Last week saw the roll-out of the latest Boeing 787, the -10 which is the largest model. Like all aircraft that are stretched, it looks more graceful than the shorter models.

Boeing released the image above of the 787-10 as well as the image below, that allows a comparison in sizes with key capacity differences.

The 787 is Boeing’s star twin-aisle aircraft. Last year Boeing delivered 24 787-8s and 68 787-9s. The market (and Boeing) has moved in favor of the larger -9 over the -8. The 787 has proven to be as disruptive as Boeing said it would be. It’s long range and fuel efficiency make it a compelling tool for opening new markets. Whether used by a legacy like British Airways opening Austin Texas (now migrated to 777) or an LCC like Norwegian opening up numerous US markets, to the chagrin of the US airlines. Other 787 operators exploiting the 787’s unique range/payload performance are Ethiopian, ANA, JAL and Air New Zealand. It is a special aircraft and it appears to be a good candidate to replace 777-200ERs, so it should have bright prospects.

The 787 is Boeing’s star twin-aisle aircraft. Last year Boeing delivered 24 787-8s and 68 787-9s. The market (and Boeing) has moved in favor of the larger -9 over the -8. The 787 has proven to be as disruptive as Boeing said it would be. It’s long range and fuel efficiency make it a compelling tool for opening new markets. Whether used by a legacy like British Airways opening Austin Texas (now migrated to 777) or an LCC like Norwegian opening up numerous US markets, to the chagrin of the US airlines. Other 787 operators exploiting the 787’s unique range/payload performance are Ethiopian, ANA, JAL and Air New Zealand. It is a special aircraft and it appears to be a good candidate to replace 777-200ERs, so it should have bright prospects.

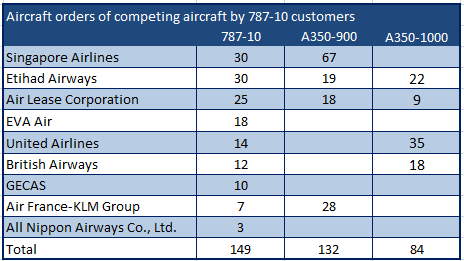

The 787-10 has orders from key “name brand” airlines and lessors that underscore its expected impact. The following table lays out the latest information from Boeing on 787-10 orders. Five of the seven airlines seem to be hedging their bets buying the 787-10 and also buying the A350.

What about the competition? Airbus offers two options, its redesigned A330neo and its new A350. The A330 has an excellent sales record and has proven to be Airbus’ most successful twin aisle. Airbus also has a “new technology” solution in the A350 of comparable size to the 787-10.

The 787-10 closely matches the 777-200ER but offers 26% better cargo space, 1% better cruise speed and 5.4% more seats with a range about 5% shorter. On the Airbus side, we compare the A330-300 to the replacement -900 model; with the -900 offering 9.2% better range and equal cruise speed. The A350-900 has 4.5% fewer seats than the 787-10, has 9.4% less cargo space, but has 26% more range with equal cruise speed.

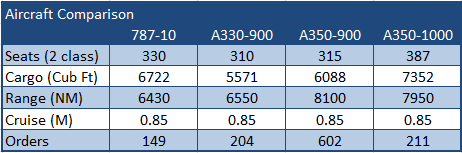

The 787-10 will be competing with the A330-900 and the A350-900. In the following table, we compare these three aircraft and added the A350-1000 as an additional comparison point.

The race is closer than the table indicates. Boeing will stress its 787-10 as the latest in technology as a key selling feature. Airbus will offer “a close to 787 technology” aircraft at a lower price in the A330-900 and the A350-900/1000 as technology equivalents.

The race is closer than the table indicates. Boeing will stress its 787-10 as the latest in technology as a key selling feature. Airbus will offer “a close to 787 technology” aircraft at a lower price in the A330-900 and the A350-900/1000 as technology equivalents.

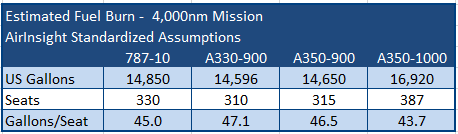

In terms of fuel burn, we offer the following table. We selected a 4,000NM mission and we can see from the fuel burn perspective, competition is tight.

