India is a nation with incredible aviation potential. The country has over 1.3 billion people. It has an economy that is growing fast. It helps that the nation is geographically large and that air travel is the most efficient means of getting between the large commercial centers. In this post, we are focusing on India’s domestic air travel market.

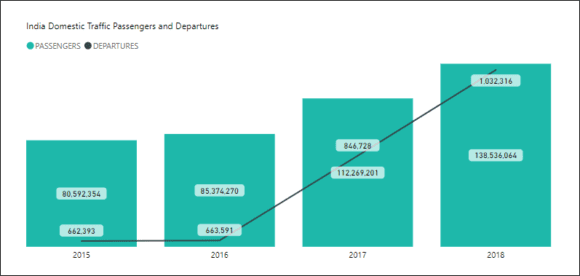

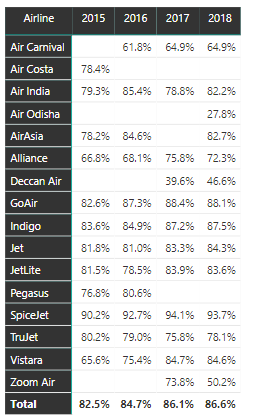

Looking at recent airline data published by the Indian Directorate General of Civil Aviation, we can see that traffic growth is significant and load factors are rising fast.

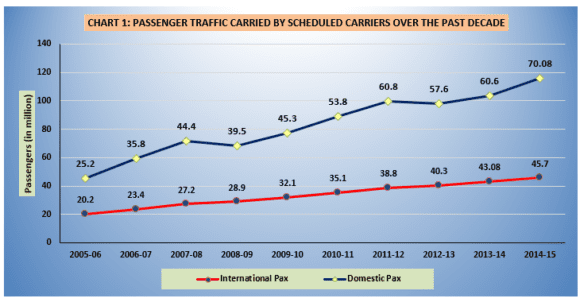

We can see that the market looks very attractive. Supporting this notion, take a look at a chart from DGCA below showing the past decade.

The DGCS notes domestic passenger traffic registered a growth of 12% (in CAGR) over the period from 2005-06 to 2014-15 while International passenger traffic grew at 9.5% (CAGR) during the same period.

What we have seen though is that startup airlines enter the market regularly and fail fast, too. All except one, of course, Air India. Asetnstate support Air India would be long gone, leaving the market to a more robust and thriving private sector.

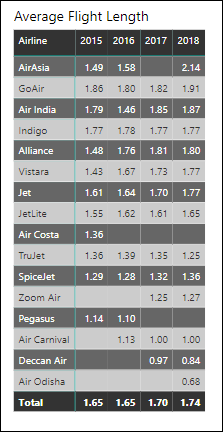

We did not go back to 2014 as the data published by the DGCA has errors. AirAsia data published for 2017 leads to a broken link.

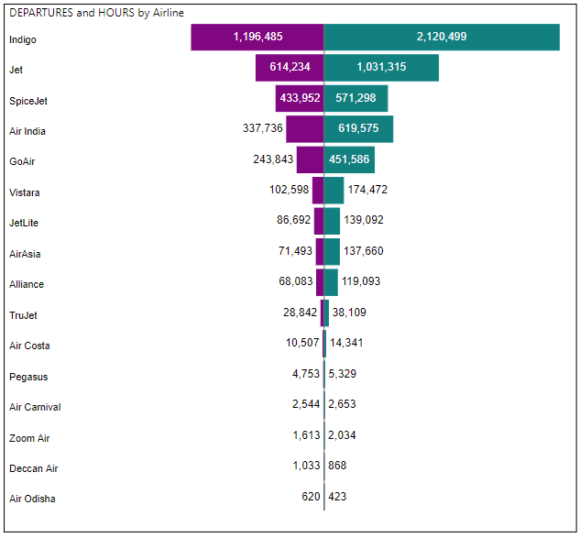

For a perspective on how much busier the private airlines are than the state-owned carrier, look a the following chart comparing the number of departures with operating hours.

Indeed, looking at the typical flight duration in India’s domestic market, the overall average has consistently been under 2 hours.

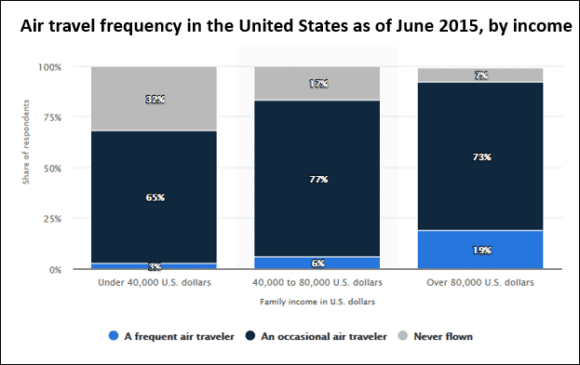

India has tremendous air travel potential as it’s economy grows from developing to developed. The next chart makes the point well.

The key metric for air travel growth in India, and other developing nations is the proportion of the population defined as middle class. Though dated 2015, the point is clear from this 2015 research.

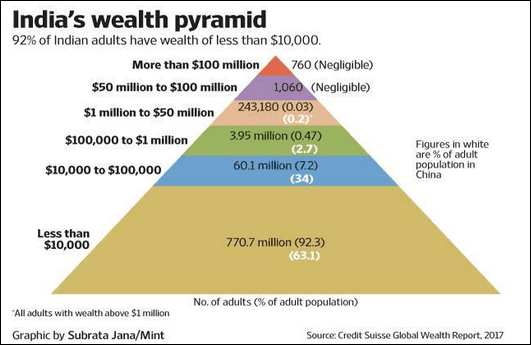

The big challenge in India is income distribution – India has nasty income inequality. The next chart makes the point of why India’s airlines face a daunting task – especially if the state continues to pour resources into Air India. Can the privately financed airlines keep growing faster than Air India regardless of the state support which keeps fares low?

As we can see from the chart above, China offers a better market for air travel given that air travel demand grows in proportion to the middle class.

Based on a combination of this last chart where we see that about four and one-quarter million Indians have incomes over $100,000 and a further 60 million earn between $10,000 and $100,000 it is clear that the bulk of the 112 million air travelers in 2017 came from the upper third of the pyramid. If India can increase the size of its middle class the airline sector could see spectacular growth.

IATA has this interesting presentation of air travel over the next 20 years. On slide ten we see the key driver. If India could grow it’s middle class, the impact on its airlines could be significant: for every 10 million more people able to travel by air, this group could generate 18 million additional flights. On the 138 million flights reported for 2018, these additional 18 million flights would grow the markey by 13%.

Views: 0