MG 3804

Cathay Pacific announced a HK$9.865 billion HY1 loss on August 12, in line with its unaudited profit warning on July 17. It ended the most challenging first six months the group has ever faced in its 70-year history, CEO Richard Lam said. While the Hong Kong-based airline has seen some improvements in connecting demand via Hong Kong, Lam fails to see “any meaningful recovery in our passenger business for some time to come.”

The HY1 Group-loss is double that of the unaudited result reported in Q1 when Cathay and Cathay Dragon posted an HK$-4.5 billion loss. The HY1 result compares to a HK$1.347 billion profit in 2019.

Cathay Pacific and Cathay Pacific Dragon recorded a HK$-7.361 billion loss, with the remainder coming from losses in subsidiaries.

The result includes impairments costs of HK$2.465 billion related to deep storage of sixteen aircraft until at least the Summer of 2021 plus “certain airline services subsidiaries assets.” It also spent HK$42 million on redundancy costs in connection to the closure of outport crew bases.

Cathay has burnt HK$2.5 to 3.0 billion in cash per month but this has been reduced to HK$1.5 billion and is expected to remain at this level.

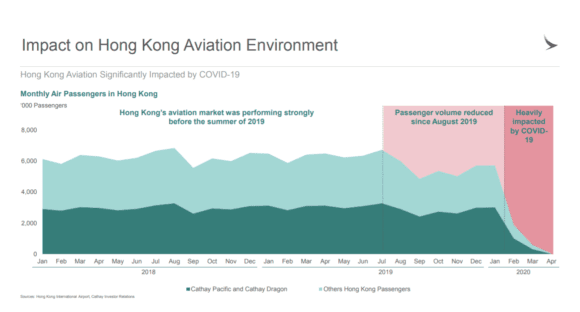

The airline was first hit by political unrest in Hong Kong from August 2019, when a notable drop in passenger volumes was visible during September-December. This was followed by the impact of Covid-19 when the virus struck China, then the Asia Pacific, and followed by Europe and the rest of the world. With new cases emerging, Cathay’s position has been static since January. In addition, new political unrest in Hong Kong after the implementation of a security act by Beijing in July has further destabilized the situation.

Graphic showing how Cathay’s traffic has developed until April 2020.

Being heavily dependent on long-haul traffic, Cathay has seen demand drop to almost non-existent. This becomes evident once more from the latest traffic results from June: Cathay Pacific and Cathay Dragon combined flew only 27.106 passengers, a drop of -99.1 percent from last June. HY1 passengers total 4.3 million.

Revenues per Kilometer (RPK) were down -98.8 percent to 145.713. Its biggest market has been to North America with 71.010 RPKs, with Europe next at 26.053. Cathay Pacific resumed international services to New York, San Francisco, and Amsterdam in May, to Melbourne in June, and to Frankfurt this week. Capacity for July is back at seven percent, with ten percent planned for August.

In the first six months, passengers carried dropped -76 percent to 4.3 million. Available capacity (ASK) was down -96.1 percent.

Cathay’s cargo services have seen a “mild pickup in general airfreight movements”. Yet, Cathay’s business dropped five percent last month to 596.037 Revenue Tonne Kilometers (RTK), -35.8 percent compared to June last year. A decrease in medical supplies from China is quoted as the main reason for the drop. In HY1, RTKs were down -24.6 percent to 4.129 million.

Recapitalization plan gets approval

In July, Cathay Pacific received shareholder approval for its HK$39 billion recapitalization plan announced early in June and completed the plan on August 12. This includes HK$19.5 billion in preference shares with warrants that have been fully subscribed by the Hong Kong-government, which also provided HK$7.8 billion as a bridge loan with an 18-month maturity. The government will have two observers on the Board.

The third pillar of the package is a rights issue with existing shareholders of HK$11.7 billion after Swire Group (45 percent), Air China (29.99), and Qatar Airways (9.99) took up irrevocable undertakings of their pro-rata portions.

The package should bolster Cathay’s equity position to HK$93.9 billion, up 31 billion. Net debt should decrease by the same amount to HK$51.1 billion. Before the recapitalization, Cathay strengthened its liquidity position by HK$575 million and arranged a sale and leaseback on six Boeing 777-300ERs in March.

A second wave of voluntary special leave has been implemented as well as a further round of executive pay cuts. The Board will present a plan on the airline’s optimum size and shape by Q4, which “inevitably will involve rationalization of future planned capacity”, it says in a rights issues prospectus released on July 22. The Board will continue to explore options to strengthen its capital structure and balance sheet.

Deliveries pushed back

Before the Covid-crisis, Cathay Pacific and Cathay Dragon had 70 aircraft up for delivery until 2024, including five Airbus A320neo’s for Hong Kong Express, 32 A321neo’s (including 16 for HKE), four A350-900s and eight -1000s, plus 21 Boeing 777-9s.

In its rights issues prospectus published on July 22, Cathay confirmed it has reached an agreement with Airbus about revised delivery positions. Deliveries will be spread of two extra years. Instead of 2020-2023, the A321neo’s will now arrive between 2020 and 2025 while the A350s have been pushed back from 2021-2021 to 2020-2023. Cathay has converted orders for two -1000s into -900s. The prospectus doesn’t mention the A320neo-slots for Hong Kong Express.

With Boeing, ‘advanced negotiations’ are ongoing about the deferral of the 777-9 order to an unspecified date.

Views: 1