This means Boeing will see competition being driven by the A330-900 from below the 787-10 and from above by the A350-900. Airbus will be the segment price leader and offer a technology equivalent. Price won’t be the over-riding item every airline is going to look for. As the first table shows, airlines ordering the 787-10 are focused on high technology and capabilities. If we do a comparison based on list prices we get a rough idea of how these aircraft compare from the following table.

This means Boeing will see competition being driven by the A330-900 from below the 787-10 and from above by the A350-900. Airbus will be the segment price leader and offer a technology equivalent. Price won’t be the over-riding item every airline is going to look for. As the first table shows, airlines ordering the 787-10 are focused on high technology and capabilities. If we do a comparison based on list prices we get a rough idea of how these aircraft compare from the following table.

No airline pays list price – but we can assume any airline in the market will be offered an equivalent discount. It used to be that Boeing bragged about its 787 and 777 bracketing the A350. Airbus’ decision to develop the A330neo means the 787 is now bracketed by the A330neo and A350.

No airline pays list price – but we can assume any airline in the market will be offered an equivalent discount. It used to be that Boeing bragged about its 787 and 777 bracketing the A350. Airbus’ decision to develop the A330neo means the 787 is now bracketed by the A330neo and A350.

Collateral Verifications provided market values on these aircraft. The A330-900 values are between $107-110m, the A350-900 between $153-156m, the A350-1000 is between $160-170m and the 787-10 between $145-150m. Market values are quite different from list prices. The industry rule of thumb is that aircraft list prices are typically discounted by 50%. We took the middle of each price range and produced the following table.

Boeing faces tough competition. While the 787 and A350 provide equivalent technology which will be attractive to many airlines and lessors, the A330-900 clearly is a credible alternative that will attract orders from airlines (and lessors) that do not want to pay a premium for state of the art technology. Given that long term air fares are in decline in real-terms, this should be a sizable market.

Boeing faces tough competition. While the 787 and A350 provide equivalent technology which will be attractive to many airlines and lessors, the A330-900 clearly is a credible alternative that will attract orders from airlines (and lessors) that do not want to pay a premium for state of the art technology. Given that long term air fares are in decline in real-terms, this should be a sizable market.

Views: 279

How do the different airframes compare with maintenance costs.

I suspect the A330 will be more costly to maintain than a 787 or A350. With utilization rates directly linked to maintenance intervals the other more expensive options ccould have greater revenue potential

Am surprised to see the 330-900 will have the same cruise speed as the 787/350. Can you please confirm this as coming from Airbus?

Airbus claims Mmo 0.86M for the A330-900 – http://www.airbus.com/aircraftfamilies/passengeraircraft/a330family/a330-900neo/

Airbus claims Mmo 0.89M for A350-900 – http://www.airbus.com/aircraftfamilies/passengeraircraft/a350xwbfamily/a350-900/

We assume cruise at 0.85M for the modeling

I was always curious about the number of ‘real new’ markets opened by the 787. They do exist but are relatively few such as Austin- Dusseldorf and Narita -San Jose. Air NZ only uses its 787s to replace 767s or 777’s. Looking at most airports served they are large hubs by and large. An example of long range is Dallas to Shanghai with American. San Francisco -Shanghai is a 13 hr flight with United- nothing that wasnt done before. Often a regular service can be maintained with 777 or 787 depending on the day or week or season. But up to 10-12 hr flights can be done by A330 as well. The 787-10 as you say can replace a 777-200, which is what most airlines will do. Its hard to find long range city pairs that arent being served that can generate the over $100 mill revenue per year to sustain a long haul flights with 787s.

Thank you for the reference. The A330 CEO also has an Mmo of .86 similar to the NEO. Given the wing aerodynamic improvements the NEO has, chances it will cruise a marginally faster speeds than the CEO (.82-.83). I am hoping Airbus can confirm that.

Please check, all your tables, comparisons etc are not visible.

Thanks for head’s up – now fixed