FK cDg6XIAYkihj

US ultra-low-cost airlines Frontier Airlines and Spirit Airlines have caught out a few by announcing a full merger on February 7. Under a yet to be announced name the two plan to form a “disruptive airline” that is expected “to change the industry for the benefit of consumers, bringing more ultra-low fares to more travelers in more destinations across the United States, Latin America, and the Caribbean.” Frontier-Spirit merger makes it #5 in the US.

Once the transaction is closed in the second half of the year, it will give Frontier a 51.5 percent share in the combined airline and Spirit the remaining 48.5 percent. Spirit equity holders will receive 1.9126 shares of Frontier plus $2.13 in cash for each existing Spirit share they own. That’s $25.83 per Spirit share at Frontier’s closing stock price of $12.39 last Friday. Spirits value at fully diluted equity is $2.9 billion but the transaction value is $6.6 billion when net debt and operating lease liabilities are included.

Spirit back in the hands of Bill Franke

The merger brings Spirit back under the wings of its previous shareholder Bill Franke of Indigo Partners, the group that owns Frontier but also Wizz Air, Volaris, and JetSMART. Back in 2006, Franke invested $70 million in Spirit Airlines along with Oaktree Capital Group. In July 2013, Franke sold his share to purchase Frontier after Republic sold its investment in the airline. “We worked jointly with the Board of Directors and senior management team across both carriers to arrive at a combination of two complementary businesses that together will create America’s most competitive ultra-low fare airline for the benefit of consumers”, Franke is quoted in a joint Frontier-Spirit media statement.

The combined airline positions itself as the fifth-largest US carrier behind American, Delta, United, and Southwest with the lowest costs per available seat mile (CASM) of all US airlines at $8.01. It has annual revenues of $5.3 billion, based on the 2021 results presented by both of them today. Synergies like scale-efficiencies and procurement savings will produce some $500 million in annual savings and should deliver $1.0 billion in consumer savings. Frontier’s and Spirit’s combined liquidity position is some $2.4 billion. The new Board of Directors will have seven directors and the CEO from Frontier and five from Spirit, with almost 85-year old Bill Franke acting as the Chairman.

The current Frontier, which was formed in 2010 after a merger with Midwest Airlines, operates out of its Denver hub across the US and to Latin America. It ended 2021 with 110 (leased) aircraft in its all-Airbus fleet but has another 91 A321neo’s on order after Indigo went shopping during last November’s Dubai Airshow for delivery between 2023 and 2029.

The combined network of Frontier and Spirit serves 145 destinations. (Frontier Airlines)

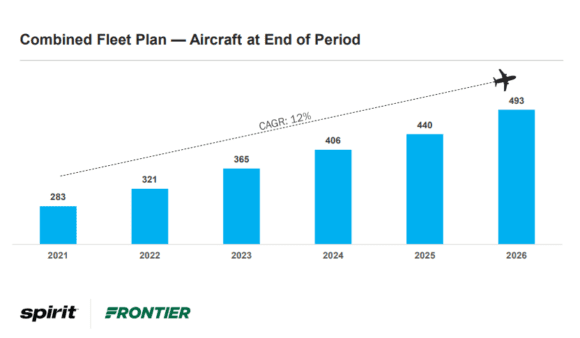

Spirit is based in Florida and predominantly operates in states on the US East Coast, California, and abroad into the Caribbean and Latin America. It also operates an all-Airbus fleet, which consisted of 173 aircraft on December 31. It has 47 A320neo’s and 26 A321neo’s left on direct order from Airbus but is also sourcing aircraft from lessors. According to the press release, Frontier and Spirit have 350 new aircraft on order to bring the fleet to 493 by 2026, when they plan to create 10.000 new jobs. The airlines will serve 145 destinations in nineteen countries, offering better operational reliability.

“This transaction is centered around creating an aggressive ultra-low fare competitor to serve our Guests even better, expand career opportunities for our Team Members and increase competitive pressure, resulting in more consumer-friendly fares for the flying public”, said Spirit’s Ted Christie.

Frontier and Spirit say they have 350 aircraft on order, which will grow the combined fleet to 493 in 2026. (Frontier Airlines)

Frontier reported a $299 million adjusted net loss in 20212 compared to $-301 million the previous year. Revenues were $2.060 billion versus $1.250 billion. Despite the effects of Omicron on bookings, the carrier reported a strong Q4 with an adjusted net loss of $52 million compared to $-133 million in the same period of 2020. Revenues improved to $609 million from $267 million. Frontier carried 5.9 million passengers, up from 2.9 million. Liquidity stands at $918 million.

Spirit reported a $472.6 million loss for 2021 today compared to $-428.7 million in the previous year. Operating revenues improved to $3.230 billion from $1.810 billion. The Q4 loss was $61.5 million versus $-159.9 million in 2020, with revenues at $987.6 million compared to $498.5 million. Strong demand over the December holidays contributed to the Q4 results, which like at all airlines was affected by Omicron cancelations and flight disruptions. Spirit ended the year with $1.7 billion in liquidity.

Views: 17