Star Air Embraer E175LR 1 7952x5304 c8423d61 72e7 4b3e 9ad9 d9aca0509619

India’s Star Air, an all-Embraer jet operator, commenced revenue flights with its first E175. The flight took place on 13 May, from Bangalore-Hyderabad-Jamnagar-Bangalore.

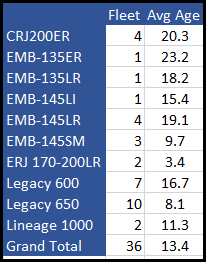

Star Air leased four E175s, which boosted the airline’s fleet of five ERJ 145s, providing greater flexibility and efficiency as it grows its network. The E175 is Embraer’s best-selling commercial airline model and one of the most-sold aircraft worldwide. The aircraft is key in stimulating the regional aviation sector with outstanding economics and performance capabilities.

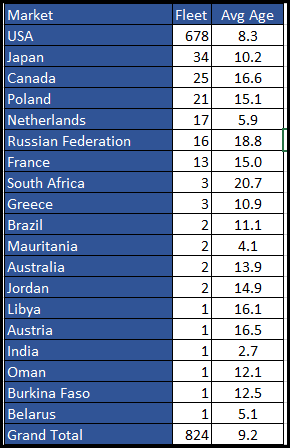

Let’s see why this small airline’s decision has an impact far bigger than it seems. The bale below lists the active or in maintenance E-170/5 fleet around the globe. Over 80% of these aircraft work in the USA. India is way down near the bottom. But not for long.

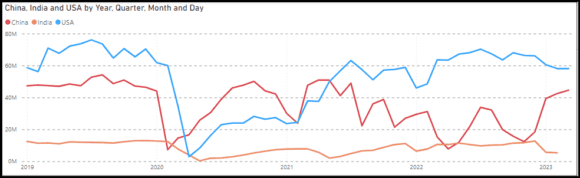

The Indian air travel market is growing fast, and we regard it as one of three tier-one markets, as the chart illustrates. Despite the news about the demise of Go Air, India’s air travel market will keep growing. India has the world’s largest A320neo orders. Akasa, a startup, is acquiring MAX8s rapidly and, along with other Indian airlines, will replace the gap created by Go Air.

Star Air may be a small fish, but its decision to upsize from E145s to E175s is very important to Embraer. As the table above clarifies, Embraer is over-exposed to the US market. Since US regional airlines are struggling, Embraer, the only Western regional jet OEM, is at risk in this market.

Therefore growth outside the US market becomes crucial. And the key markets for Embraer will be India and China. Since China will push the ARJ21 onto its regional airlines, the E175 faces an uphill battle. But India is wide open and rich with opportunities. We would not be surprised to see Embraer deepen this opportunity. The talk has already started.

Embraer will exploit its BRICS ties to the fullest. Among the BRICS countries, India, in our view, offers the best upside. India has a deep talent pool that Airbus and Boeing have exploited, and Embraer would do well to exploit and invest in it.

Moreover, we do not expect the E175-E2 to ever work in the US; what can Embraer do to recover its capex in that program? Build them in India for the Asian market, of course. The E175-E2 will compete in Asia with the ARJ21 and SSJ. The SSJ has no future outside Russia, taking it out of the competition. The ARJ21 will primarily focus on Chinese regionals, limiting its availability beyond China. Good times for the stalled E175-E2? Perhaps.

The E175-E2 might work well if assembled in India. Embraer gets to move a stalled program, opening its Brazilian facilities (capex, factory space, and talent) for new programs like the turboprop. Having Indian talent work on the E175-E2 helps build India’s commercial aircraft industry. A locally built aircraft might find lots of opportunities.

Consider that India has a tiny regional jet fleet. Many of the aircraft are aging out in economic terms. Note further that Embraer has a strong presence. To us, this reflects a strong opportunity.

Star Air’s decision could be a spark that leads to something bigger. Even as India’s air travel market grows, other forces could come to play that will drive regional air traffic to grow faster. There are good reasons for the Indian government to encourage this, not the least of which is the blossoming of its domestic aerospace cluster.

Views: 167

The data, especially that in the table, appears to be wrong. There are confirmed 3 e170 ac in India itself. Also, Europe has more Embraers, which is not reflected.