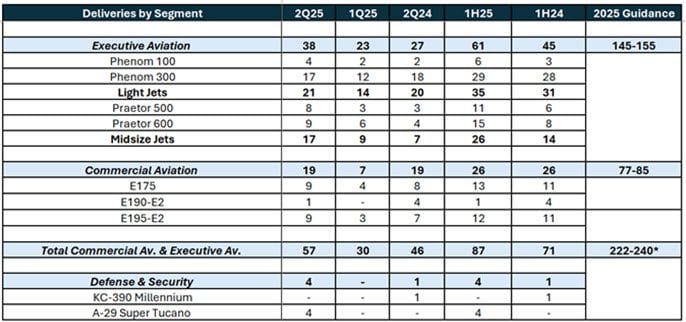

PR: Embraer (NYSE: ERJ / B3: EMBR3), a global leader in the aerospace industry, delivered 61 aircraft in the second quarter of 2025 (2Q25) across all its business units. The result represents an increase of 30% compared to 2Q24, when 47 jets were delivered, and more than double (103%) the volume recorded in the first quarter of 2025.

Deliveries in Commercial Aviation maintained the same volume as in 2Q24, totaling 19 aircraft. Compared to 1Q25, deliveries rose 171%. In Executive Aviation, deliveries reached 38 aircraft and surpassed the number from a year ago by 41%, while increasing 65% over 1Q25. The company also delivered 4 A-29 Super Tucano aircraft in the Defense & Security segment, bringing the total number of airplanes in the quarter to 61.

Embraer’s deliveries estimates for the year are between 77 and 85 in Commercial Aviation in 2025 (midpoint 10% above year-over-year), and 145 to 155 jets in Executive Aviation (midpoint 15% above year-over-year).

Notes:

- The strength lies in business jets. The Phenom 300 is the segment leader, as we noted yesterday in our report on the FAA business jet report.

- The KC-390 continues to offer promise, if not deliveries. BofA notes: “We continue to see ERJ’s KC-390 as well positioned to capture demand from increased NATO defense spending. In June the Portuguese Air Force ordered its sixth KC-390 with the option for ten more aircraft. This implies the plane is currently sold out through 2030 at current planned production volumes.”

- Commercial has made a few wins, the latest being the SAS order. This division continues to depend on the US regional market and demand for the E175. This market is unlikely to be as large as it once was. Even with a monopoly position, airlines want something newer and more efficient. E2 production, in our view, remains a weak spot. The backlog has grown, warranting faster production.

- Even with a more vertically integrated supply chain than its competitors, Embraer appears to struggle with increasing E2 production.

Views: 203

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}