IMG 3005 scaled

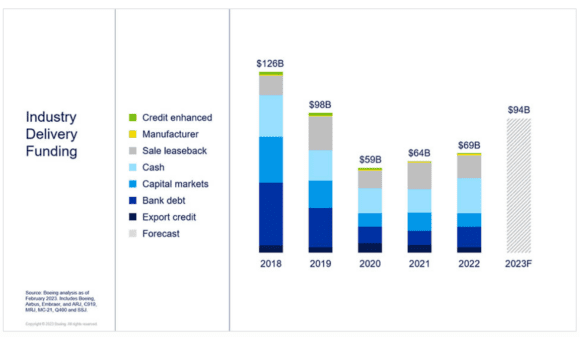

Boeing is confident that 2023 will see commercial aircraft financing reach almost 2019 levels again. In the latest Commercial Aircraft Financial Market Outlook (CAFMO), Boeing Capital expects some $94 billion in aircraft financing to be available this year compared to $98 billion in 2019.

CAFMO is an annual review of aircraft financing trends and near-term dynamics. Last year’s report was published a little later in the year in May 2022. The year saw $69 billion in aircraft delivery funding available for 2022, up from $64 billion in 2021. “It was encouraging to see another year of recovery (…) that sets us on a better path for 2023,” says Vasgen Edwards, Managing Director of Capital Markets and Outreach of Boeing Customer Finance in a video about CAFMO.

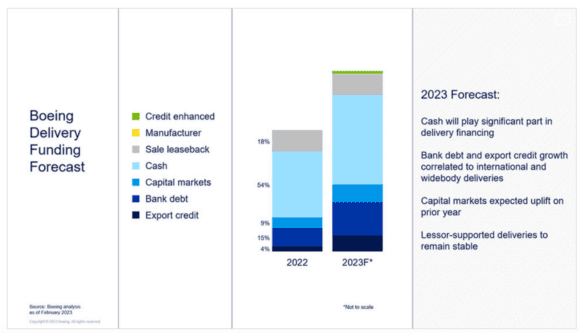

Edwards noted that cash was the dominant force in the acquisition of Boeing aircraft in 2022 compared to the previous year and a smaller share of capital markets. One reason is that interest rates were up higher year on year. But it can also be explained by the fact that most of those aircraft (MAX) were delivered to customers in markets where the international recovery was the strongest and had sufficient cash on hand, principally in North America and Europe.

Despite a “degree of confidence” that the industry is recovering well, the 2023 outlook is a limited forecast as some (economic) challenges still persist. High interest rates are one factor in some markets that will affect aircraft financing. While the capital markets are expected to make a return this year, cash will remain the dominant form of financing in 2023.

“However, our belief is that the balance of cash versus new financing may yet shift out of an abundance of caution and financing may be used for deliveries previously earmarked with internal resources,” says Edwards. An increase in bank debt and/or export credits is very well possible in correlation to international widebody deliveries, but this may vary by region.

CAFMO says that lessor-supported deliveries remain important, but they may face competition from other sources. Leasing accounts for 47 percent of the industrywide fleet, which is unchanged from 2021. This year could see a change as even lessors themselves are offering alternative financing options. “A material factor in this trajectory will be the funding of those airlines with significant order books as their scale can influence the outcome,” says Edwards.

Asset-based securities were at their lowest level last year since 2013 and may need “structural enhancements” to make them appealing enough to investors.

Views: 6