239080001 10158014382941078 13601894583630830 n

American Airlines is not as outspoken on its full-year guidance as United Airlines but is nevertheless positive that in the short-term, it will return to profitability during the second quarter, it said on April 21. The first quarter produced a $1.6 billion net loss, the highest of the US Big Three carriers. American expects profit in Q2 but doesn’t look further yet.

American’s $1.635 billion net loss compares to $-1.250 billion for the first quarter of 2021. The operating loss was $1.723 billion versus $-1.315 billion. Operating expenses were higher for most items but notably those of fuel, to $2.502 billion from $1.034 billion.

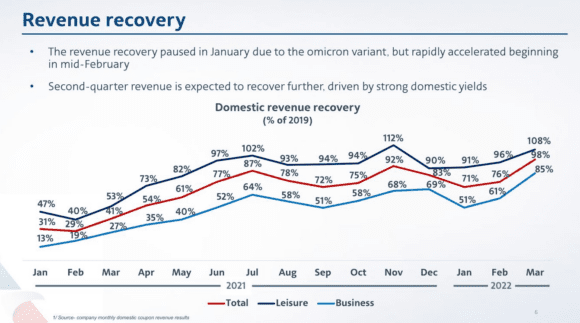

Total revenues for the quarter were $8.899 billion, up from $4.008 billion or 84 percent of 2019. Of these, $7.818 billion were passenger revenues (2021: $3.179 billion) and $364 million from cargo ($315 million). After one and a half months affected by Omicron, March produced record sales and revenues even surpassed those of 2019, which is the first time this has happened since the start of the pandemic. Without special items, March would have been profitable.

Slide projecting how American’s revenue has developed between January 2021 and March 2022. (American Airlines)

American is seeing increased demand for domestic leisure as well as business travel, with more and more small and medium-sized businesses booking flights again. International bookings have also picked up significantly. Already in Q1, revenue passenger kilometers (RPK) on international routes increased to 11.7 million from 3.9 million in 2021. Latin America continues to be the strongest market (7.6 million RPKs versus 3.576 million), but transatlantic traffic is also recovering quickly (3.605 million, up from 199.000). The Pacific continues to be “pretty insignificant”, said Chief Financial Officer Derek Kerr. Domestic RPKs were up to 32.6 million from 18.5 million. Passenger enplanements increased to 42.7 million from 24.3 million.

American’s new CEO Robert Isom repeated that running a reliable operation and returning to profitability are key priorities. Despite adverse weather, the airline led the on-time departure performance and ended second in on-time arrivals. The airline will continue to aggressively hire new crew to be prepared for the summer. It has already hired 600 new pilots this year. Still, American is short on pilots for its regional operations, which are down twenty percent on 2019 levels compared.

Q2 revenues are expected to be up six to eight percent

Despite the positive outlook, for now, American is looking no further than the current second quarter. It expects revenues to be up by six to eight percent compared to 2019, see pre-tax margins excluding special items of between three and five percent. Capacity should be between six and eight percent lower compared to 2019, the same it is expected for the full year. American reckons with fuel costs of between $3.59 and $3.64 per gallon, higher than the $3.43 of United. By comparison: fuel was $2.80 per gallon in Q1. Costs per available seat mile (CASM) excluding fuel and special items will likely be up by eight to ten percent in Q2 as well as for the full year. “To achieve profitability for the year, we need to start in the second quarter”, was the only thing Kerr was willing to say about the FY22 guidance.

American Airlines continues to repair its balance sheet and reduce net debt as deleveraging the balance sheet remains a top priority. It wants to reduce its total debt by $15 billion in 2025, having already lowered debt by $4.1 billion since the second quarter of 2021. In Q1, it completed $317 million in open market purchases of $750 million in senior unsecured notes for maturity in June. The carrier’s total liquidity stood at $15.5 billion by the end of March, of which $12.5 billion in unrestricted cash and short-term investments.

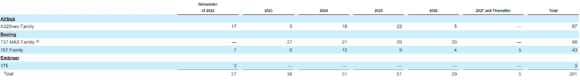

American’s fleet plan for 2022 to 2027. (American Airlines)

American expects to take delivery of 27 new aircraft this year, of which seventeen are Airbus A320neo family, seven Boeing 787s, and the final three Embraer E175s on order. Another fifty A320neo’s are expected for delivery through 2026. Between 2023 through 2026, 88 MAX are scheduled to join the airline, including thirty aircraft for which it exercised purchase rights in February. American counts on Boeing restarting Dreamliner deliveries in the second half of the year, but now expects most of them (twelve) to join in 2024. The delayed delivery of ten 787s affected American’s summer schedule for this year. American has 787 pilots trained and keeps them current until whenever the new aircraft are delivered.

Views: 0