a321neotakeofflow

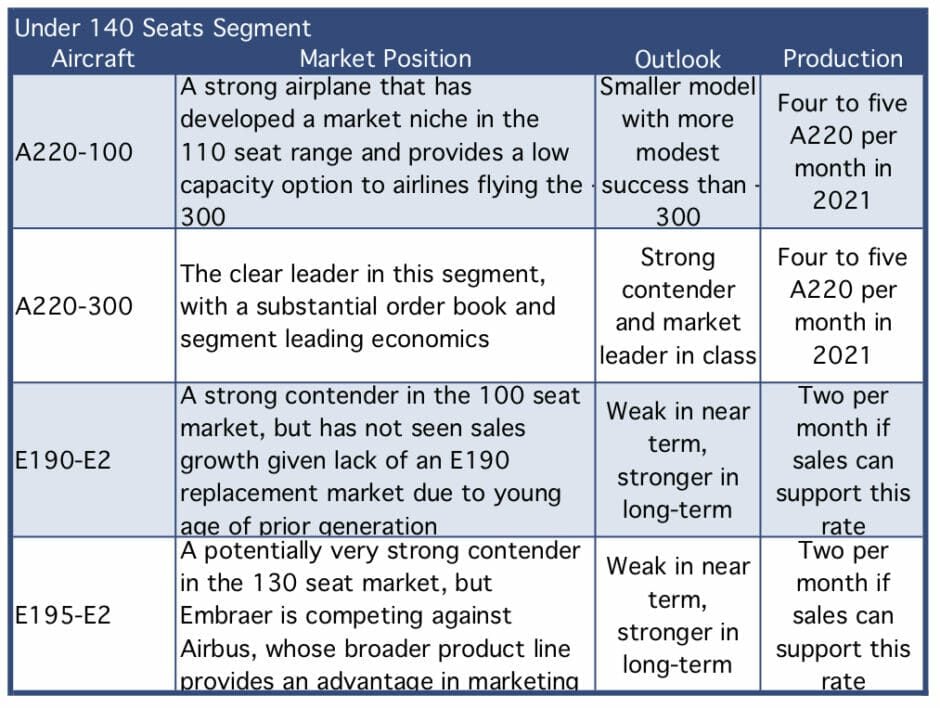

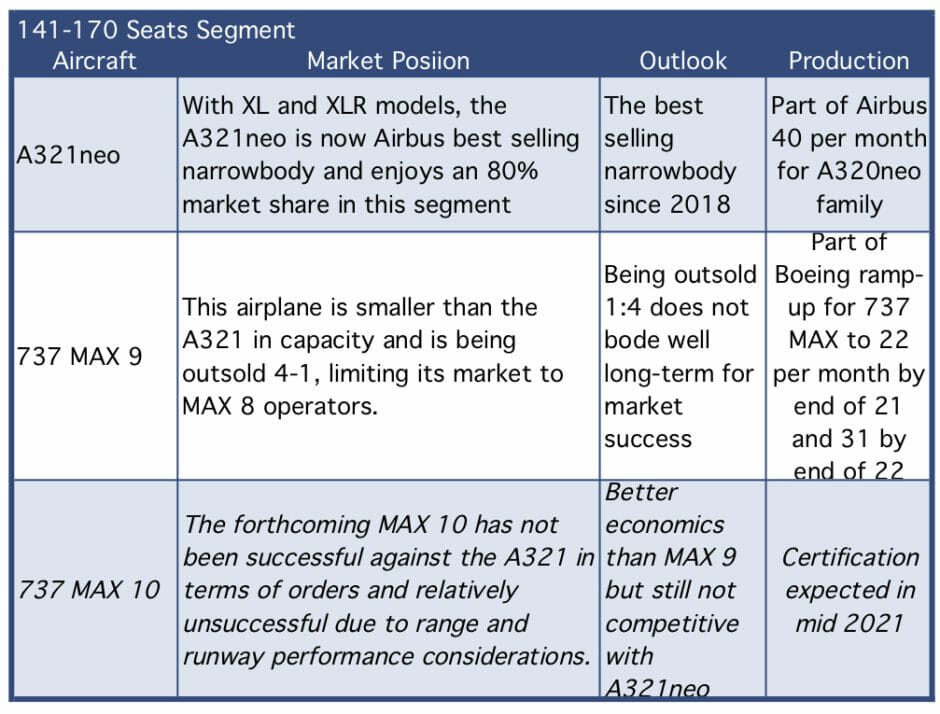

In this first of our series of previews for 2021, we look at the market for narrow-body aircraft. We break the narrow-body market into three segments, the under 140 seat segment, the 140-170 seat segment, and the over 170 seat market.

Subscriber content – Sign in Monthly Subscription Annual Subscription