A320neo easyJet MSN8920 350th aircraft Details scaled

Reallocating a significant part of its capacity to the strongest markets and radically optimizing the network has been instrumental in reducing easyJet’s losses in its first half-year of FY22. The European airline reported a £545 million headline loss before tax for the period, an improvement of some £150 million. easyJet benefits from capacity reallocation.

In HY1, easyJet reallocated 1.5 million seats from weaker markets to stronger (leisure) markets, launching 48 new routes since January. It continues to build on this by adding capacity at Manchester (plus two aircraft to twenty), Milan Linate (plus three to 25), and Paris (plus one to 22) while doubling the fleet at destinations bases from nine to nineteen. This includes Greece and Portugal. The carrier will add domestic capacity in the UK and France as well as capacity at slot-constrained airports like Gatwick, Porto, Lisbon, and Linate.

Chief Commercial Officer Sophie Dekker noted that together with Ryanair, easyJet is the only airline to actually add capacity for the summer. All legacy airlines in Europe (its main competitors on two-thirds of easyJet’s network) and even Wizz Air have cut capacity in Q4 by high single-digit to double-digit teen numbers. Compared to 2019 levels, there are 46 million fewer seats in the European market. After securing more slots, easyJet will strengthen capacity at London Gatwick. As it capitalizes on the reduced size of British Airways at Gatwick, easyJet is now the biggest airline in the London area for the first time ever.

Leisure capacity around Easter was 115 percent of 2019 levels, with load factors up to ninety percent again. Since the lifting of Covid restriction in the UK, bookings have been strong: in the last ten weeks, they were up six percent on pre-Covid levels. easyJet expects capacity in the current third quarter (April-June) to reach ninety percent op 2019 and 97 percent in Q4. CEO Johan Lundgren is particularly happy with the strong bookings at easyJet Holidays, which are up by 530 percent from 2019. Holidays should contribute to FY22 passenger numbers by some 1.1 million, adding £100 million in incremental mid-term profit to the Group.

Ancillary revenues up by 44 percent

easyJet reported a headline loss before tax was £545 million versus £-701 million, in line with its guidance from April. Group EBITDAR was £-208 million versus £-469 million. Fuel costs increased to £362 million, up from £97 million, although effective fuel costs per metric tonne were lower. Headline costs excluding fuel were also significantly higher to £1.344 billion from £612 million, reflecting higher operating costs from more flying compared to the weak 2020-2021 period offset by lower crew, maintenance, and ownership costs.

The airline carried 23.4 million passengers, up from 4.1 million the previous year, with Q1 and Q2 about even at some 11.6 million. Total revenues increased to £1.498 billion from £240 million, of which £985 million from passenger revenues. Revenues per seat were up by 29 percent to £47.61 as load factors increased to on average 77.3 percent and even 81 percent in February and March. Ancillary revenues per seat from seat and baggage reservations increased by 44 percent to £15.12 or £513 million in total. The airline is seeing benefits from new ancillary products that in introduced a year ago. It plans another ‘step change’ in ancillary revenues.

The Group ended the year with £3.5 billion in cash and cash equivalents, and money deposits. It repaid £300 million in commercial paper and has no maturities until FY23. Net debt stood at £596 million, down from £2.098 billion the year before. Net cash generation in HY1 was £109 million and a cash outflow of £159 million.

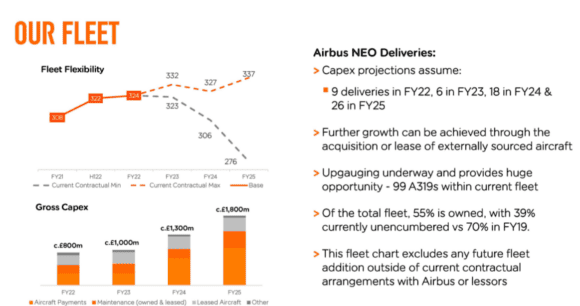

easyJet has various options to grow or reduce its fleet by adding new aircraft and/or terminating leases. (easyJet)

Flexibility to grow or reduce the fleet

easyJet ended the first half-year with a fleet of 322 aircraft, which will grow to 324 by year-end. It projects deliveries of nine aircraft in FY22, six in FY23, eighteen in FY24, and 26 in FY25. At the same time, it will start phasing out its 99 Airbus A319s until 2027 and replace them with higher-capacity A320neo’s and A321neo’s, of which another 115 remain on backlog plus 59 purchase options and purchase rights. How it will split deliveries between the two variants is still subject to confirmation, but by adding the Neo’s, easyjet can upgauge capacity without adding more aircraft. Chief Financial Officer Kenton Jarvis said that the fleet could grow to 337 aircraft by FY25, but the carrier could also reduce the number to 276 by not extending current lease contracts. Following the sanctions on Russia, easyJet returned six aircraft that were sourced from lessors that had ties with Russia.

Lundgren said that easyJet will keep a strict eye on labor costs by improving productivity and through seasonal contracts. Like other airlines, it has been confronted with labor market issues that forced it to cancel many flights in April. In response, the airline has taken the odd decision to leave one seat row per aircraft unused to reduce the number of cancelations if it would be forced to do so. With new recruitment programs in place, Lundrgen says “we believe we have the right amount of crew for the summer period.” The airline is prepared to pay extra to staff in crucial positions like ground handling and airport operations to secure adequate staffing.

Given the continued short-term uncertainties, easyJet isn’t giving guidance on the full year. Forward bookings might be positive but remain close in. The airline is not so worried about fuel costs as it has hedged 71 percent of its fuel for HY2 at an average of $619 per metric tonne, 49 percent for HY1 2023, and twenty percent for HY2 2023.

It is also hedged by eighty percent for dollar fluctuations this year and 100 percent on offsetting carbon credits. The airline said today that it has updated its interim target of emission reductions, targeting now a 35 percent improvement by 2035 compared to an FY2020 baseline. The revised target is based on its Science-Based Targets Initiative tool. Since 2000, easyJet claims to have reduced carbon emissions per passenger by 33 percent. Improvements must come from fleet renewal, operational efficiencies, improvements in air traffic management, and scaling up the use of sustainable aviation fuels (SAF). Earlier this week, we discusses easyJet’s sustainability strategy with Director of Flight Operations, David Morgan.

Views: 5