2024 05 01 155828 scaled

Today, Bombardier held its Investor Day in its manufacturing facility at Toronto’s Downsview Airport. Bombardier’s CEO Èric Martel and CFO Bert Demosky guided the remainder of 2024 and 2025, and some hints about the potential results out as far as 2030. The company confirmed a 12 Challenger 3500 aircraft order plus 238 options from NetJets this morning. Bombardier views continued business from fractional operators as a major plus, as it introduces the aircraft to a much wider audience than an individual sale.

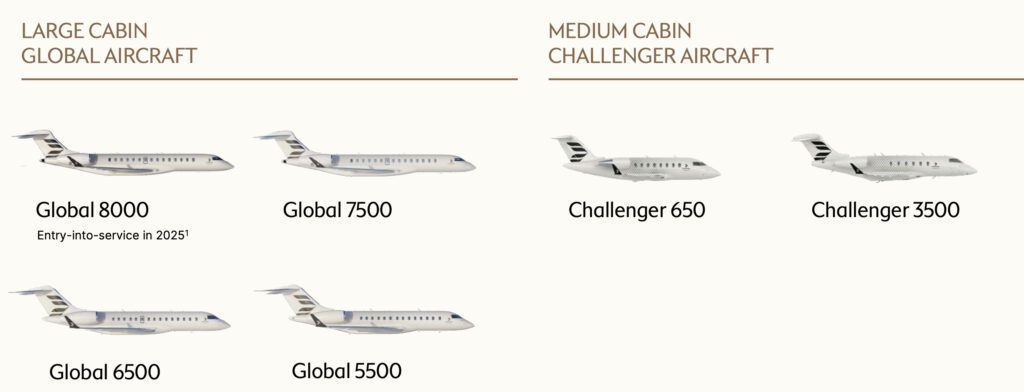

The company also introduced its new logo last week, nicknamed the Mach, in celebration of the Global 8000 breaking the sound barrier during flight testing. That aircraft will enter service next year and will have a high-speed cruise of M0.94, the fastest in its class. Martel indicated that Bombardier is known for being innovative and agile and is now the #1 or #2 in every category in which it competes.

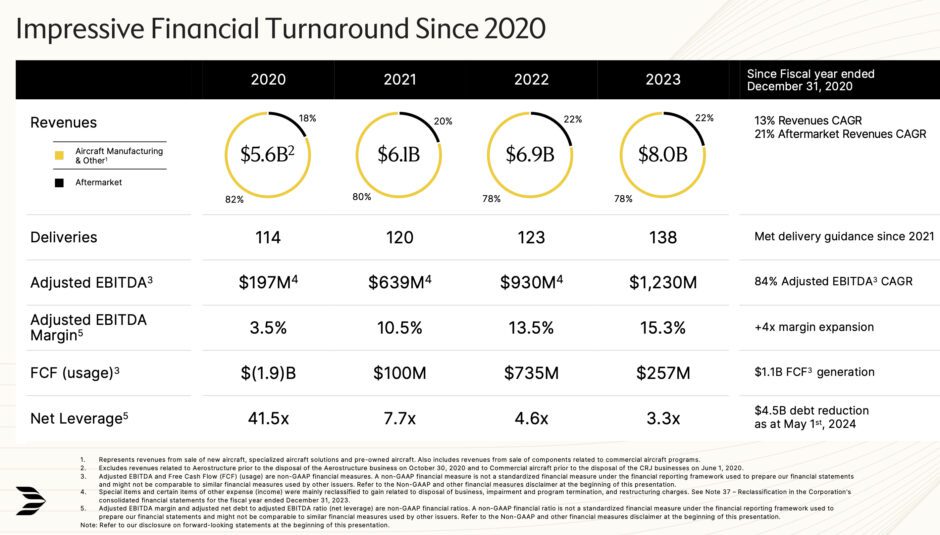

Bombardier believes it is well positioned for growth, particularly in services, defense, and pre-owned aircraft. The emerging segments have a substantial potential for organic growth through the rest of the decade, and even with keeping new aircraft flat at 150 per year in projections, the company should show significant revenue and earnings growth. The following presentation chart shows key Bombardier financial attributes from their turnaround from 2020 through 2023. Over those four years, revenues grew from $5.6B to $8.0B with increasing margins and a dramatic reduction in net leverage. First-quarter earnings of $110 million started the year on a positive note.

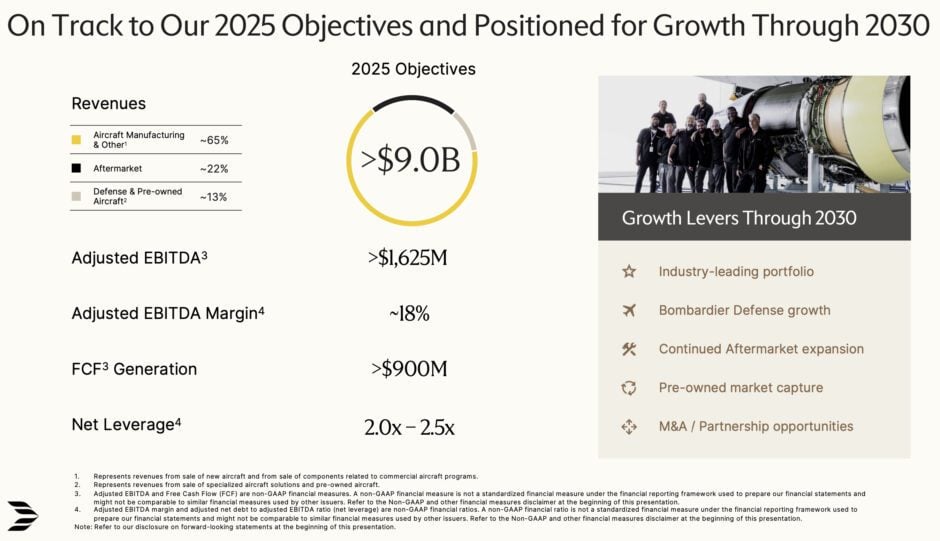

Looking ahead to 2025, Bombardier is projecting revenues of $9.0 billion, adjusted EBITDA of $1.625B, more than $900 million in free cash flow generation, and a reduction in net leverage to 2.0x to 2.5X. The strong performance and dramatic debt reductions should help the company regain an investment-grade credit rating over the next three years.

Bombardier will likely even out its revenue distribution by leveraging its services segment, which is growing organically with the fleet, adapting existing products for defense applications, and an extension of the Bombardier Certified used aircraft programs. Each of these segments is growing and will likely bring opportunities to move the ratio of aircraft versus other earnings from 69% in 2023 to 50% by 2030. Balancing that growth with a conservative aircraft forecast indicates the likelihood that Bombardier can achieve its guidance.

The Bottom Line

The company is working on long-term future designs, but over the next few years, it will rely on derivative models from today’s platforms until a radical departure and innovative aerodynamics are introduced in the 2030-2040 time frame.

Their EcoJet demonstrator program provides a clue as to what the future might look like.

Propulsion technology is changing, and like other OEMs, Bombardier needs to wait for that technology as it will likely have the greatest impact on fuel economy and reducing emissions. With a strong SAF program already in place, Bombardier should be well positioned for future developments as technology emerges, with strong earnings, lower debt, and free cash flow to innovate with a clean-sheet next-generation business jet.

Views: 100