Stored Aircraft

The recovery in the US airline market has been slow, and is still nowhere close to 2019 levels in traffic and activity. The forecasts of a long recovery back to pre-pandemic levels appear to be accurate, despite everyone in the industry wishing otherwise.

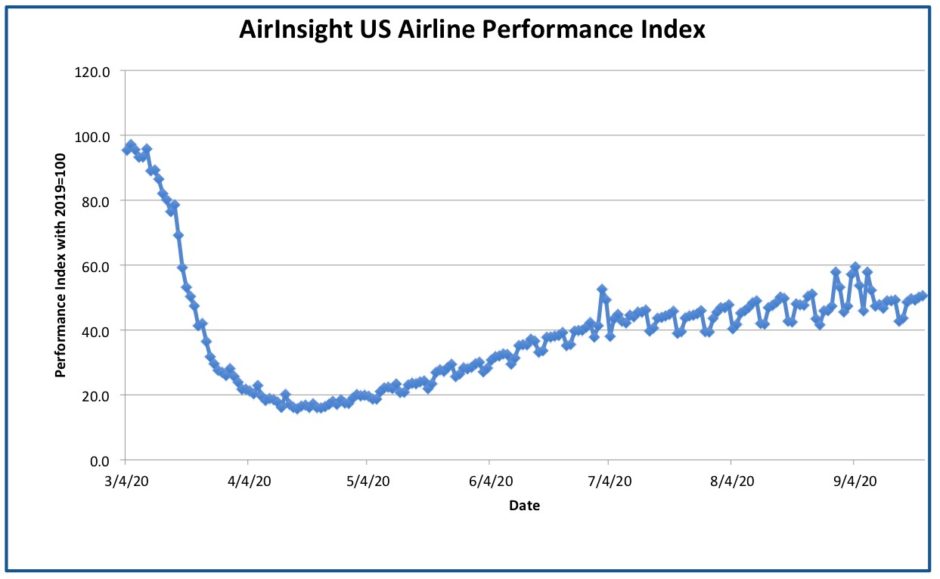

Our overall index shows signs of improvement, albeit quite slow. But despite some upward movement as schedule changes and the 4th of July and Labor Day holidays, the recovery appears stalled at very slow growth rates. If we extended a trend line to the current chart, it would take until 2024 to return to 2019 levels.

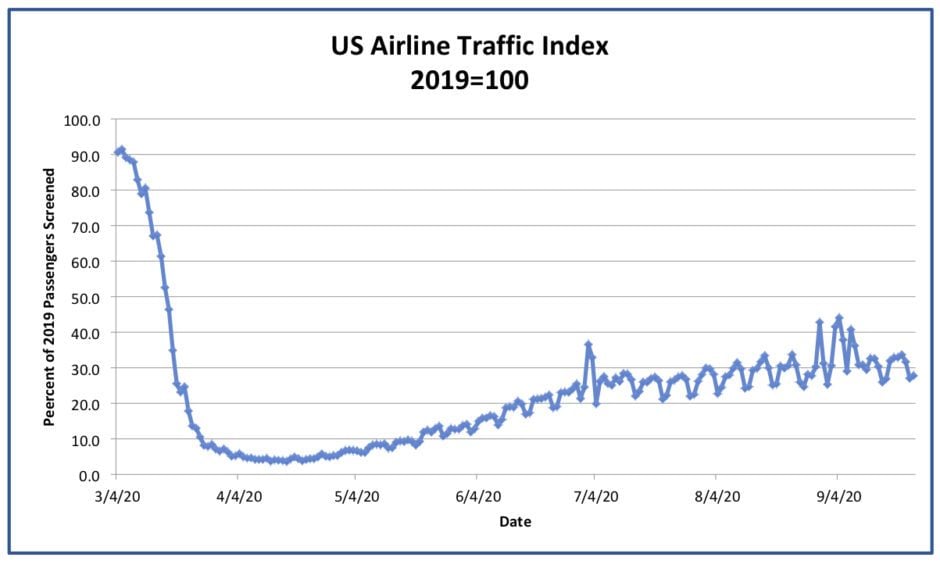

Airline traffic has been growing slowly through the summer but appears to be regressing in September after a Labor Day weekend bump. The trend, if it continues, may result in a slower fourth quarter than previously anticipated by airlines and a longer path to recovery. Over the last two weeks, traffic has returned from about 40% of last year back into the mid 30% range, similar to July levels.

