20220525 PRODUCAO AERONAVES EMBRAER CC4 1746 scaled

UPDATE – Supply chain issues continued to pose challenges for Embraer in Q3, which resulted in fewer aircraft deliveries. Yet, the airframer expects to significantly ramp up deliveries in Q4 and reaffirms its delivery targets, thanks to increasing its inventories and implementing efficiency programs. Embraer reaffirms delivery targets despite supply chain issues.

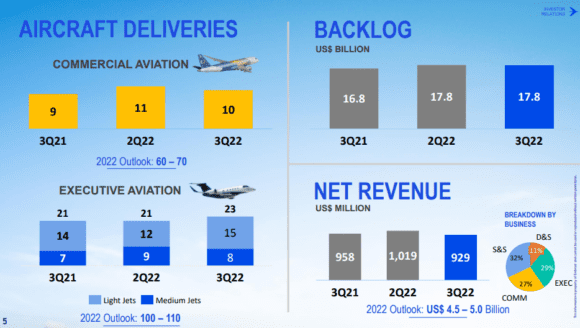

As reported last week, Embraer delivered ten commercial aircraft in Q3 compared to eleven in Q2 and nine in Q3 last year. Deliveries of executive aircraft were 23, up from 21 in both Q2 and Q3 2021. So far, Embraer has delivered 27 airliners this year and 52 business jets. This is still a long way from its full-year targets of sixty to seventy E-jets and 100-110 executive jets.

But despite the supply chain challenges, Embraer maintains its full-year deliveries guidance, it said today in its Q3 earnings presentation. President and CEO Francisco Gomes Neto added that deliveries will be at the lower end of the guidance for both airliners and business jets, so around sixty and 100 respectively. “It is a challenge for us, but we have seen this before. If you compare it with 2020, the concentration of deliveries in Q4 is not that different. So we know how to deal with the issue. We believe our deliveries will be at the lower end of the guidance. When we announced our guidance, we were already conservative.” Forty percent of the 2022 deliveries should be done this Q4.

Gomes Neto specified that supply issues affected engines, interiors, and avionics, “with parts arriving late in the process. The problem hasn’t increased, but it remains.” He expects it to persist at least through the first half of 2023 and normalize not until 2024. Chief Financial Officer Antonio Carlos Garcia added that Embraer ‘lost’ some ten aircraft deliveries each in Commercial and Executive this year due to supply chain issues.

Consolidated net loss of $30.2 million

The consolidated Q3 results show a $-30.2 million net loss compared to $-45 million in the same period of 2021 and improved from $-146.4 million in Q2. Adjusted EBIT was $49.9 million, up from $35.7 million last year but down from $81.2 million in Q2. Adjusted EBITDA was $92.9 million, up from $79.2 million in Q3 last year, resulting in an Adjusted EBITDA margin of ten percent.

Total revenues were $929 million, down from $958.1 million in Q3 last year and also down from $1.019 billion in Q2.

Adjusted free cash flow was $-109.4 million, down from $91 million in Q2. Embraer says this is directly related to the higher inventory for deliveries in Q4. That’s why it revised its full-year guidance for free cash flow from $50 to $150 million.

By segment

Commercial Aviation contributed to the results with $253.3 million in revenues, up from $242 million in Q1 2021 but down on $299.9 million in Q2. The consolidated gross margin of 5.4 percent reflects an unfavorable mix of aircraft deliveries, with only one E195-E2 being delivered in the quarter. For January to September, Commercial reported $722.4 million in revenues, down from $902.7 million.

Executive Aviation performed better, with Q3 revenues of $271.7 million versus $256.4 million last year and also up from $266.7 million in Q2. Nine-month revenues were $628.3 million, down from $674.7 million last year. The gross margin slipped to 19.7 percent.

Services & Support reported Q3 revenues of $295 million, up from $276.2 million last year but (again) lower in this quarter than in the second ($320.1 million). For the year to date, the trend is better as the business unit benefits from the further recovery of air travel and the need for maintenance. Revenues ended at $886.3 million, up from $824.8 million, with a Q3 gross margin of 31 percent.

A lower percentage of completion revenues of the A29 Tucano trainer impacted Defense & Security, which saw Q3 revenues drop to $101.7 million from $176.5 million last year and $126.6 million in Q2. 9M revenues were also down, to $296.6 million from $479.9 million.

Embraer ended September with $1.3 billion in cash and cash equivalents, which together with other financial investments resulted in $1.9 billion in total cash. It also has a net debt of $1.3 billion, down $500 million from Q3 last year but slightly up from $1.2 billion in June. In October, the airframer secured a revolving credit facility of $650 million with fourteen financial institutions to increase its liquidity position and improve the capital structure. It also finalized a $100 million credit facility from JPMorgan/UKEF to use for the financing of suppliers. Today, Embraer said that Brazil’s National Bank for Economic and Social Development (BNDES) approved a $400 million export credit facility for its commercial aircraft business. All current loans and facilities mature through 2028, with a $300 million loan reprofiled from 2024 to 2027.

Production slots are almost filled

The backlog in September was $17.8 billion, which is identical to the end of June. The focus for this year is to get as many aircraft delivered as possible. As reported before, Embraer plans to increase production rates and reduce lead times, which will help stabilize revenues and profitability.

This will be more difficult as supply issues continue. As Gomes Neto replied to a question from AirInsight: “Of course, if we don’t get the parts on time, this affects our production schedule and the lead times. But we continue with a strong focus on reducing the production lead time even with all difficulties that we are seeing. We are seeing some progress. We have been working with Toyota to reduce the lead times of the wings of our E2-jets and this is moving very well. Not at the speed that we wanted, but we will continue as we believe this will improve our financial results.”

Gomes Neto said that production slots for 2023 and 2024 are almost all filled. More sales campaigns are underway and the Embraer President is optimistic that his company will produce double-digit growth numbers for all business units. President and CEO of Commercial Aviation, Arjan Meijer, said that Embraer is actively working on sales in the Chinese market and has high hopes, now that the E190-E2 has been certified by the Chinese regulatory authorities.

Views: 8