off 4% and 30% respectively.

Views: 1