A321LR TAP Delivery

The month ends tomorrow, and barring miraculous numbers, the trend is in – OEM deliveries slowed a lot in July. Industry-wide new aircraft deliveries through the 30th currently hover at 100 compared to last month’s 142. Did summer vacations come early this year? Or maybe the heat was just too much. However, we want to share some intriguing delivery trends that are quite distinct.

- The duopoly has an iron lock on the industry – through July, it accounts for 90% of new deliveries. The other OEMs are almost drowned out. What does this mean? If you’re in the supply chain, who do you focus on? The duopoly drives the supply chain.

- Airbus – this chart tells what you need to know. Click on the image to make it larger.

The A321neo is their #1 product (red arrow). It is streets ahead of the A320neo, and that has huge implications.

Look at their top customers (orange block)- that is what they are taking delivery of.

Also, notice how wide the Airbus customer spread is. Customers are all over the globe. That probably means a lower risk of any economic shocks – something this industry faces virtually every few years.

- Boeing – click the chart to make it bigger.

The MAX8 is the #1 deliverable (red arrow). The MAX9 and MAX 8-200 are the next two.

The orange block highlights their top customers. There are four if we include Alaska. Three of the four are based in the US — many eggs in one basket.

An item worth noting – Akasa is already as important a customer as flydubai. Who was expecting that?

Freighters are a powerful market for Boeing, and Airbus is woefully behind in this arena.

- Airbus almost certainly charges more for its A321neo than Boeing charges for its MAX8. Data from ch-Aviation suggests an average market value of an A321NX at $52.8M compared to $42.5 for the MAX8, $46M for the MAX8-200, and $46.3m for the MAX9. This enormous pricing advantage provides Airbus with a significant downstream impact. Airbus can discount the A320neo to drive down MAX8 pricing via transfer pricing. Is it any wonder that Boeing is laser-focused on bringing the MAX10 to market before the MAX7? Even to the intense annoyance of their top MAX customer, Southwest. Every day that Airbus gets to drive MAX8 pricing in competitions, Boeing bleeds a little more.

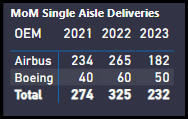

- Next, look at the MoM segment because this is where the single-aisle market is headed.

Airbus had a 5.9 ratio advantage in 2021, then 4.4 in 2022, and currently is at 3.6. Boeing knows how crucial this segment is, and its MAX9 is seeing adoption by key customers like Aeroméxico, COPA, Alaska, and United. The MAX10 is going to reduce Airbus’ advantage further.

Airbus had a 5.9 ratio advantage in 2021, then 4.4 in 2022, and currently is at 3.6. Boeing knows how crucial this segment is, and its MAX9 is seeing adoption by key customers like Aeroméxico, COPA, Alaska, and United. The MAX10 is going to reduce Airbus’ advantage further.

But if we can expect Airbus to offer something new (i.e., the still mythical A322), then what does Boeing do? Airbus’s financial advantage provides it with R&D resources that Boeing might not have. There is a powerful competition quietly taking place before our eyes. And the outcome of this has huge competitive implications.

Remember how concerned Boeing was with the C Series? The single-aisle MoM issue is a much greater threat.

Subscribers can access our 25-page daily delivery model with several views on delivery trends. As we frequently point out, orders are plans, while deliveries are facts. This model may be one of our most important because it points to trends that insiders need.

A stable duopoly is crucial for commercial aviation. Industry risk from disruption at the duopoly level is probably being overlooked. There is much more that can be said. But, perhaps, not here.

Views: 10

Airbus had a 5.9 ratio advantage in 2021, then 4.4 in 2022, and currently is at 3.6. Boeing knows how crucial this segment is, and its MAX9 is seeing adoption by key customers like Aeroméxico, COPA, Alaska, and United. The MAX10 is going to reduce Airbus’ advantage further.

Airbus had a 5.9 ratio advantage in 2021, then 4.4 in 2022, and currently is at 3.6. Boeing knows how crucial this segment is, and its MAX9 is seeing adoption by key customers like Aeroméxico, COPA, Alaska, and United. The MAX10 is going to reduce Airbus’ advantage further.