Despite an almost full recovery of traffic on domestic routes, Chinese airlines remain cautious or even pessimistic about their financial situation and outlook. The number of flights might have recovered to 2019 levels but load factors and yields remain weak, representatives of five leading Chinese airlines said during webcast sessions on September 25 at the World Aviation Festival. Discussed were domestic and international market trends.

In its latest figures available of July, IATA said domestic revenues per kilometer (RPK) were -28.4 percent compared to July 2019 and capacity/available seat kilometer (ASK) -18.3 percent. By comparison: in February, RPKs were at -83.6 percent and ASKs at -70.4 percent.

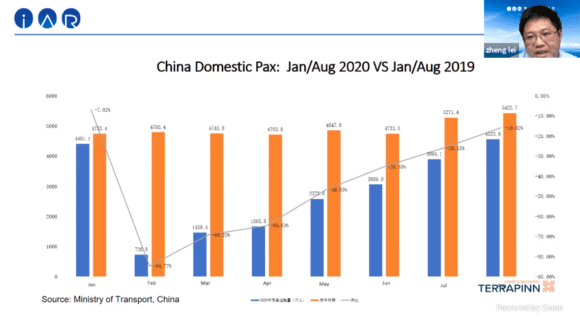

In an online presentation, president Zheng Lei of the UK-based Institute for Aviation Research (IAR) presented recent data. Passenger numbers have recovered from 728.800 in February to 4.553 million this August, an improvement of some 84 percent but a little over 20 percent down compared to August last year. “If we look at data from last week, we can see passenger numbers exceeded that of last year by one percent. That’s a very fast recovery,” Zheng said.

From the low point at 95.808 in February, domestic flight numbers have recovered by 95 percent to 367.322 in August. This compares to 385.539 in August 2019. Load factors are now at 75 percent versus 86 percent in August last year.

This September, most Chinese airlines increased domestic capacity: China Eastern by 11.7 percent, China Southern by 6.6, Air China by 9.5, and regional operator China Express Airlines by even 127.4 percent. Only Hainan Airlines offered fewer capacity at -32.4 percent.

Domestic traffic data in China presented by Zheng Lei.

Indeed, airlines confirm the surge in demand and a return of traffic to almost 2019-levels. “In China, the pandemic is well-controlled by the government. It is a key factor in the return to the higher number”, said Guoxiang Wu of China Southern Airlines. “Everyone thinks that taking a plane in China is safe. There are no worries. Wearing face masks is now normal.”

Fengru Shao of China Eastern added: “We have educated passengers online on how to use their smartphones for contactless flying. Airports have biometric systems that minimize physical contact points to improve safety.”

Cheap tickets have stimulated flying

Domestic flying has been promoted when airlines started offering cheap tickets or packages in May. China Eastern was the first, said Shao: “We launched the “fly weekend”-product that allows you to fly without restrictions until the end of the year and as much as you like. This has stimulated demand and others have followed with similar products.”

While these unrestricted tickets have been very successful, passenger behavior has changed as it comes to bookings, said Chen Mingqiong of HNA Group: “Passengers are more sensitive to healthy and security issues. This has improved further in September, but currently, they tend to book a ticket as close to the travel date as possible. 62 Percent of passengers buy a ticket within ten days of traveling, 41 percent buy it three days before flying. This used to be 28 percent. And passengers are more price-sensitive. This includes both the private traveler and the business traveler as businesses are cutting back on travel budgets.”

The airlines have mixed experiences as far as revenues are concerned. “Cheap prices at the beginning pushed the recovery. Step by step, revenues and prices are improving”, said Xiamen’s Su Chengjian. Pan Yi of Tianjin Airlines thinks differently: “Domestic capacity is back to 60 percent in our region but revenues are quite low. Only when they go up again, we can bring back more stored aircraft in service.”

Financial performances no good

“Airline performances on a domestic level aren’t good from a financial perspective”, said China Eastern’s Shao. “The biggest airlines’ operating performances are showing a CNY -18.8 billion loss and it will be under pressure for some time.” Financial results presented by Zheng Lei showed all airlines presented losses for the first half-year, with Hainan Airlines the highest at $-12.7 million, Air China at $-10.2 million, China Southern at $-9.5 million, and China Eastern at $-9.4 million. Xiamen shows a $-1.7 million loss.

As a result, Xiamen’s Su thinks that the price war will be only temporary: “Low prices can be attractive to passengers but it will be a short-term campaign for the airlines.” Pan Yi thinks likewise: “I agree that this will be a short-term product to stimulate market demand and cash flow, but long-term it will have a negative effect on yields.”

China Southern’s Wu has a different opinion: “The price war will be the new normal. This will change the industry forever. There is a new business model to go for, there is no way we can go back to what we used to have in 2019.”

The recovery of the international market for Chinese airlines is a different story. There is some recovery, but only on a very limited basis. For example, Air China used to operate 400 international flights a week to the US before Covid hit. When it did, it dropped to just a single flight, recovering to four and now to sixteen per week, Zhihang Chi said.

The Chinese government through its regulatory agency CAAC introduced a set of rules in March that limited airlines to operate to a specific country only once a week. The same applied to international airlines coming into China. Social distancing on board needed to be observed, with load factors not exceeding 75 percent. Since then, these measures have been relaxed “but overall CAAC tries to minimize the import of Covid cases”, Zheng Lei said. The numbers confirm this: Chinese airlines operated just 2.173 international flights in August (or only three percent) compared to 84.275 in August 2019. By mid-September, international ASKs were down by -89.4 (Juneyao Airlines) to 98.4 percent (Shenzhen Airlines).

The lack of international services has severely hurt the combined wide-body/long-haul fleet of Chinese airlines. While flight hours of narrowbodies have recovered to 6.6 hours per day (versus 8.1 hours in August 2019), widebodies are flying only 5.3 hours a day compared to 10.8 last year. China Southern is making good use of its five Airbus A380s since May, operating them now to airports not served by the type before like Tokyo Narita, Paris CdG, and Seoul.

But many airlines have deployed part of their widebodies on domestic routes in order to keep them and their crews active but also using them to respond to higher domestic demand. HNA’s Chen is a bit worried about this trend: “The use of wide bodies on domestic routes puts a lot of pressure on the market and has an impact on financial performance. I expect some airlines will call on the (regional) governments for financial aid.”

Flight hours of widebody aircraft like this China Eastern Airbus A350 have come down with Chinese airlines, although many have been deployed on domestic routes. (Airbus)

Long-haul and international services will recover only slowly. China Eastern’s Shao follows IATA’s guidance for a full recovery not before 2024. “If there is a vaccine it could be better, but that is still difficult to predict.”

Even then, back to the ‘old days’ isn’t something Xiamen’s Su Chengjian is expecting: “There will be network changes. No way the international network will be stretched and maintained as before Covid. Every focus will be on yields: those routes with low yields will be reduced or canceled.”

Before Covid, Chinese regional airlines used to sponsor airlines to generate international traffic and tourism. Not anymore, thinks Tianjin’s Pan Yi: “Regional governments will want to prioritize local recovery first. It isn’t certain they will continue to support us on international routes.”

China Southern’s Wu is expecting another change in travel behavior. “Passengers might want to use fewer transfer flights through big hubs and instead prefer point-to-point services from smaller airports. The downside of this is of course that smaller cities offer fewer international connections.”

And if the Chinese tourist will travel again, even the way he does is expected to change from traveling individually instead of in big groups. “Maybe older people might prefer to travel in groups of thirty or forty people, but I expect especially younger travelers to prefer to make their own arrangements. That is a big change”, said Pan Yi.