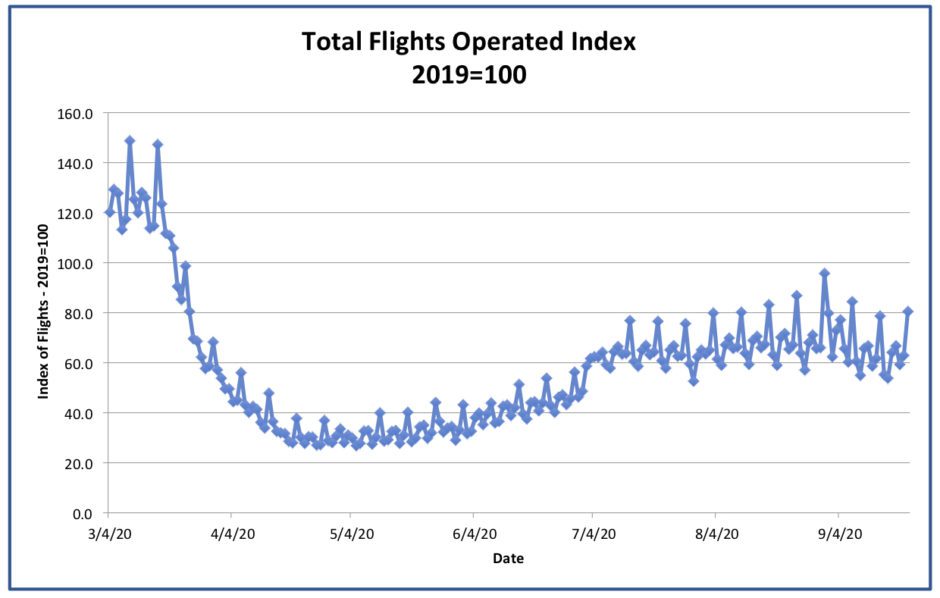

Airlines have re-adjusted planned schedule increases after summer traffic did not materialize, and several carriers reduced planned growth in flights for September and October. As a result, activity levels remain weaker than other global markets, particularly China which has now restored about 80% of its domestic capacity when compared to last year. The US industry remains in the 55%-65% range in terms of flights, but much lower in terms of seats as larger aircraft on many routes have been replaced with smaller aircraft. The flight levels in September have dropped from their late August levels, and appear to be relatively flat as shown in the chart below.

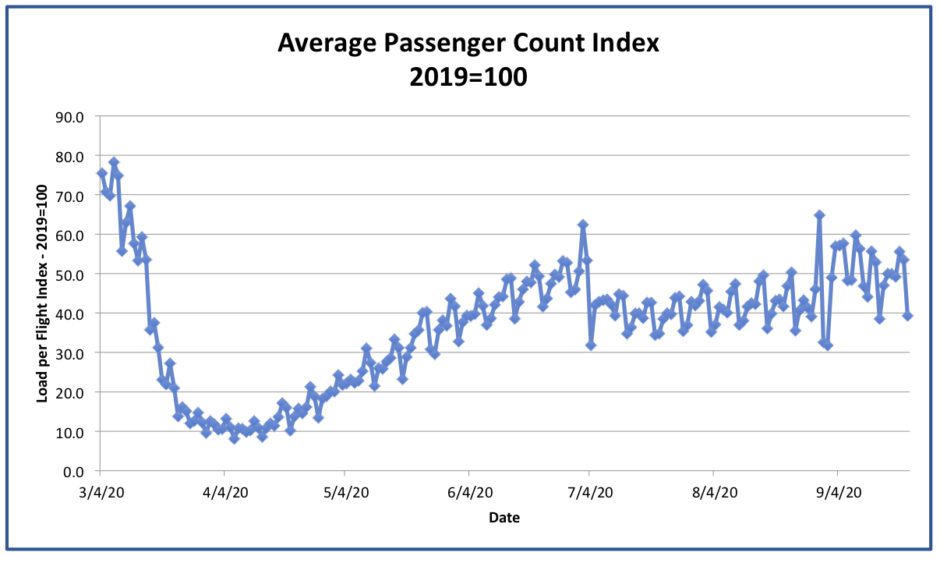

The average passenger count per flight is a good surrogate for profitability. That index had been climbing until July when additional capacity entered the market. With some of that capacity removed in early September, the passenger counts rose slightly to levels consistent with the end of June. The flattening of the trend line, which increased steadily during the first half of the year, illustrates the weakness of the recovery in the US airline market.

The Bottom Line:

The recovery in the airline industry has stalled, and we expect a period of low or no growth through the normally lower travel seasons, the 4th and 1st quarters. With business travel remaining weak and leisure travel somewhat restricted by fears of required quarantines upon return, bookings remain lower than airlines anticipated a couple of months ago. Schedule increases have been adjusted downward as airlines are matching capacity with demand, and we don’t expect a return to a strong upward trend until the 2nd quarter of 2021.

Our outlook for next year tops out at about 70% of the average passengers per flight that was achieved in 2019, with potential additional volatility around the holidays, depending on whether the pandemic experiences a “second wave.” The numbers aren’t looking very optimistic for a return to profitability anytime soon.

Views: 1