Global 6500 e1569274164647

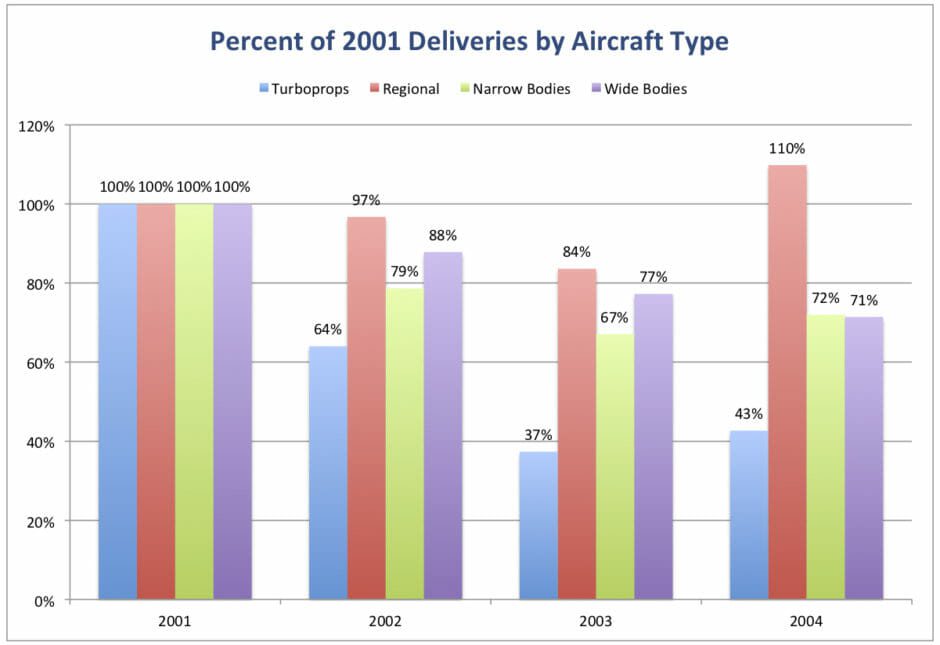

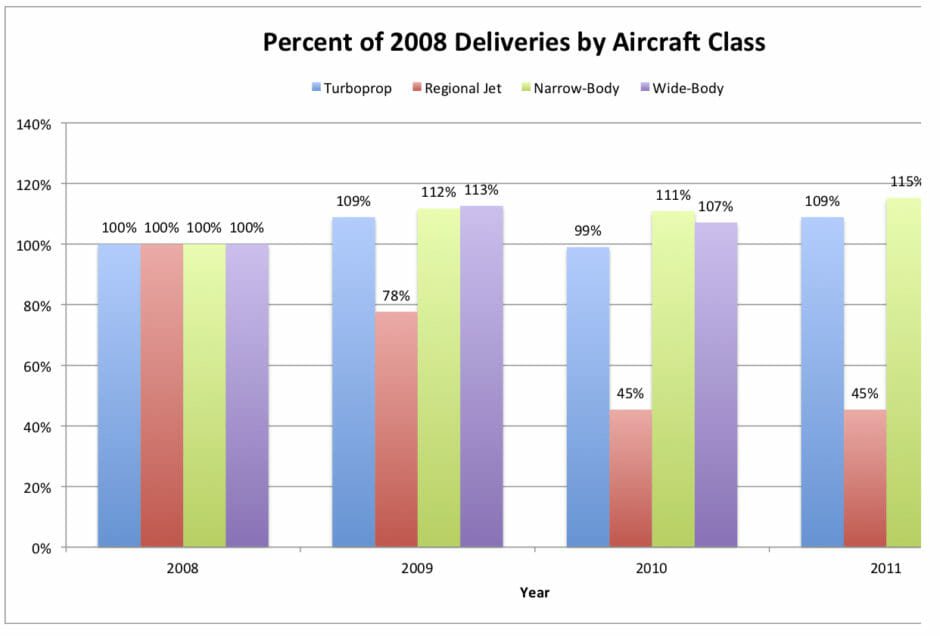

In examining earlier industry recessions, the path to recovery is an interesting topic. Which classes of aircraft lead the way back for the industry, and which recover more slowly? If the past is prologue, we should expect similar behavior as we pull out of our current global pandemic.

Subscriber content – Sign in [maxbutton id=”1″ ] [maxbutton id=”2″ ]