Conversations with several industry thinkers point to a post-pandemic airline industry fleet deployment that is likely to focus on flexibility. Gone is the “horses-for-courses” thinking. US airlines will focus on a fleet that can just about everything and misuse aircraft as necessary.

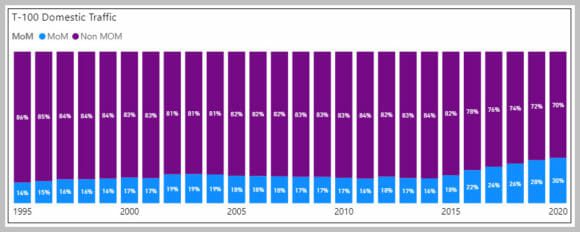

What does the data suggest we should look for? The problem here is that any data pre-Covid is of marginal use. But when that’s all you have; hammer, meet nail. Looking at the US DoT T100 domestic data which is current through January 2020, we note the following: there has been a steady rise in the amount of traffic being flown on MoM-sized aircraft.

But that was way back when we were in a market that was somewhat logical. Now we have a market that has to literally start from near-zero. As the first green shoots start to appear, how might US airlines try to serve this fragile air travel market? The attraction of MoM-sized aircraft is quite different. The number of flights that require 180+ seats has to be tiny. If not the MoM solution, then what?

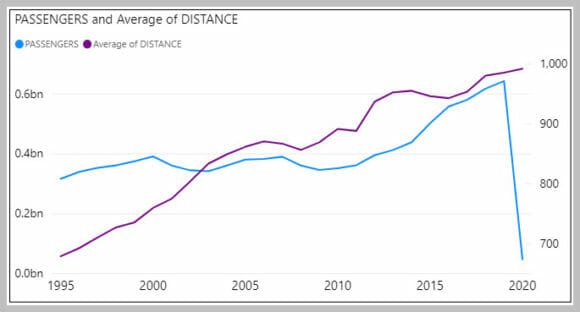

Even though we are now in “unchartered waters”, so to speak, the population of the US not disappeared. There are people who need to, indeed, want to travel. The following chart shows the average distance flown along with passenger volume. Please ignore the January 2020 volume (blue).

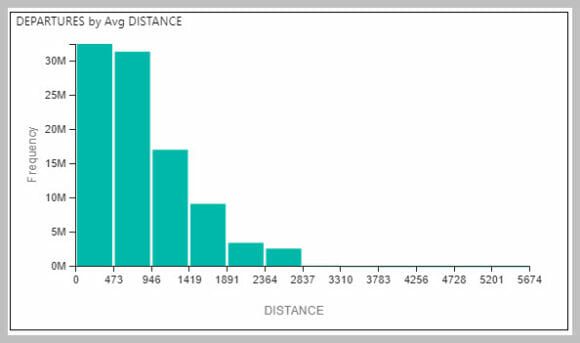

The key takeaway here is that US domestic flights average close to 1,000-miles. As the next distribution chart illustrates, more than half the US domestic flights are under 1,000 miles.

The data suggests that the optimal aircraft deployed in the market requires no more than 3,000-mile range. Indeed, the data suggests smaller is better than bigger. Focusing on the shorter ranges is more effective.

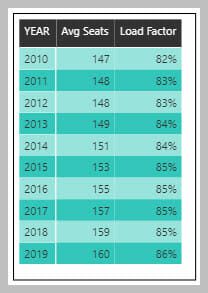

What about the most optimal gauge? Again we look back to understand a murky future. The table on the right shows how robust the market has been by way of load factor even as the average seat count has grown. Even as airlines added seats, passenger travel demand grew.

But, once again, that was then.

Understanding fleet decisions requires data that support such decisions. The US DoT data is several months behind and doesn’t offer any guidance given the sharp change circumstances. Airline managers know their loads and optimize accordingly. Combining the data the T-100 and On-Time datasets we get an idea what the typical US domestic passenger loads through January 2020. To get more current data we also used TSA and FlightRadar24 traffic data to get this chart. The gap is missing data which will close as the TSA provides their daily count.

The average US domestic flight flies used to fly under 1,000 miles and carried about 115 passengers. In January average flight range was 987 miles is probably shorter (no data to prove that yet). However we can clearly see that there has been a precipitous decline in the number of passengers per flight. The most recent data point was 4/9/20 with 12 passengers. We plan to update this data weekly.

Airlines have seen some growth in bookings as we move into the summer travel planning period. Loads are at such low levels that no airline can breakeven. Airlines must deploy the tools they have. In this market no aircraft can pay its way. The aircraft with the level of flexibility needed by the airlines does not exist, indeed no commercial aircraft was ever designed to operate in the environment we face. Since cash preservation is job #1, aircraft with the lowest trip costs are what we expect to see flying.

Views: 1