MG 8201 scaled

European low-cost carrier easyJet significantly reduced its losses in FY22, thanks to a strong summer that produced a record-high EBITDAR. For FY23, the airline will try to focus on its key markets to build back to pre-pandemic levels. And it will introduce Wi-Fi onboard the generate more ancillary revenues. easyJet benefits from strong demand and business transformation.

First, let’s dig into the numbers. easyJet reported a headline loss before tax of £-178 million, which compares to £-1.136 billion in FY21. The reported loss was £-208 million. Headline EBITDAR was £569 million versus £-551 million. Headline EBIT was marginally positive at £3 million, an improvement from £-1.036 billion last year despite £78 million higher disruption costs over FY19. The loss is in line with its trading update in October.

Revenues improved to £5.769 billion from £1.458 billion. Non-fuel expenses were up to £3.921 billion from £1.638 billion, with fuel costs at £1.279 billion from £371 million last year. Higher expenses reflect the increase in capacity flown.

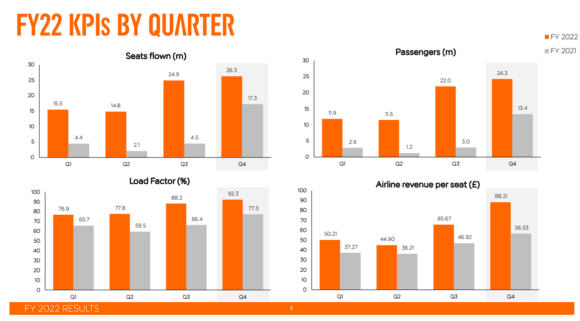

easyJet had a very strong final quarter (Q4, July-September) with a record-high headline EBITDAR of £674 million. It carried 24.4 million passengers, up from 13.3 million in the same period last year. The load factor was up to 92 percent for the quarter or 85.5 percent on average for the full year. After strikes caused numerous disruptions and cancelations in Q3, the operating performance in Q4 stabilized and was even better than in FY19.

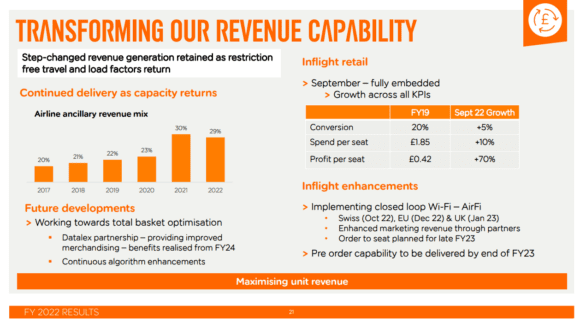

CEO Johan Lundgren is most happy with the step-change in ancillary revenues, which improved to £1.585 billion from £424 million or to £19.43 from £15.06 per seat. It now takes up 29 percent of all revenues. Revenues per seat increased to £66.23 per from £50.54. easyJet launched a new retail product in September that includes direct sourcing and contracting for onboard offerings.

But there is more to come: easyJet has identified Wi-Fi as another opportunity to enhance ancillary revenues. It will introduce a closed-loop system on its Switzerland- and EU-based fleet in December and on the UK fleet in January. It also will introduce order to seat and pre-order duty-free in the coming year. Further optimization is planned for FY24 as the airline expands its partnership with Datalex.

easyJet Holidays generated a £38 million profit from 1.1 million passengers who booked holiday packages, up from £8 million and 600.000 customers in FY21. The airline group targets a thirty percent growth in customers in FY23 as it wants to grow to a £100 million pre-tax profit in the medium term.

Business transformation

Lundgren said that easyJet is reaping the benefits from its business transformation. Looking at opportunities, the airline will remain focused on its key markets and ‘focus cities’. For this, it reallocated 2.1 million seats in FY22. easyJet intends to prioritize capacity at slot-constrained airports, as this is where its customers prefer to fly and where the airline can generate cost advantages from scale. Lundgren said that its scale gives it a cost advantage over its main competitors and intends to keep that position.

London Gatwick, Lisbon, Porto, the Greek islands, and Italy have all contributed strongly in FY22 and will remain key markets in the coming year. In Lisbon, easyJet will benefit from a further nine slots and grow its based fleet to nineteen aircraft. It expects to become the second-largest airline there behind TAP Portugal but ahead of Ryanair. easyJet is consulting legal firms about how it can fight the short-term capacity reductions at Amsterdam Schiphol that are expected to continue until late March. The carrier offers flights to 54 destinations out of Schiphol.

At the same time, easyJet will keep a strict eye on costs. The focus on voluntary seasonal contracts with pilots, smart capacity planning of the fleet, and hedging of fuel, currency costs, and emissions credits have all helped to reduce fixed costs in FY22 to below five percent of revenues. But as costs and inflation continue to increase, FY23 will look at ways to reduce fuel costs and increase digital services. The airline hopes to conclude new collective labor agreements with pilots and cabin crew that have failed to do so this year. Another area in which it will reduce costs is by insourcing line maintenance to five of its MRO bases.

It also will benefit from upgauging as more and bigger Airbus A321neo’s come in to replace smaller A319s. At the end of September, easyJet had 320 aircraft (57 percent owned), with 135 A320neo’s and 33 A321neo’s on order. Through extending or terminating leasing contracts, there is the flexibility to operate a fleet in FY23 of between 333 and 336 aircraft, growing to 308-346 in FY25. All wet leases have left the fleet at the end of October. New deliveries are expected to include just seven aircraft in FY23, growing to 21 in FY24 and 23 in FY25. As part of its risk management, the airline continues to maintain the residual value of its older aircraft through sale and leasebacks.

Recruitment campaigns

Bookings for leisure trips, business travel, and the UK domestic network have fully recovered to pre-pandemic levels. But city trips are some thirty percent behind, as are bookings outside the seasonal peaks. For the coming winter period, bookings are strong, with yields for the Christmas period currently up by eighteen percent. easyJet is already seeing this trend continue for Easter 2023. It is offering 28 new routes this winter, traditionally the lowest period of the year, to summer and ski destinations. Stimulating demand requires pricing action.

To be fully prepared for next year, easyJet will use the winter period to build more resilience into its operations. In response to the tight labor market, it has already begun a seasonal recruitment campaign. The company already recruited 1.650 employees this year but needs another 2.100 cabin crew.

Capacity in HY1 FY23 is expected to grow by 25 percent year-on-year to 38 million seats and by nine percent in HY2 to 56 million seats. Only in Q4 (July-September), capacity is expected to return to pre-pandemic levels. easyJet has hedged 74 percent of fuel in HY1 and 51 percent in HY2. It is hedged 77 percent against the US dollar in HY1 and 54 percent. Carbon emissions are hedged 77 percent in HY1.

easyJet ended September with £3.6 billion in cash and cash equivalents and £0.7 billion in net debt, having repaid £377 million in commercial paper. It has a £500 bond maturity in January that it plans to repay in cash. Capital expenditure will be around £900 million next year, increasing to £1.6 billion in FY25 as more new aircraft come in.

Views: 20