347611361 612449210821946 5924314783323263023 n

You know it was an awful event when the airline’s earnings report starts off talking about a near disaster.

The airline reports that “Air Group’s first quarter operation and results were significantly impacted by Flight 1282 in January and the Boeing 737-9 MAX grounding which extended into February. The Company has received $162 million in initial cash compensation from Boeing to address the financial damages incurred during the first quarter.”

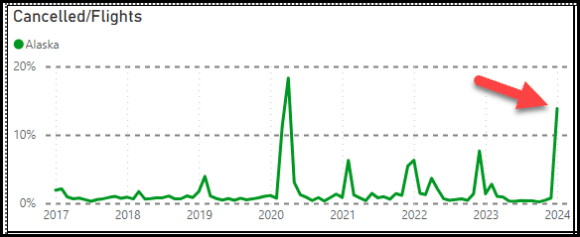

Separately, here is our chart showing the impact of that MAX 9 grounding. There is no doubt that the effect was a nasty earnings hit

Financial results

- A net loss for the first quarter of 2024 under GAAP was $132 million, or $1.05 per share, compared to a net loss of $142 million, or $1.11 per share, for the first quarter of 2023.

- A net loss for the first quarter of 2024, excluding special items and mark-to-market fuel hedge accounting adjustments, of $116 million, or $0.92 per share, compared to a net loss of $79 million, or $0.62 per share, for the first quarter of 2023.

- Repurchased 561,086 shares of common stock for approximately $21 million in the first quarter.

- Generated $292 million in operating cash flow for the first quarter.

- Held $2.3 billion in unrestricted cash and marketable securities as of March 31, 2024.

- Ended the quarter with a debt-to-capitalization ratio of 47%, within the target range of 40% to 50%.

Operational items

- Hawaiian shareholders approved the agreement to buy Hawaiian Airlines for $18 per share. The proposed combination remains subject to regulatory approval.

- Ratified a five-year collective bargaining agreement with approximately 1,000 Alaska Airlines employees represented by AMFA.

- Completed inspections of all 737-9 MAX aircraft and returned the fleet to service in February.

- Enhanced quality oversight program at the Boeing production facility to validate the work and quality of our aircraft as they progress through the manufacturing process.

- Received two E175 aircraft during the quarter, bringing the total in the Horizon fleet to 43.

Notes:

- The MAX 9 grounding was a significant issue. While the aircraft is back in service, trickle-down impacts from FAA rate limits on Boeing’s MAX line remain. Our analysis shows that the MAX 9 fuel burn per seat is industry-leading, and delivery delays do not enable Alaska to benefit as much as it might have.

- It’s not clear what compensation will be given to the airline. Based on what we know is happening with other airlines, delivery delay compensation rolls into future delivery discounts.

- Another item to watch for is the Hawaiian deal. The current DoT does not seem as sympathetic to airline consolidation.

- Labor costs are rising, which squeezes margins. This is an industry problem, and this impact will become apparent during the rest of the year.

- The market reaction to 1Q24 has been positive. Boeing paid Alaska $162m to compensate for the MAX 9 grounding. Alaska should have reported a 3c/share profit for 1Q24, making this the best first quarter since 2019.

Views: 2